吉利汽車(00175.HK):批發環比改善 需求逐步回暖,維持“買入”評級,目標價15.36港元

機構:華西證券

評級:買入

目標價:15.36港元

事件概述:公司發佈2020年3月銷量公告:單月汽車批發總銷量(含領克)7.3萬輛,同比減少41.1%,環比增長245.0%;其中,新能源汽車銷量2,503輛,佔總銷量3.4%;出口銷量3,152輛,同比減少60.4%;中國市場銷量7.0萬輛,同比減少40.1%。公司第一季度累計批發銷量20.6萬輛,同比減少43.8%,完成全年目標141萬輛的14.6%。

環比改善符合預期,終端需求逐步回暖。新冠病毒疫情衝擊汽車需求導致行業2月產銷斷崖式下滑,乘用車行業產銷分別同比減少82.9%/82.6%,公司銷量同比減少74.7%;3月供需兩端隨疫情得以有效控制呈回暖之勢,我們預計4-6月將延續環比改善的趨勢,批發及零售銷量持續走高:1)各品牌銷量修復節奏同步。吉利品牌3月銷量6.6萬輛,環比增長243.7%;領克品牌銷量7,369輛,環比增長256.7%;2)公司SUV銷量修復最為明顯,其次為轎車、MPV及跨界車型。轎車3月銷量2.4萬輛,環比增長183.5%;SUV銷量4.8萬輛,環比增長305.7%;MPV及跨界車型銷量1,014輛,環比增長11.1%。我們認為,SUV銷量大幅反彈主要受益於老產品博越、繽越及領克01持續發力,疊加新產品ICON上市銷量爬坡。

展望2020全年:維持戰略穩健,加速平台佈局。1)產品週期保持新車高頻投放。繼2月成功推出ICON後,公司計劃在2020年再推出五款全新車型,其中包括吉利品牌一款緊湊型轎車、吉利品牌豪越、幾何品牌第二款車型以及領克05/06,在產品週期推動下,預計公司2020年銷量目標(141萬輛,同比增長3.6%)大概率超額完成,我們預計全年銷量150萬輛(同比增長9.7%);2)平台化戰略逐步兑現效益。2020年為公司模塊化平台車型發佈大年,三大平台車型陸續上市(CMA平台下領克01/02,BMA平台下繽越/ICON,PMA平台下發布首款純電動轎車),平台化車型上量的過程中逐步實現規模化,縮短研發週期提升效率的同時,進一步降低生產成本,驅動盈利向上;未來公司將繼續加碼平台化佈局,2020年資本開支預算68億元(不包括併購項目),主要針對新汽車平台研發及現有產線擴建升級。

擬與沃爾沃業務合併,開啟“全球大吉利”時代。公司與沃爾沃汽車擬業務合併重組提高競爭力。我們認為,各業務一體化勢不可擋,未來有望開啟“全球大吉利”時代:1)研發一體化。沃爾沃汽車目前在全球範圍內擁有三大研發中心(歐洲、美洲、亞太),未來有望與吉利在電動智能化領域開展高效同步研發;模塊化平台技術的共享(沃爾沃SPA2、吉利CMA/PMA等)將進一步縮短產品研發週期,提升產品更迭效率;2)生產一體化。對於吉利汽車而言,沃爾沃汽車的全球供應鏈體系及歐洲、美洲工廠將助力吉利品牌加速實現出口及國際化;對於沃爾沃汽車而言,吉利在中國市場成熟的供應鏈體系及成本控制優勢將推動沃爾沃汽車在華零部件本土化,進而優化成本結構,國產替代邏輯將利好吉利產業鏈核心零部件供應商【拓普集團、新泉股份】;3)運營一體化。未來“吉利一體化”概念將涵蓋沃爾沃、吉利、領克及極星四大品牌,保留每個品牌的獨特性;運營方面,品牌間將形成有效互補,系統性管理催化運營協同效應。

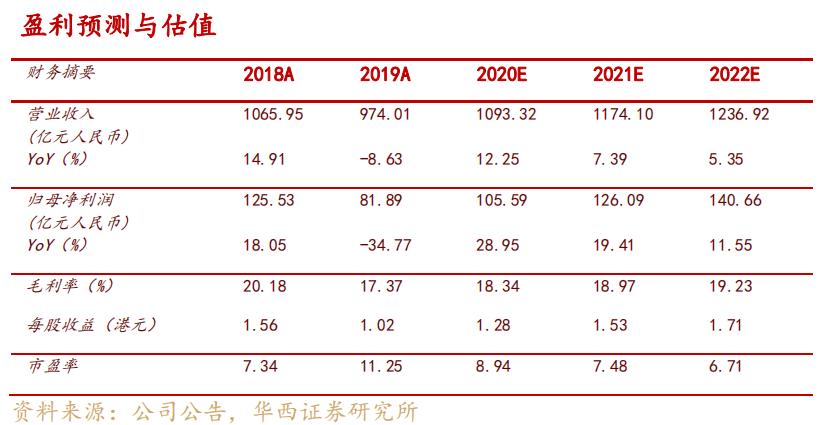

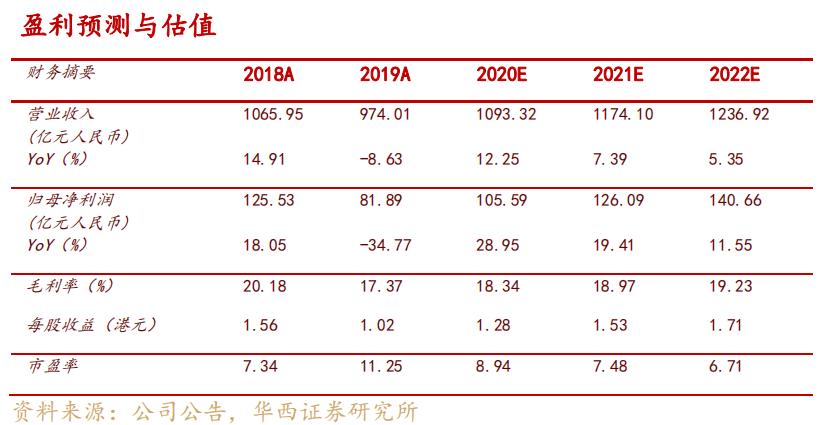

投資建議:乘用車行業短期銷量承壓,“刺激政策+首購釋放”雙重邏輯驅動需求回暖;公司目前終端庫存合理,3月起銷量環比改善明顯,展望2020全年,產品週期持續發力,業績修復彈性較高。維持盈利預測:公司2020-2021年歸母淨利105.6/126.1億元,按照1:0.89的人民幣港元匯率換算,EPS1.28/1.53港元,對應PE8.94/7.48倍;繼續給予公司2020年12倍目標PE,目標價15.36港元,維持“買入”評級。

風險提示:乘用車行業銷量不及預期;新產品上市節奏及銷售不及預期;乘用車行業價格戰造成盈利能力波動;沃爾沃汽車合併進展不及預期

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.