比亞迪遭遇“雙擊”:股價回落之際,1-3月汽車銷量也降了48%

4月8日,比亞迪披露2020年3月銷量快報,銷量下降幅度依然引人矚目。

據銷量快報顯示,當月汽車銷量30,599輛,同比下降34.65%。其中,新能源汽車銷量12,256輛,同比下降59.25%;燃油汽車銷量18,343輛,同比增長9.51%。1-3月,比亞迪累計汽車銷量61,273輛,同比下降47.89%。其中,新能源汽車累計銷量22,192輛,同比下降69.67%;燃油汽車累計銷量39,081輛,同比下降11.99%。

除此之外,與銷量下滑同樣扎眼的則是比亞迪連連下滑的股價了。

從盤面上來看,自3月2日以來,一個多月的時間內,比亞迪股價已經累計下跌超15%了,截止今日收盤,其股價繼續下探1.76%至55.32元,總市值為1509億元。

(行情來源:wind)

而值得一提的是,此前不久公佈的2019年業績快報,也隱隱道出了比亞迪銷量增長的困境。

3月31日,比亞迪公佈了2019年業績快報。2019年,比亞迪實現營業收入1277.4億元,下降1.8%。比亞迪全年營收與2018年基本持平,但利潤出現大幅下滑。2019年比亞迪實現營業利潤23.20億元,同比下滑45.31%;歸屬於上市公司股東的淨利潤16.12億元,較去年同期下降42.03%。

而銷量方面,2019年比亞迪全年銷量低於預期,65萬輛銷量目標僅完成70.98%。據財務數據顯示,2019年,比亞迪實現汽車銷量46.14萬輛,同比下滑11.39%。其中,新能源汽車銷量為22.95萬輛,同比下滑7.39%。要知道,比亞迪在2019年上半年新能源車型銷量還達到14.6萬輛,同比增長94.5%,銷量的下滑主要是從2019年下半年開始。

與此同時,比亞迪也與全球新能源車銷冠失之交臂。2019年,特斯拉以36.75萬輛的成績反超比亞迪,成為全球新能源汽車銷冠。而這是比亞迪自2016年以來新能源汽車銷量首次低於特斯拉。

而針對於該公司的業績表現,行業人士表示,“儘管比亞迪的2019年業績表現在預期之中,但這也充分暴露了行業下行以及自身增長乏力帶來的壓力。”

當然,在整個車市下行的大背景下,比亞迪銷量下滑也是不可避免的事實。

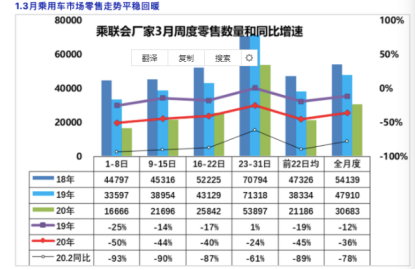

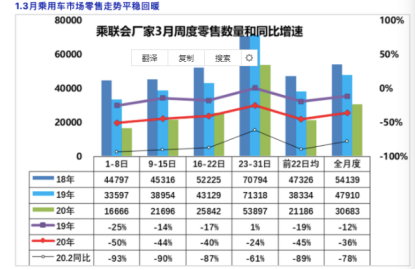

據中國乘聯會初步數據顯示,中國3月乘用車日均零售同比下降36%。今年2月的最後一週零售同比下降61%,3月第一週的同比下降50%,第二週下降44%,第三週下降40%,最後一週加速回暖,體現車市零售已經是從疫情影響下平穩改善。

(數據來源:乘聯會)

此外,乘聯會還表示,雖然部分城市已經鼓勵恢復正常秩序,但由於消費者購車信心在3月底內很難迴歸正常,加之學生基本沒開學,購車需求短期內難以強力爆發。

不過,有研究機構也表示,隨着3月的快速恢復,4月的進一步修復,估計4月底的車市周度銷量就將接近歷史同期正常水平。如果刺激消費政策見效,5月的疫情影響基本消除,疫情對中國車市的直接衝擊影響好於歐洲。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.