機構:東吳證券

評級:增持

投資要點

理文造紙發佈2019財年業績:報告期內,公司實現營業收入271.44億港元(-15.72%),淨利潤33.00億港元(-32.37%),剔除匯兑收益1.93億港元全年實現淨利潤31.07億港元(-35.03%)。其中19H1/19H2分別實現收入增速-20.91%/-10.36%;分別實現淨利潤增速-43.63%/-14.72%。公司期內合計實現銷量629萬噸(+2.78%),單噸淨利約525港元,受進口外廢減量,2019H2噸淨利466港元/噸(H1單噸淨利598港元/噸)。

銷量小幅上升,包裝紙業務略顯承壓:公司造紙業務實現銷售額271.43億港元(同比-15.72%)。其中,細分紙種包裝紙、生活用紙分別實現銷售額223.88億(-17.56%)、47.55億(-5.81%)。期內公司實現銷量約629萬噸,較去年同期增長17萬噸(+2.78%)。整體營收下滑受紙價下跌所致,主要紙種包裝紙整體下行,截至19Q3跌至低點3907/3246元人民幣(同比-24.84%/-29.40%),行業盈利跌至箱板/瓦楞毛利率22.48%/10.36%,19Q4箱板/瓦楞價格環比僅上升4.29%/4.27%,此外生活用紙受漿價低位運行致使行業價格競爭,19全年價格同比下降10.6%。

疫情拖累終端需求,關税利好盈利彈性:(1)前期疫情拖累國廢回收,大廠惜售,小廠開工不足,導致成品紙供給短缺,廢紙產業鏈箱板/瓦楞噸價開年來已累計提漲367/575元人民幣至4577/4070元人民幣,目前廢紙回收業陸續復工下供應緊張狀況已逐漸緩解,隨着原材料價格逐步回調以及下游需求疲軟,預計將對後續價格構成壓力,靜待下半年包裝紙旺季廢紙系邏輯兑現提價;(2)部分美國商品的進口關税擬被取消(廢紙&再生漿),利好理文造紙的進口原料成本下行,預期全年節約税額達1.68億元人民幣。

開啟產能釋放,看好營收、淨利成長:截至2019年底公司合計擁有紙、漿產能約723.5萬噸,其中包裝紙603萬噸、生活紙102.5萬噸、紙漿18萬噸(2019年僅在年底於江西投產10萬噸生活紙),公司在東莞、洪梅、常熟、重慶、江西等地均有生產基地佈局,此外越南工廠包裝紙年產能約為40萬噸。公司計劃於20年3月在馬來西亞新增投產40萬噸再生漿板產能,同時於20年底在越南新增50萬噸箱板瓦楞紙產能,公司瞄準東南亞市場,推進國際佈局,穩定產業鏈的配套能力,看好20年公司上游原料佈局帶來成本改善及銷量增長貢獻營收增量。

毛利率略有下滑,管理效率持續領跑:報告期內公司毛利率同比減少4.55pct至18.76%,主要是由於外廢政策疊加廢紙加徵關税使原材料成本上升,隨着越南投產和各地佈局產能不斷爬坡,毛利率有望改善。期內三費率7.74%(+0.23pct),分項來看,銷售費用6.12億港元,銷售費用率2.26%(+0.46pct);管理費用11.63億港元,管理費用率4.28%(-0.43pct),效率不斷提高;財務費用3.25億港元,財務費用率1.20%(0.21pct),其中利息淨支出3.25億港元(+1.64%),期末匯兑淨收益1.93億港元(+96.94%)。綜合來看,公司淨利率(含少數股東權益)由去年同期15.15%下滑2.99pct至12.16%,符合預期。

資產負債率向好,營運能力改善:報告期間公司資產負債率為40.04%,較去年同期減少5.85pct,資產負債率向好。期末公司賬上應收貿易及其他賬款53.56億港元,較期初減少6.01億港元,應收賬款週轉期增加4天至39天。賬上存貨35.71億港元,較期初減少13.15億港元,原料及製成品存貨週期分別減少7天/6天至54天/10天;賬上應付貿易及其他賬款28.33億港元,較期初減少8.38億港元,應付賬款週轉期減少6天至27天。截止報告期末,公司未償還銀行借貸123.36億港元,較去年同期減少14.54億港元。從公司應收賬款週轉天數、存貨週轉天數以及應付賬款週轉天數表現來看,營運能力持續改善。

廢紙系旺季邏輯通順,看好公司原料及產品端擴張:公司現有包裝紙產能603萬噸,是僅次於玖龍紙業的第二大箱板龍頭,且近年來佈局生活用紙,產品多元化擴張順利。公司佈局海外基地於今年逐步開啟產能釋放,預期將從成本端及收入端給公司帶來盈利彈性。此外中期我們仍舊看好進口外廢限制導致的纖維缺口,將進一步優化行業格局,預期廢紙系旺季提價邏輯順暢,帶動盈利修復。

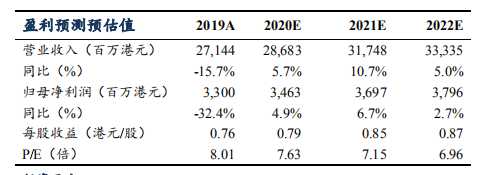

盈利預測及投資評級:我們預計20-22年分別實現營收286.83/317.48/333.35億港元,同增5.7%/10.7%/5.0%;歸母淨利34.63/36.97/37.96億港元,同增4.9%/6.7%/2.7%。當前股價對應PE為7.63X/7.15X/6.96X,維持“增持”評級。

風險提示:原材料價格大幅波動,環保力度加大。