中國建材(03323.HK):建材旗艦,內核升級,給予“優於大市”評級

機構:海通證券

評級:優於大市

投資要點:

央企核心產業平台、旗艦上市公司,競爭力已不可同日而語。公司是大型建材央企中國建材集團最核心的產業平台和旗艦上市公司,7項業務居世界第一。我們認為公司在經歷自我革新、合縱連橫、水泥長期高景氣背景下,成本費用控制、區域市場掌控力、資產負債表等已大幅改善,其競爭力已不可同日而語。?水泥重組宗師,合縱連橫新秀。

閃電式併購,堪稱重組教科書。公司過去通過直接融資及銀行借款支撐迅速收購水泥資產,分別於2007、2009、2011年組建南方水泥、北方水泥、西南水泥,各水泥子公司大規模聯合重組基本在2~3年即完成,期間不乏在景氣低谷期“抄底”浙江水泥資產的經典案例。公司2008年超過海螺水泥成為全國產能規模第1的水泥企業並維持至今,2018年5月完成吸收合併另一家大型央企建材公司中材股份,產能規模進一步擴大,成為名副其實的水泥“巨無霸”。

自我革新,輕裝上陣,產業延伸。當前公司正通過三步棋自下而上改善及獲取新增長:1)我們認為公司可藉助產能置換實現淘汰落後產能,提升綜合生產效率,水泥熟料生產成本費用有望逐步改善。2)應收賬款週轉逐步好轉,高盈利期審慎計提減值,為後續輕裝上陣鋪路。3)大力發展“水泥+”模式,在提升水泥盈利的同時擴充商混、骨料等業務規模,貢獻新增業績增長點。

合縱連橫,統治力上台階。公司在大規模聯合重組告一段落的同時,逐步與各大水泥龍頭深入戰略合作:1)“左手”控股同力、“右手”滲透山水,橫貫魯豫市場,我們認為魯豫之於公司可類比安徽沿江基地之於海螺、西江兩點一線之於華潤,其控制力和未來高盈利穩定性已不可同日而語;2)公司與萬年青深度交叉持股,於上峯水泥派駐董事,此外也持有亞泰集團、金隅集團部分股權,增強區域話語權;3)攜手海螺創業,大力發展水泥窯協同處置環保業務。

新材料&工程服務成犄角之勢。公司新材料業務板塊擁有多個先進製造業翹楚包括石膏板龍頭北新建材,玻纖龍頭(中國巨石、泰山玻纖),我們認為未來隨着石膏板降本增效、品牌化以及玻纖行業景氣底部回升,新材料板塊業績增長展望良好;工程服務板塊已邁向全球,將跟隨非洲以及印度、俄羅斯等戰略性區域市場共同成長。

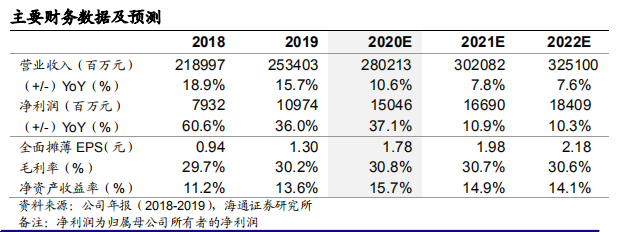

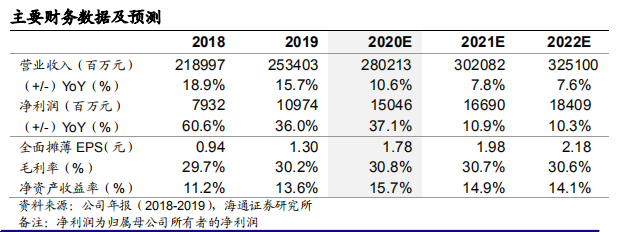

盈利預測及估值。我們預計公司2020~2022年歸母淨利潤為150、167、184億元,給予2020年PE6~7倍,合理價值區間為11.87~13.84港幣/股,給予“優於大市”評級。

風險提示。1)地產、基建需求超預期下滑;2)燃料成本超預期提升等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.