雙匯發展(000895.SZ):提價效應漸顯,肉製品盈利將成亮點

作者:楊勇勝/歐陽予

來源: 招商食品飲料

公司19年成功應對高豬價、高雞價、高關税等多重考驗,通過低價庫存銷售和肉製品提價等手段,實現全年靚麗增長,展現全球產業鏈龍頭效率優勢。展望20年,提價效應將繼續護航,成本壓力下降,肉製品盈利有望大幅改善。我們給予20-22年EPS預測1.73、1.85和2.07元,需求穩健及盈利改善下,當下值享確定性溢價,給予1300億目標市值,對應目標價39元,暫維持審慎推薦。

報告正文

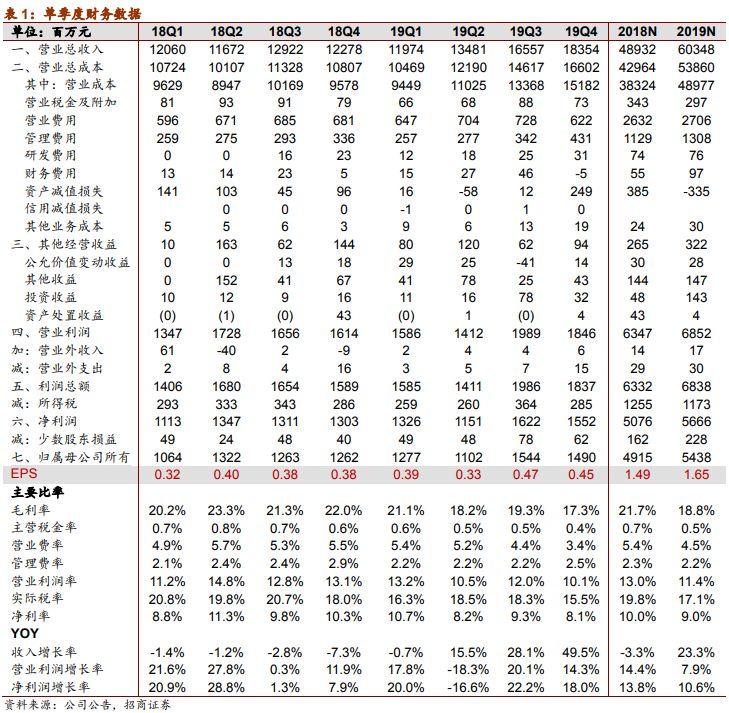

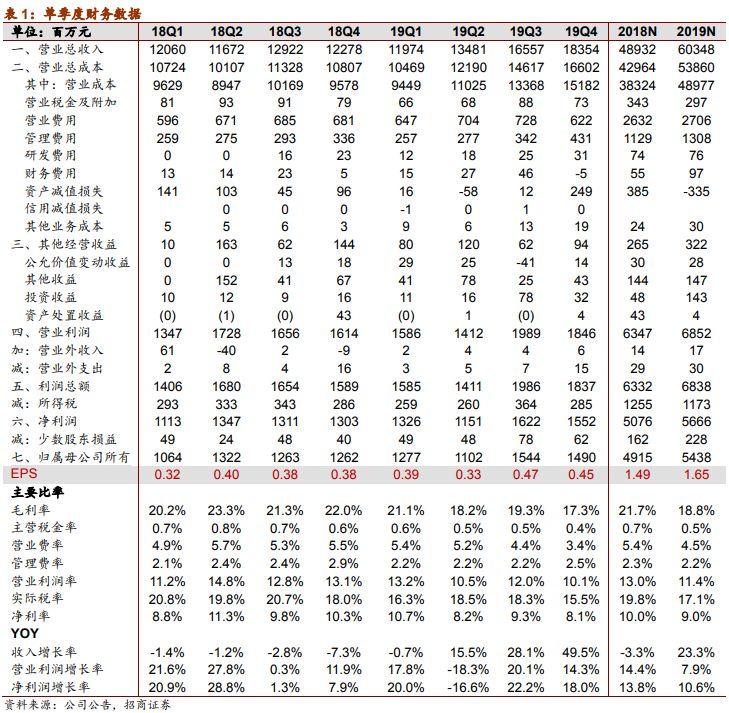

19年靚麗收官,持續儲備庫存應對豬價上漲。公司19年收入603.5億元,歸母淨利54.4億元,同比增長23.4%和10.7%,其中19Q4單季收入183.5億元,歸母淨利15.0億元,增長49.7%和19.0%,屠宰業務凍肉銷售貢獻明顯。全年經營性現金流保持平穩,採購支出大幅增長,19年末生鮮品庫存量20.91萬噸,同比增長70.4%,繼續為豬週期上漲加大原材料儲備。公司年報披露擬每10股派 10元現金紅利(含税),19年分紅率61%,同比有所下降,期末貨幣現金34.5億元,仍具備較高分紅能力。

