舜宇光学(2382.HK) :业绩超预期,继续引领光学创新

作者:何立中

来源: 学恒的海外观察

全年业绩超预期,营收增长46%,净利润增长60%

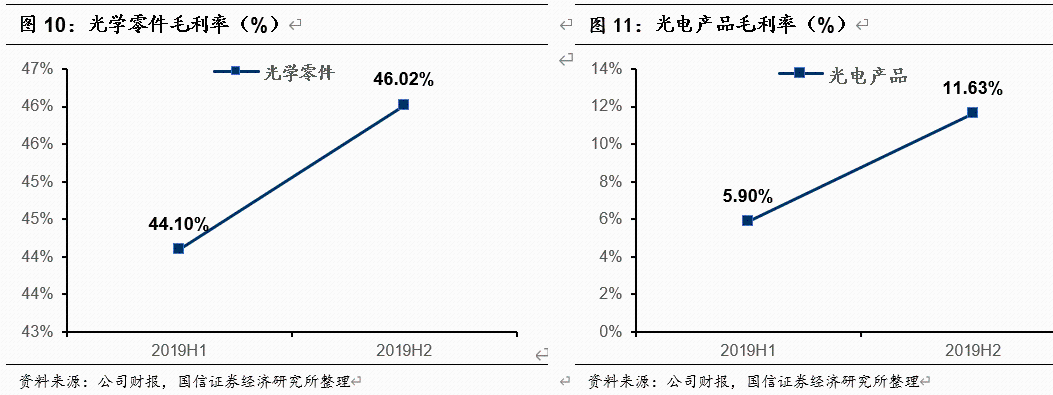

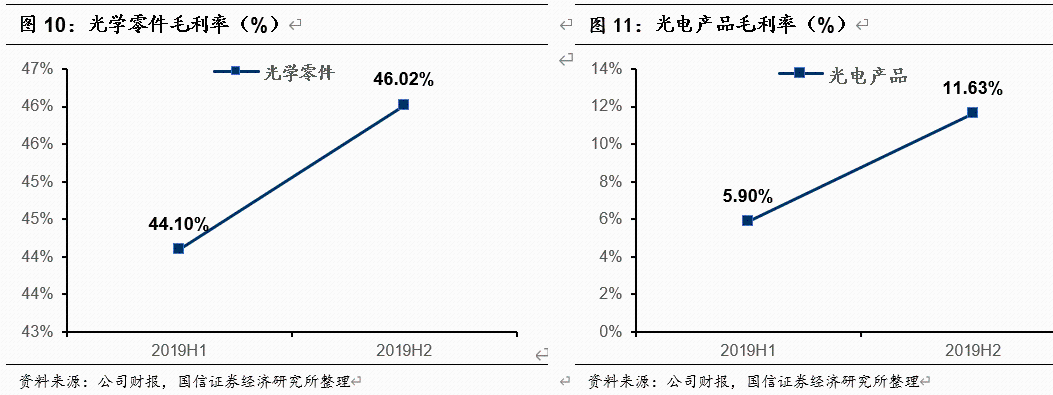

2019年公司营收378亿元,同比增长46%,净利润40.2亿元,同比增加60%。毛利率20.5%,同比上升1.55个百分点。营收增速和净利润增速均超市场预期。2019营收增长主要是因为智能手机业务、车载成像及传感相关业务带动。光学零件收入增长46.4%,光电产品增长46.6%,光学仪器下降-5%。

光电产品毛利率近翻倍,超预期地从5.9%提升至11.63%

2019公司毛利率、净利润率都有提升,受益于光学零件、光电产品的毛利率都有提升,特别是光电产品(手机模组为主)毛利率从2019上半年的5.9%提升至2019下半年的11.63%。光电产品毛利率提升,说明公司模组创新获得客户认可,产品持续升级,与竞争对手逐渐拉开差距。

从供给角度看,公司继续引领光学创新

市场总是容易低估行业龙头的各种壁垒,总是担心后来者扩产抢夺把龙头份额,实际上这种情况很少发生。如果,所有的投资扩产都能见效,那中国的科技早就超过美国了。舜宇在镜头领域也是一步步慢慢地缩小和大立光的差距,如果国内其它落后者能快速超越舜宇,那舜宇早就超过大立光了。所以,光学领域依旧看舜宇,舜宇依旧是能影响供给的光学龙头。

上调评级至“买入”评级——好公司跌得越多越有投资价值

预计2020~2022年公司收入分别为491亿元629亿元/789亿元,增速分别为29.8%/28.1%/25.6%,2019~2021年利润分别为51.5亿元/67.1亿元/88.3亿元,增速为29.2%/30.2%/31.5%。我们遵循资本回报率越高、增长速度越快,市盈率越高的理论。同时考虑公司既有光学镜头、也有摄像模组,具有垂直整合优势。公司在未来光学领域依旧是国内龙头,继续引领光学创新,竞争格局持续向好,国内其它竞争对手还需要时间打磨自身产品工艺,短期内对公司没有威胁。公司2019年下半年的业绩再次证明以上判断,公司市盈率合理估值范围28~30倍,对应2020年的合理价格区间为146 -156港元,上调评级至“买入”。

风险提示

行业竞争加剧,毛利率不能回升、市场份额减少。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.