A股丨一個月暴漲155%!誰將成為下一個以嶺藥業?

作者:費天元

來源: 上海證券報

近期市場有兩條主線已十分明確:一是一季報業績的確定性,二就是大醫藥板塊。偏偏有幾隻股票同時沾邊這兩大熱點,股價自然也水漲船高。

最具代表性的當屬以嶺藥業。

今日早盤,以嶺藥業開盤不到兩分鐘便大單封死漲停,這已是該股近期取得的連續第4個漲停。在過去一個月內,以嶺藥業股價累計漲幅已達到155%,成為在此期間兩市“第一牛股”。

以嶺藥業日線走勢

3月30日晚間,以嶺藥業披露業績預告,預計公司一季度實現淨利潤4.33億元-4.61億元,同比增長50%-60%。公司方面表示,一季度業績預增主要源於公司主導產品——連花清瘟產品營業收入較去年同期大幅增長。

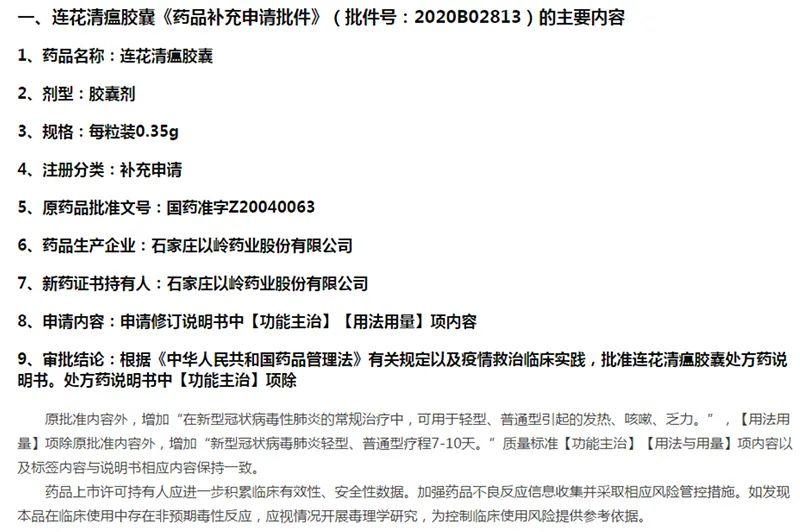

4月14日午間,以嶺藥業發佈公告稱,收到國家藥品監督管理局下發的《藥品補充申請批件》。批件為公司和北京以嶺現有產品連花清瘟膠囊和連花清瘟顆粒在原批准適應症的基礎上,增加“新型冠狀病毒肺炎輕型、普通型”新適應症的批覆。

