早盤覆盤:港A兩市再度大跌滬指創年內新低,白酒板塊下挫4.3%

今日午盤,兩市主要指數下跌,滬指盤中大跌3%後反彈,午間收跌2.14%報2670.37點,創年內新低;深成指跌1.93%報9836.21點,創業板盤中大跌2.5%後回升,午間收跌1.11%報1866.14點;上證50跌3.37%,盤中大跌逾4%。兩市成交額近4900億,2595股下跌,1069股上漲;北上資金淨流出45億。

盤面上,行業板塊普遍下跌,旅遊、釀酒、保險板塊重挫,煤炭、地產、汽車、銀行等板塊大跌靠前。光刻機概念強勢,勝利精密、容大感光等多股漲停;維生素、芯片、衞星導航、氮化鎵等概念活躍。

港股方面,今日恆指、國指低開後繼續下行,截至午間收盤,恆指跌4.25%,報21344點;國指跌4.94%,報8366點;主板半日成交1021億港元。

從板塊上看,電訊設備股、航空股、內房股、香港零售股、體育用品股、港口運輸股等板塊悉數下跌。

今日A股熱門板塊:

光刻膠板塊領漲全市,勝利精密、飛凱材料、容大感光、澄星股份漲停,西隴科學、晶瑞股份漲超6%,上海新陽、南大光電漲逾5%。

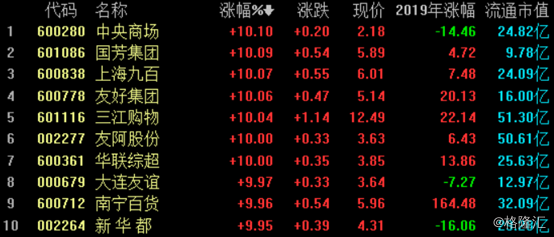

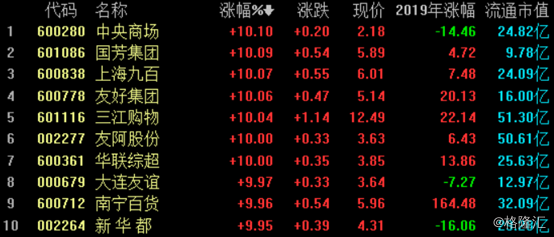

零售板塊板塊掀起漲停潮,中央商場、國芳集團、上海九百、友好集團等10股漲停,華聯股份、合肥百貨、家家悦等股跟漲。

數據中心板塊漲幅排名靠前,廣東榕泰、萬馬科技錄得漲停,延華智能、易事特、沙鋼股份、科創信息紛紛上漲。

氮化鎵板塊走強,台基股份漲停,華峯測控、乾照光電、捷捷微電、耐威科技等多股跟漲。

互聯網彩票板塊表現較強,友阿股份、新華都漲停,拓維信息漲近5%,姚記科技、天虹股份、中青寶等個股上漲。

白酒板塊領跌,板塊內的今世緣跌近9%,古井貢酒跌逾8%,五糧液、順鑫農業、酒鬼酒、山西汾酒、瀘州老窖均跌超5%。

口罩板塊跌幅再度居前,順威股份跌停,奧佳華、陽普醫療、欣龍控股、振德醫療、泰達股份等多隻概念股均大跌。

科創板方面,今日午盤科創闆闆塊表現一般,其中神工股份漲11.43%領漲,卓易信息上漲6.09%,華峯測控、紫晶存儲、安集科技、普元信息等個股上漲;南微醫學下挫7.83%領跌,潔特生物、寶蘭德、東方生物、博瑞醫藥等個股跌幅靠前。

板塊資金流向方面,今日半日主力整體流出較多,其中,淨流入前三的是零售指數、精細化工指數、半導體指數,主力淨流入額分別為9.1億元、6.98億元、6.8億元;淨流出額前三的板塊是酒類指數、房地產指數、建築指數,分別為6.76億元、5.69億元、4.11億元。

個股資金流方面,今日主力淨流入狀況一般,淨流入額前三為海正藥業、飛凱材料、台基股份,分別流入9.22億元、3.84億元、3.44億元;而淨流出方面,五糧液淨流出最多,為3.44億元,其次是中科曙光和為未名醫藥,分別流出1.95億元和1.87億元。

滬深港股通資金流方面,滬股通淨流出30.41億元,深股通淨流出14.86億元,北向資金半日合計淨流出45.27億元;港股通(滬)淨流入50.26億元,港股通(深)淨流入29.68億元,南向資金半日合計淨流入79.94億元。

港股板塊方面,上漲板塊僅6個,其中應用軟件板塊上漲4.03%領漲,其餘上漲板塊包括國內零售股、影視娛樂、地產代理、超市便利店、百貨業股;航空服務大跌9.37%領跌,電訊設備、油氣設備、內房股、水務、頁巖氣等板塊跌幅居前。

港股個股方面,恆指成份股中僅瑞聲科技上漲1.63%,而長江基建集團大跌11.02%領跌,中國人壽也大跌了10.95%,長和、長實集團跌近9%,碧桂園、華潤置地、石藥集團、新世界發展等多股跌逾7%。

國指成份股全部下挫,中國人壽、粵海投資、融創中國、中國鐵塔、中國財險、碧桂園等個股跌幅居前。

期貨方面,國內期市午盤多數下跌,12個品種跌停。具體跌停品種包括:瀝青、塑料、聚丙烯、苯乙烯、乙二醇、PTA、20號膠、甲醇、滬銅、滬錫、棉紗、鄭棉。黑色系多數下跌,焦炭、鐵礦石跌逾4%,熱卷跌逾3%;貴金屬均下跌,滬金跌逾2%,滬銀跌逾5%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.