北上資金淨流入超70億,大肆抄底大消費,海天味業2周飆漲超40%

受海外市場超級反彈的刺激,今日A港股兩市整體呈現大幅高開反彈走勢,農業、科技、軍工等板塊表現強勢,市場資金入場抄底的跡象明顯。

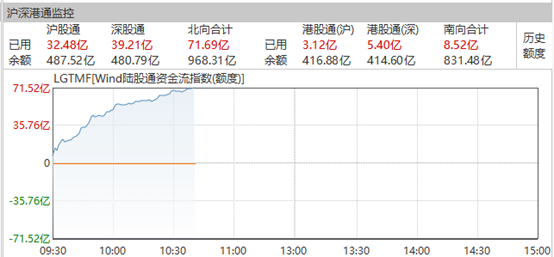

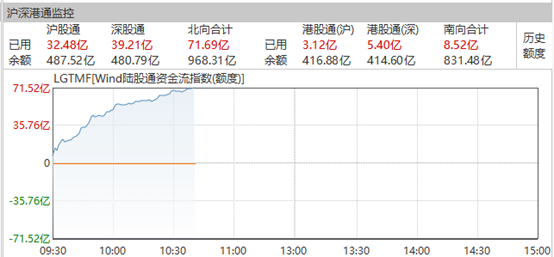

截至上午10點40分,北上資金再度呈現大幅淨流入的狀態,目前累計淨流入超過71億元,其中滬股通淨流入超32億元,深股通淨流入超39億元。

2020年第一季度,近半數行業獲北向資金淨流入。其中,當季累計淨流入前五的行業分別為醫藥生物、計算機、建築裝飾、休閒服務、電氣設備。淨流出前五的行業為非銀金融、家電、電子、建築材料、銀行。其中,醫藥生物自去年6月份以來便穩步淨流入,今年3月依然呈現大幅淨流入,今年累計淨流入160億元。

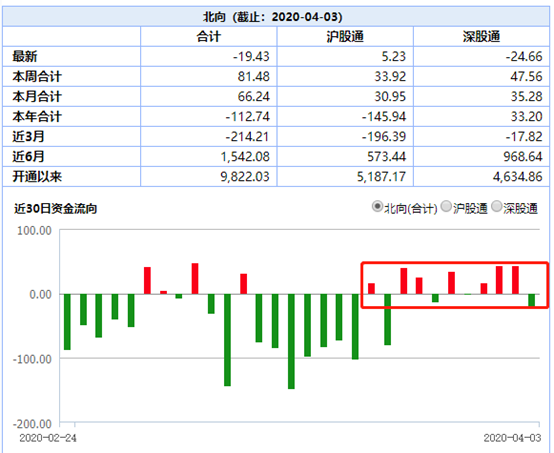

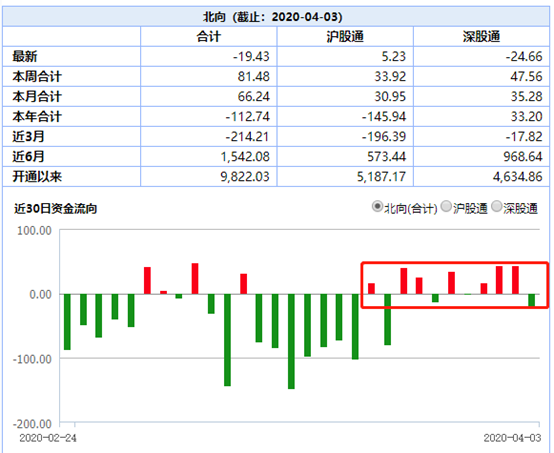

尤其是自3月下旬以來,隨着海外市場的初步企穩,北向資金開始迴流,目前已逐漸呈現多日流入的狀態,在過去的11個交易日中,有7個交易日的北上資金都處於淨流入狀態。

數據顯示,在3月30日-4月3日期間,北上資金淨流入81.48億元,連續兩週保持淨流入。滬股通淨流入33.92億元,深股通淨流入47.56億元。

在上週,由於國內全面復工復產,內需消費景氣度回升,此前大幅外流的消費板塊迎來了北向資金的補倉。其中食品飲料、電子和醫藥生物顯示淨流入較多,分別淨流入37.14億元、26.94億元和10.37億元;家電、交運和有色淨流出11.57億元、7.46億元和6.58億元。4月3日相對多數TOP20重倉股被增持,其中海康威視、海天味業和萬科A分別增持0.57%、0.46%和0.19%;上海機場、海爾智家和中國國旅分別減持0.50%、0.47%和0.27%。

值得一提的是,在上週5個交易日中,貴州茅台每天都登上盤後十大活躍成交股榜單,該股全周合計獲北向資金淨買入15.01億元,持股比例上升了0.14個百分點,今日貴州茅台股價漲1.51%,市值超過14540億元。

同時消費股核心龍頭海天味業在上週也獲得了14.93億元的淨買入,5個交易日獲北向資金增持逾1219萬股,持股比例大幅上升0.45個百分點。這使得該股在近期的股價持續大漲,近兩週漲幅已超過40%。今日海天味業股價繼續大漲,目前漲超6%,總市值高達3660億元。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.