最勤勞的快遞小哥,配得上最先復甦的快遞行業!

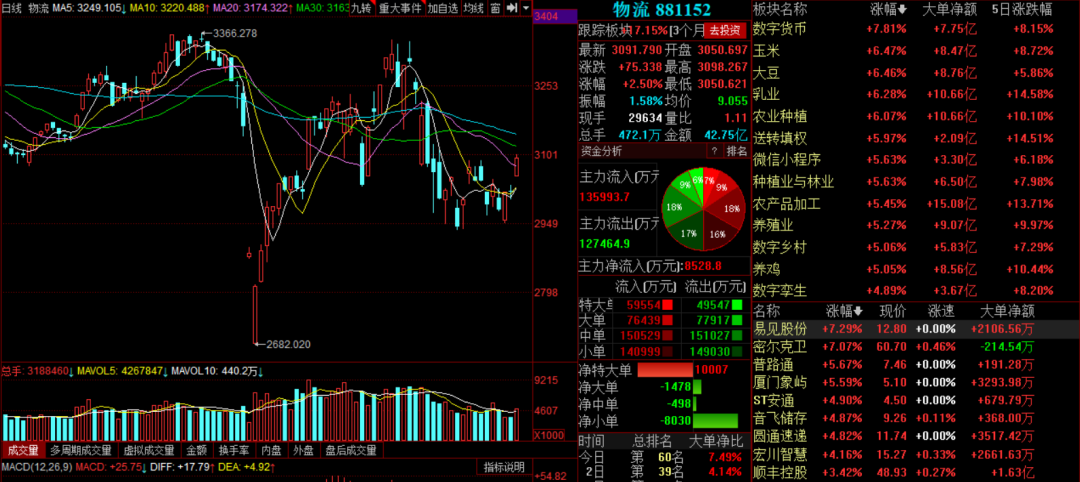

大盤週二全線走紅,上證指數漲2.05%,深成指漲3.15%,創業板指漲3.31%。受大盤帶動,物流板塊指數上漲2.50%,板塊中圓通速遞漲近5%,順豐控股漲3.42%,申通快遞漲2.24%。

(圖源:同花順)

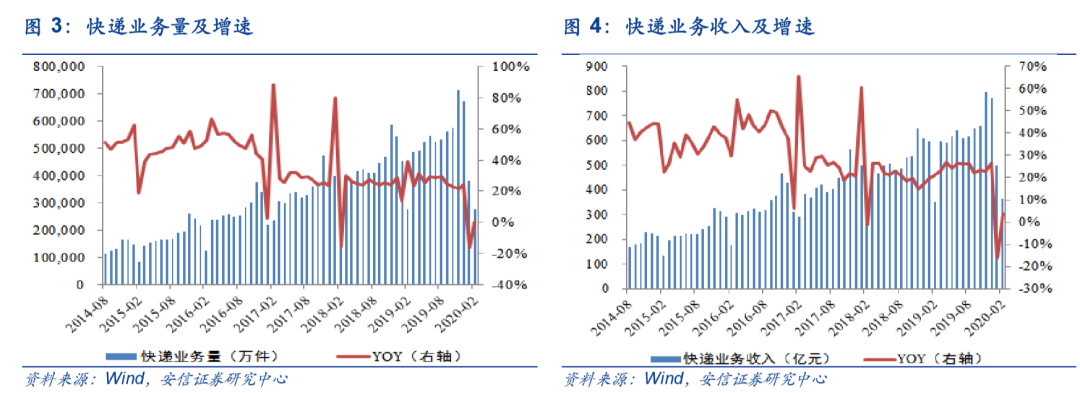

比物流板塊更早復甦的其實是快遞行業。國家郵政局近日發佈的《3月中國快遞發展指數報告》顯示,上月快遞業務量預計完成57億件,同比增長17.3%;快遞業務收入預計完成715億元,同比增長20%。

光從增速上看,行業基本已恢復至疫前水平。隨着行業走出疫情陰霾,行業個股亦或可再適時關注一下。

1

寄遞企業到崗率98.6%

據《發展報告》統計,上月快遞行業發展指數為214.9,同比提高23.4%,基本恢復至疫情發生前水平。今年前兩個月,行業發展指數僅為172.1及157.3。其他指數方面,快遞發展規模指數、服務質量指數及發展能力指數分別為238.2、269.9及184.5,同比分別提高17.7%、38.5%及15.5%。發展趨勢指數為71.1,同比去年持平。

截至上月月底,主要寄遞企業到崗率已達98.6%,主要寄遞企業市級以上分撥中心全部恢復正常運行,主要寄遞企業營業網點(不含末端備案網點)營業率達99.7%。

(圖源:中國郵政局官網)

對比之下,今年前兩個月,行業累計僅完成快遞65.5億件,同比下降10.1%。當中異地、同城、國際業務量累計分別完成11.7億件、51.9億件、1.9億件,同比分別下降19.6%、8.1%及增長5.3%。

2月份單月,行業完成快遞27.7億件,同比增加0.2%;錄得快遞業務收入364.4億元,同比增長4.1%。

(圖源:安信證券研報)

前三個月而言,一月份受春節及疫情影響,快遞業務量錄得大幅下降;二月份由於復工及去年同期春節假期影響基數較小,快遞收入及快遞業務量同比小幅增長;三月份行業繼續反彈,行業基本面恢復至疫情前水平。

2

集中度持續提升,順豐逆勢增長

因為三月份行業個股的業績數據還未披露,故要看行業龍頭表現的話,只能參照2月份經營數據。

整體而言,快遞行業集中度CR8仍持續提升,為86.4%,同比提升6.3pct,環比提升1.6pct。疫情延長假期期間,順豐、京東及中國郵政為全國少數保持正常經營的快遞企業。

