100多隻股票一季度淨利預增超30%,高德紅外預告淨利增幅超19倍

進入4月份的業績公告期,一些A股的一季度業績預告陸續披露,截止4月8日的最新數據統計顯示,111只股票一季度淨利有望同比增長超過30%。

有分析人士表示,隨着行情的推進,市場或將進一步聚焦今年一季報,季報行情有望打響。

一季度預告淨利同比增長最高超40億

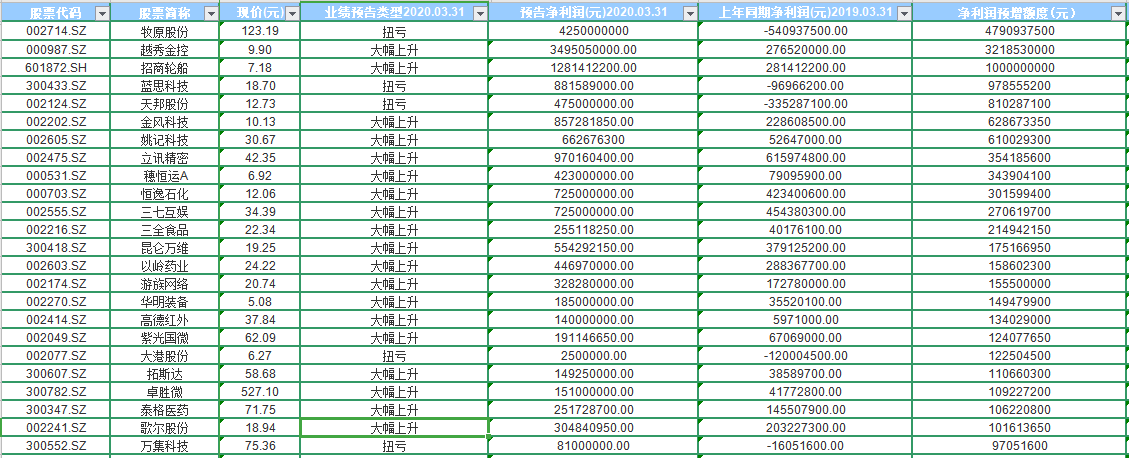

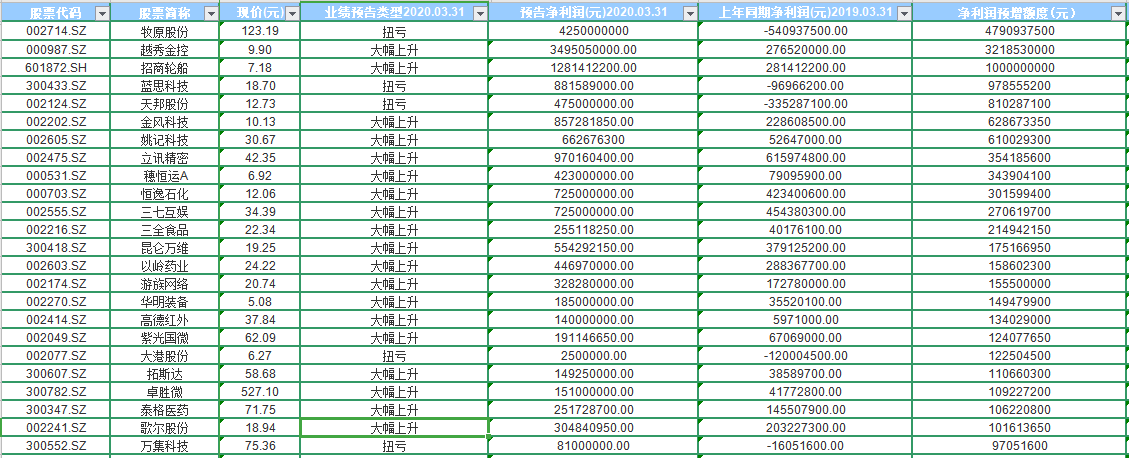

從一季度業績預增額度(按預告淨利潤中值計算,下同)上看,牧原股份扭虧為盈,同比增長超40億,受非洲豬瘟疫情影響,國內生豬產能大幅下降,豬肉市場供需矛盾突出,2020年一季度生豬價格較上年同期大幅上漲,是導致報告期淨利潤扭虧為盈的主要因素。

越秀控股一季度淨利潤344505萬元至354505萬元,同比增長30多億,位居第二位。還有招商輪船、藍思科技、立訊精密、三七互娛等21只個股公司一季度淨利潤同比增長都在1億以上。

部分一季度淨利預增額居前個股(截止4月8日)