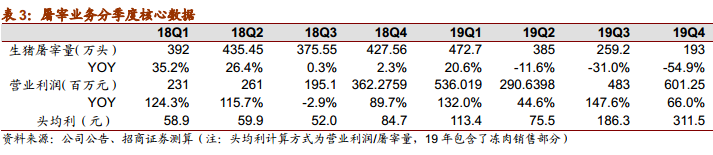

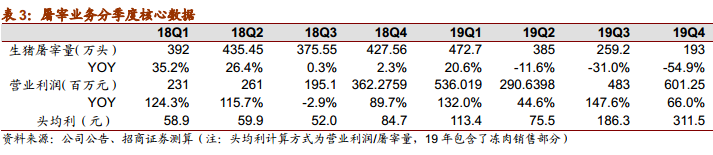

屠宰業務:存儲凍肉和進口肉貢獻,Q4利潤大幅增長66%。公司19年屠宰1310萬頭,同比下降19.7%,銷量148.5萬噸,下降2.9%,其中19Q4屠宰193萬頭,同比下降54.9%,單季鮮凍肉銷量37.3萬噸,微降2.3%。豬價高位下屠宰量持續受抑制,低價存儲凍肉銷售貢獻較大,下半年進口量加大。19Q4分部營業利潤6.01億元,同比高增66.0%,前期低價庫存釋放,及跨區銷售持續大幅貢獻。

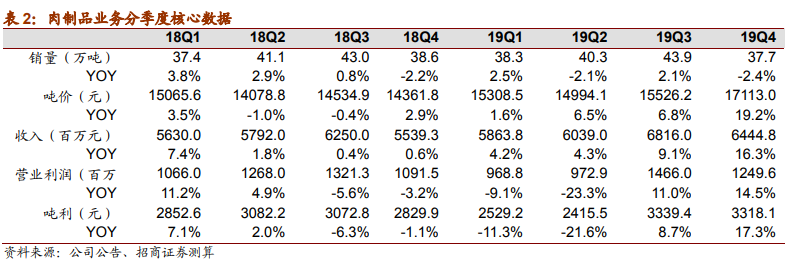

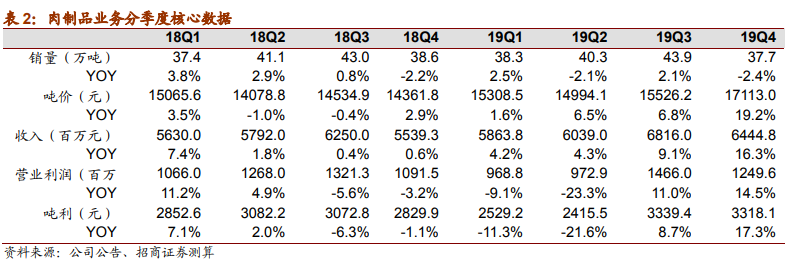

肉製品業務:連續提價開始體現,成本上漲有效控制,下半年盈利能力明顯好轉。肉製品業務19年銷量160萬噸,同比持平,收入增長8.4%,其中Q4銷量37.7萬噸,下降2.4%,噸價1.71萬元,提升19.2%,提價貢獻幅度放大,單季銷售收入64.5億元,同比增長16.3%。在低價庫存及進口豬肉、和提價等多措並舉下,成本壓力得到良好對衝,19Q4噸均利提升17%至3318元/噸,單季營業利潤12.5億元,增長14.5%。

20年展望:提價效應護航,成本壓力下降,肉製品利潤將成亮點,更待新業務突破。公司提價效應有望在20年持續體現,且肉製品經歷6次提價,銷量仍平穩,需求剛性得到檢驗。成本端方面,19年在高豬價、高雞價、高關税等多重考驗下,產業鏈一體化優勢充分發揮,20年雞價成本壓力下降,國內豬價仍維持週期高位,但從美國進口豬肉關税自3月起下降至38%,在中美豬肉巨大價差下,雙匯從羅特克斯進口量將大幅增加,有望對衝成本壓力。公司營銷層面在19年取得實質性進展,期待後續仍能加大品牌精準投放,培育年輕消費主體,同時公司近年在中式肉製品、餐飲供應鏈等新業務佈局,期待更大突破。

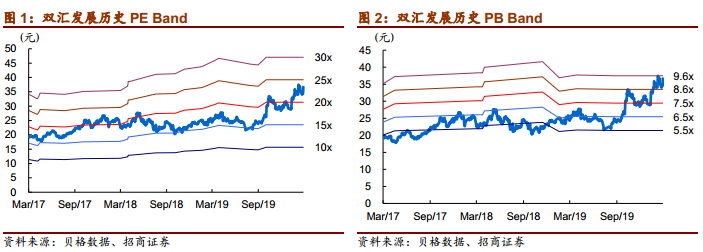

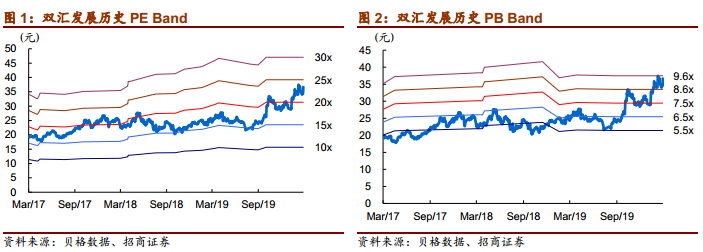

投資建議:關注肉製品盈利持續改善,值享確定性溢價,上調目標價至39元,暫維持審慎推薦。公司19年全面彰顯產業鏈一體化龍頭實力,充分對衝成本壓力,實現報表靚麗增長,新冠疫情對雙匯影響較小,且肉製品提價效應、成本壓力下降,將護航20年報表。我們給予20-22年EPS預測1.73、1.85和2.07元,給予20年22倍PE,或按分部估值法,20年整體盈利預測57.2億元,其中肉製品業務盈利42.1億元,增長20%,需求穩健及盈利改善下給予25倍PE,目標市值1100億元,屠宰及其他業務15.2億元,目標市值200億元,整體目標市值1300億元,對應目標價39元,維持“審慎推薦-A”投資評級。

風險提示:需求持續回落,肉製品轉型不及預期,成本波動

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.