2月快遞行業品牌集中度CR8為86.4%,同比提升6.3pct,環比提升1.6pct。由於春節錯峯疊加新冠疫情,順豐、京東、中國郵政是少數保持正常運營快遞企業,預計3家市場份額在疫情期間提升明顯。

體現在具體的經營數據上,順豐控股業務量同比大幅增長119%;業務收入增長82.11%。其餘三通(申通、圓通及韻達股份)業務量及業收入均錄得下降。三者比較,韻達在業務量、業務收入及單票收入方面跌幅均為最小。

全行業市佔率方面,順豐市佔率為17.2%,環比1月份上升2.1個百分點。韻達為10.72%,小幅上漲0.12個百分點。圓通及申通的市佔率分別為8.41%及5.7%,小幅下降7及11個百分點。

(圖源:羣益證券研報)

細分行業市佔率方面,按照2019年全年數據,順豐為商務快遞領域龍頭企業,細分市場佔有率達54%;而電商件細分領域市場集中度相對較低,頭部企業市佔率相若,最高為韻達及中通,分別為19%及22%。四通一達CR5集中度為86%。

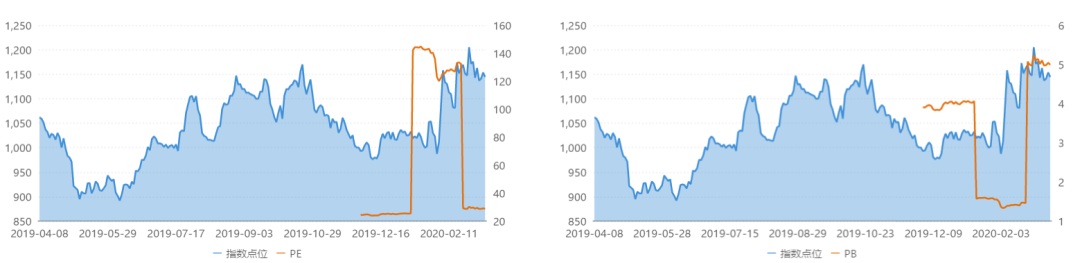

板塊估值方面,由順豐、兩通一達及德邦股份組成的物流運輸板塊PE處於近一年來的低位。

(圖源:同花順iFinD)

具體個股方面,2月份經營數據表現最好的商務件龍頭順豐控股在板塊中滾動市盈率最高,為37.26X。韻達股份當前滾動市盈率在A股“兩通一達”中同樣為最高,為25.33X。

(圖源:同花順iFinD)

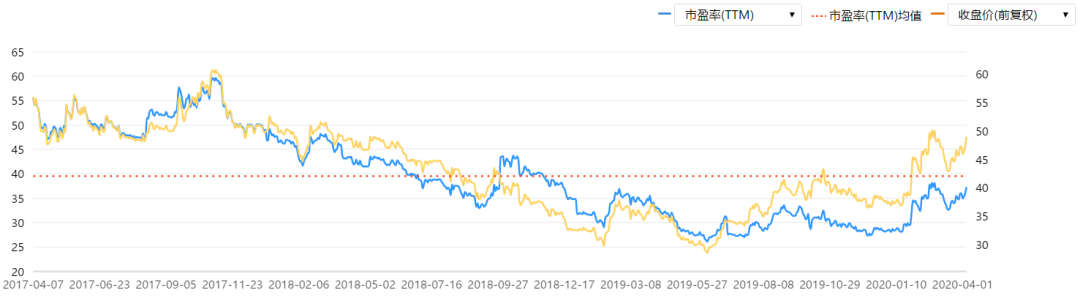

目前,順豐控股股價雖然近期出現一定下行,但滾動市盈率仍高於過去一年平均水平。但放長至過往三年曆史數據來看,當前滾動市盈率仍低於平均水平。在行業持續轉好之下,經營數據向來理想的順豐是否值得投資就留待讀者自行判斷了。

(圖源:同花順iFinD)

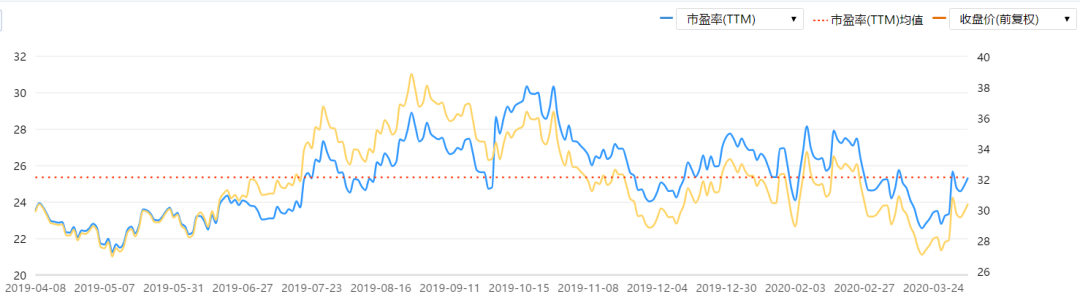

韻達在經歷了股價震盪下挫之後,當前滾動市盈率已重新跌穿過往一年的平均水平,考慮到韻達在2月份多重不利因素之下業務量、業務收入及單票收入在行業龍頭中的跌幅最小(表明公司業績彈性較大),可繼續關注3月份的經營數據。

若韻達即將披露的3月份數據大幅優於行業平均水平,則在細分領域市佔率仍稍微領先的公司或具有一定的估值修復空間。

(圖源:同花順iFinD)