5500億航母級券商真要誕生?中信建投一度封板,中信證券漲逾4%

今日14點之後,中信建投、中信證券,兩大龍頭券商份份直線拉漲,前者收漲8.88%,盤中一度漲停,後者收漲4.22%,盤中一度漲超6%。兩大券商的走好,帶動整個券商板塊集體上行,其中紅塔證券、南京證券、華西證券、招商證券紛紛大漲超過3%。

(來源:Wind)

另外,中信建投H股同樣暴漲8.54%,中信證券H股上漲3.31%。

兩大龍頭券商的大漲,導火索是一條重磅消息。據彭博社報道,知情人士稱,中國已着手啟動可能將中信證券、中信建投證券進行合併的流程。隨着中國對外開放金融市場,兩家公司合併後可更好地與全球大投行相競爭。

知情人士稱,中信證券和中信建投證券,以及國有股東中信集團、中央匯金投資有限責任公司,近期已開始盡職調查和交易結構方式的可行性研究。不過當前的討論並不一定會最終達成協議。

目前,中信證券市值3000.3億元,中信建投市值2511.83億元,合併成為超過5500億元的超級巨擘,甚至會超過高盛。

不過,中信建投高管對外迴應稱,“我們沒聽説”。

當前,中信證券為中信建投第四大股東,持股比例為5.01%。另外,中央匯金資產管理有限責任公司為中信證券第五大、中信建投證券第二大股東,中國中信為中信證券第二大股東。

(來源:Wind)

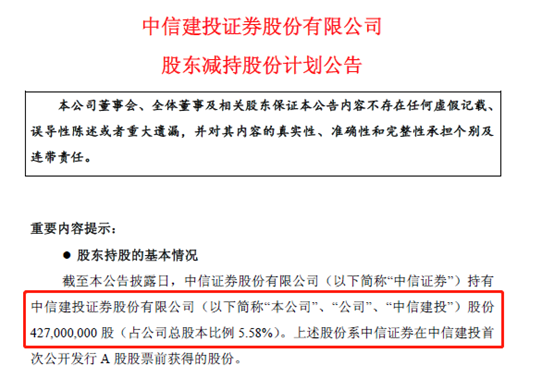

要知道,2019年6月25日,中信證券清倉式減持中信建投。據當時公告顯示,中信證券擬在公告披露日起15個交易日後的6個月內通過集中競價方式及/或自公告披露之日起3個交易日後的6個月內通過大宗交易方式合計減持其持有的中信建投全部股份。具體而言,中信證券共持有中信建投4.27億股,佔中信建投總股本比例5.58%。

(來源:中信建投公告)

而中信證券當時清倉減持中信建投,被指與“一參一控”有關。

據證監會第84號公佈《證券投資基金管理公司管理辦法》。其中,第十一條規定:“一家機構或者受同一實際控制人控制的多家機構參股基金管理公司的數量不得超過兩家,其中控股基金管理公司的數量不得超過一家。”這就是業界簡稱的“一參一控”。

而2018年12月25日,中信證券發佈了併購重組相關預案,籌劃發行股份購買廣州證券100%股份。中信證券繼續持有中信建投證券的股權,會涉及到同業競爭的問題。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.