截自以嶺藥業《關於連花清瘟膠囊(顆粒)新增適應症申請獲得批准的公告》

英科醫療同樣是“一季報預增+醫藥”的典型代表。

今日早盤,英科醫療高開高走封上漲停,股價創出歷史新高,今年以來累計漲幅達到241%。

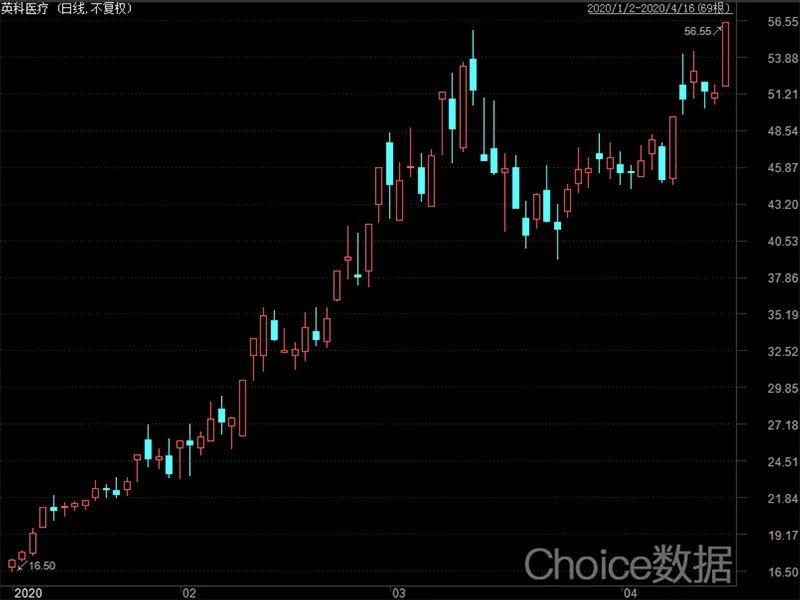

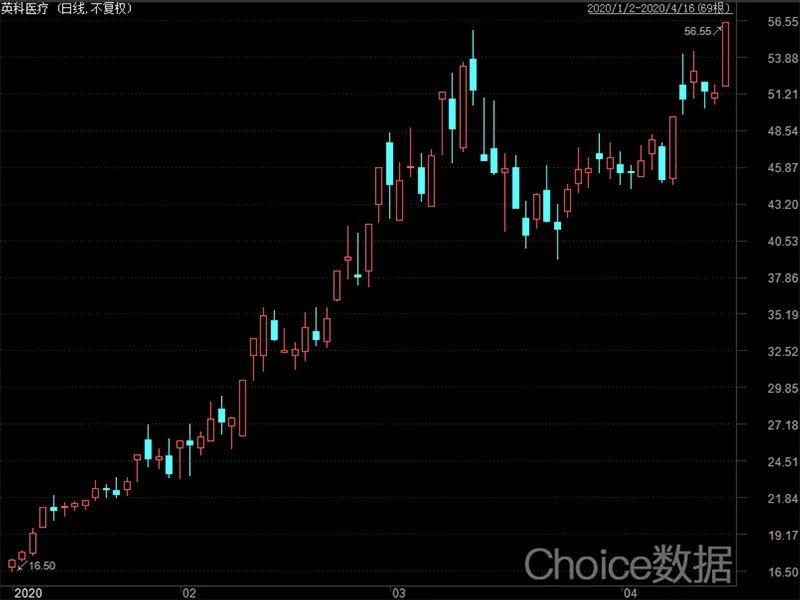

英科醫療日線走勢

4月9日晚間,英科醫療披露業績預告,預計今年一季度實現淨利潤1.2億元-1.3億元,同比增長254.6%至284.1%。公司方面表示,受疫情影響,公司的核心主營產品一次性防護手套需求激增,且產品售價有一定增長。

4月15日晚間,英科醫療公告公司最新決議,擬將3月初公司公告的擴建年產98.8億隻(988萬箱)高端醫用手套項目變更為“英科醫療防護用品產業園項目”,建成投產後將達到年產210億隻(2100萬箱)高端醫用手套生產規模。

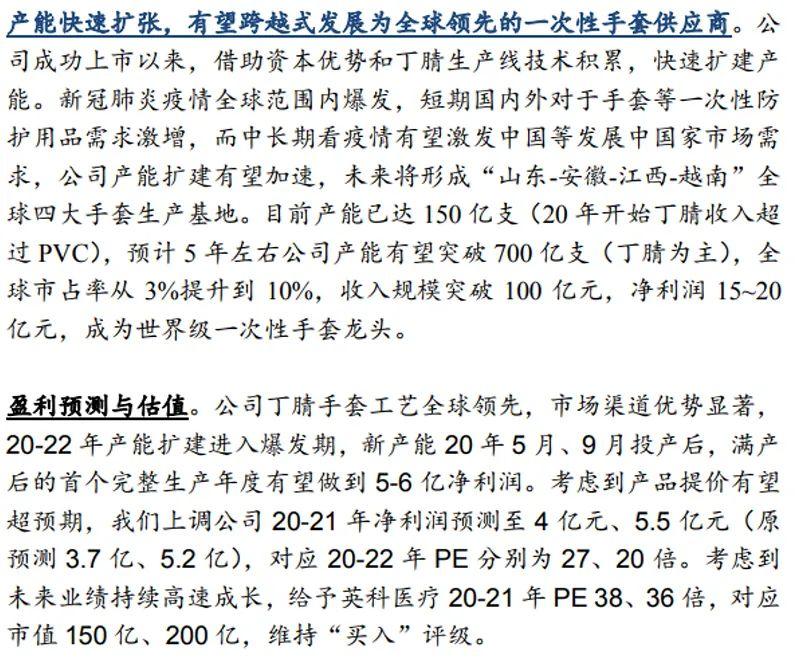

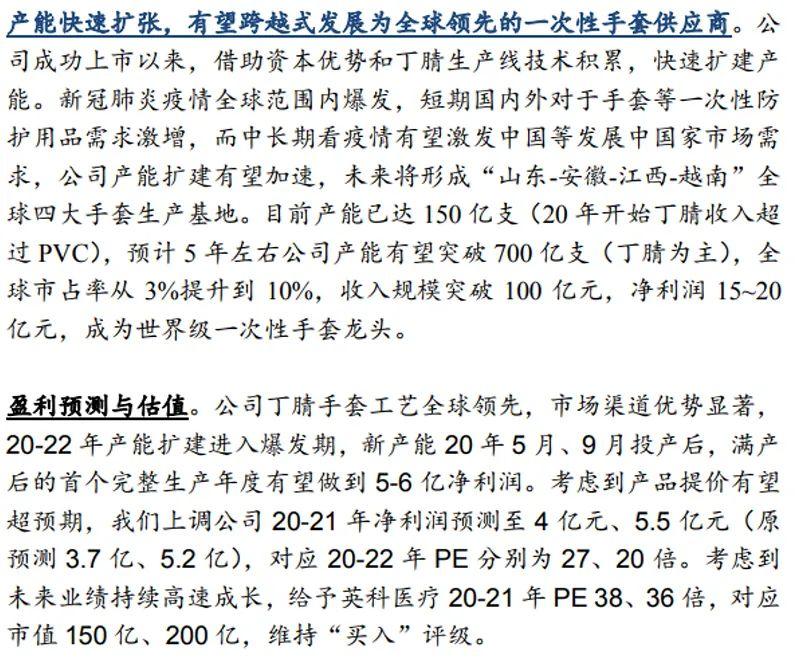

太平洋證券近期已發佈多份英科醫療個股研報,認為新冠肺炎疫情全球範圍內暴發,短期國內外對於手套等一次性防護用品需求激增,而中長期看疫情有望激發中國等發展中國家市場需求。英科醫療產能擴建加速,未來有望成為世界級一次性手套龍頭。

摘自太平洋證券英科醫療個股研報

當然,一季度業績預增的醫藥股並非只有上述兩隻。

在此,我們同時引入“一季報預告淨利潤增幅下限>50%”“一季報預告淨利潤下限>5000萬元”“近6個月內有研究機構給予買入評級”3項指標,可以篩選出12只受機構關注且一季報預增的醫藥股。

值得一提的是,篩選出的這12只醫藥股本月以來股價全部收穫上漲,且平均漲幅高達11.02%,不但跑贏同期三大股指,也跑贏了同期申萬醫藥生物行業(7.65%)。

12只受研究機構關注且一季報預增的醫藥股

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.