來源:同花順iFind

高德紅外Q1淨利預增超19倍,業績預增個股4月份最多上漲超30%

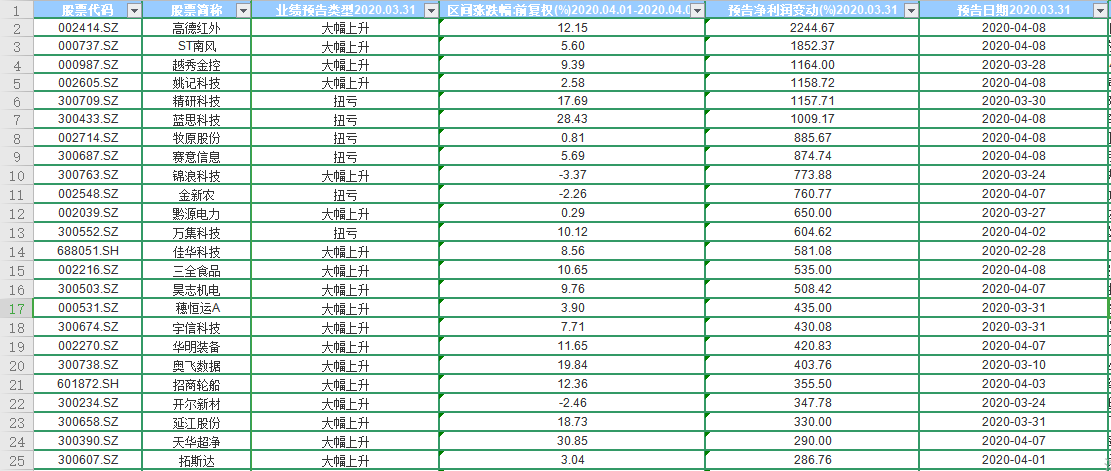

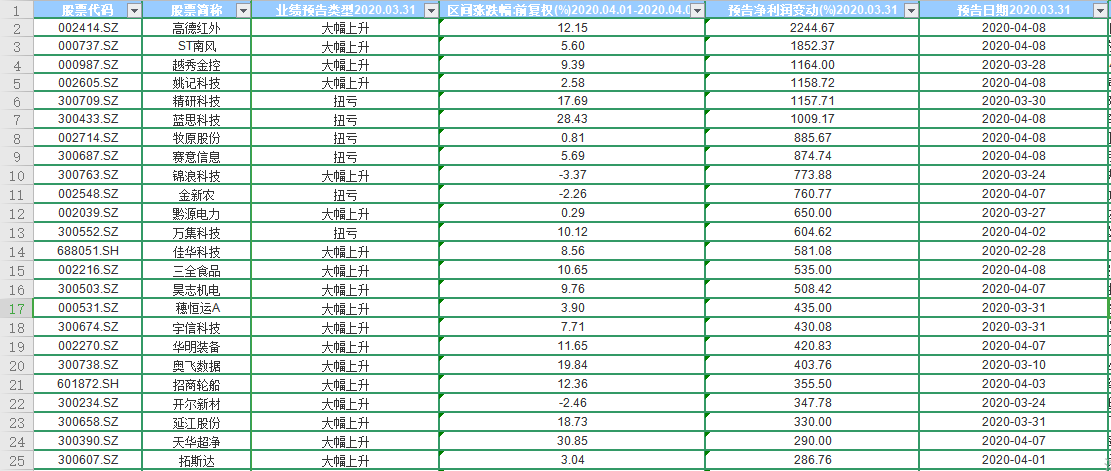

部分業績預增增幅居前個股(截止4月8日)

來源:同花順iFind

從業績預增增幅上看,高德紅外Q1淨利預增超19倍,增幅最高。ST南風、越秀金控、姚記科技預計一季度淨利潤同比增幅中值為1852.37%、1164%、1158.72%,增幅位列第二、三、四位。

其中,高德紅外公司預計2020年第一季度歸屬於上市公司股東的淨利潤1.2億元-1.6億元,同比增長1909.71%-2579.62%,預告淨利潤增幅中值為2244.67%。

對於業績暴增的原因,高德紅外表示,正值新型冠狀病毒疫情期間,作為國家工信部指定的疫情防控物資重點生產企業,公司自春節以來一直加班加點,生產出來的全自動紅外體温檢測告警系統全部供應疫情防控需求,廣泛應用至全國各地機場、火車站、醫院、地鐵站、學校等人流密集的公共場所。

同時,公司稱,本次疫情充分體現紅外熱成像設備在疫情防控一線的重要性,同時憑藉紅外焦平面探測器晶圓級封裝產線的批量生產,報告期內諸多新興民用領域對紅外熱成像設備產品市場長期需求凸顯,進一步激發了紅外熱成像技術在消費電子、智慧家居、智慧金融、安防監控、無人機等多個行業的新興應用。

與業績增長相匹配,公司股價也在不斷攀升。據統計,今年以來,高德紅外累計漲幅已超70%,期間最高漲幅已翻倍,其中4月份以來上漲12.15%。

來源:同花順

另外,一季度預增榜單中大多數股票4月份以來都出現不同幅度的上漲,刨除新股雷賽智能和次新股天箭科技,天華超淨4月份以來漲超30%,上漲37.7%,漲幅最大。

來源:同花順

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.