雅生活服务(03319.HK)2019年业绩点评:跨越式增长,站上新起点,维持“买入”评级,目标价45.86港元

机构:光大证券

评级:买入

目标价:45.86港元

◆19年营收+51.8%,归母净利润+53.7%

公司发布19年业绩,营收51.3亿元同比+51.8%,归母净利润12.3亿元同比+53.7%。基础物管、业主增值、非业主增值收入分别占比55%、35%、10%,收入结构改善。整体毛利率下降1.5pc至36.7%,主要受外拓及收并购在管面积占比提升影响。销管费用率下降3.7pc至6.6%,主要由于公司组织架构优化,实行区域集约管理,并对收并购公司进行管理精简、集约化采购。

◆收入拆分:基础服务营收高质量增长,业主增值服务精耕细作

19年在管面积+69%至2.34亿平米,基础物管营收+74%至28.3亿元。新增第三方项目(不含收并购)平均单价同比+13.6%,实现高质量增长。业主增值服务营收同比+68.1%至4.85亿元,其中三个子板块生活服务、社区资源管理、家装宅配增速分别为53%、108%、33%。生活服务板块精耕细作,推出小雅系列家居服务及乐享荟平台,以刚需、高频产品引流,高价、低频产品保利润;社区资源管理板块积极盘活社区公共资源,降低资源空置率。非业主增值服务营收同比+24%至18.1亿元,其中案场物业管理收入+3.9%至7亿元,其他外延增值服务收入+41%至11.1亿元,主要是由于物业营销代理业务量增加。

◆业务经营:第三方在管面积占比73%,聚焦永续型社区服务发展

基础服务毛利率下降2.1pc至25.3%,主要是由于积极承接外拓项目,使得项目前期投入过多;同时毛利率相对较低的收并购项目占比提升。19年末公司来自第三方外拓(包括收并购)面积占比提升11.7pc至73.3%的高位,显示出公司已相对具备独立发展能力。由于优化供应链管理、加大催收力度,经营性净现金流16亿,同比+81.2%,覆盖净利润1.24倍(18年为1.09倍)。业主增值服务方面,单户ARPU达到207元,与18年基本持平(209元)。整体来看,永续型业务(生活服务、社区资源管理)发展较好,业主增值服务板块收入结构优化。

◆业务拓展:外拓发力,并购中民物业实现跨越式发展

基础服务方面,合约面积3.56亿平米,覆盖在管面积1.52倍。公司瞄准优质企业,完成了青岛华仁、哈尔滨景阳、广州粤华、兰州城关四个收并购项目。第三方外拓(不含收并购)新增合约面积3274万平米。20年3月17日,中民物业收购事项由临时股东大会批准。截止2018年底,中民物业控股公司在管面积1.54亿平米,参股公司在管面约积1亿平米。含中民物业及新中民物业,公司总在管面积接近5亿平米,实现跨越式发展。

◆上调目标价至45.86港元,维持“买入”评级

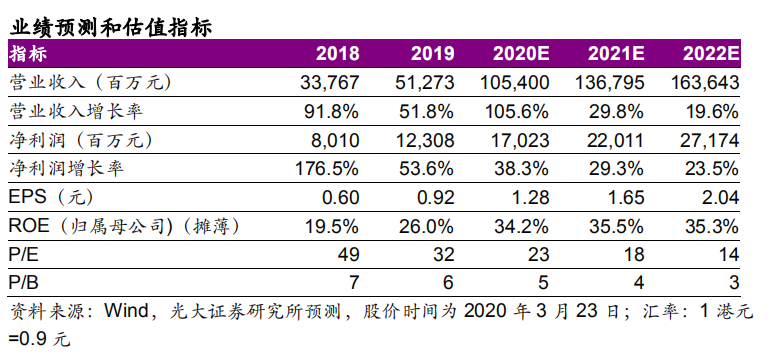

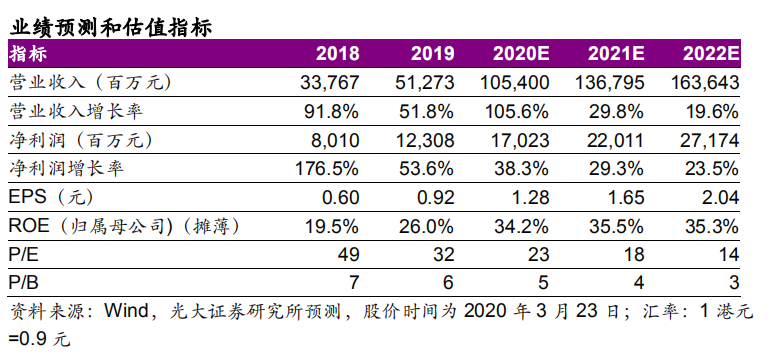

随着中民物业及新中民物业并表,公司在管面积实现跨越式发展。同时公司还将实现收入结构大幅优化,全国布局更加均衡,并切入公建蓝海,成为全业态龙头。我们上调20-21年预测EPS至1.28、1.65元,引入22年预测EPS为2.04元。鉴于行业成长性较强,市场普遍关注公司在未来1-2年的成长,故选用2021年估值。可比公司2021年平均预测PE为25倍,我们给予2021年25倍PE,上调目标价至45.86港元,维持“买入”评级。

◆风险提示

人工成本快速上升风险;增值服务拓展不确定性风险;关联方依赖风险;外包质量风险。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.