温氏股份(300498.SH):豬雞利潤釋放,全年業績高增長

作者:馬莉 金含

來源:紡服新消費馬莉團隊

投資要點

公司發佈FY19業績快報:FY19實現收入732.28億同增27.92%,歸母淨利139.06億同增251.38%;單四季度實現收入164.05億同增51.91%,歸母淨利78.21億同增639.50%。

生豬養殖貢獻利潤彈性:19年公司銷售肉豬1851.66萬頭,同降16.95%;銷售均價18.79元/公斤,同增46.57%;收入395.45億元,同增20.03%;按完全成本14.7元/公斤計算,全年生豬養殖盈利約86億元。單四季度出欄298萬頭,扣除獎金和股權激勵費用,生豬養殖盈利60-70億元。

20年豬價將持續高位運行:整體供需格局而言,我們預計20年豬肉產量3950萬噸,較18年減產1450萬噸,進一步扣除進口肉彌補、肉類消費替代仍有約800萬噸的供給缺口。20年將依舊處於豬肉供給緊缺的狀態,且由於養殖密度和豬瘟疫情間的不確定性疊加三元留種導致生產效率降低,進一步加入此次新冠疫情的變量因素,2月正常的補欄大幅減少,進一步拉長復產進度,全年豬價將依舊保持高位運行。

養豬板塊有望繼續釋放利潤:根據20年1月數據來看,銷售肉豬86.94萬頭,銷售均價36.62元/公斤,收入37.18億元,均重117公斤,單月盈利約20億元,保持高盈利趨勢。假定20年公司生豬出欄1800萬頭,預計20年生豬養殖板塊利潤310-360億元。

禽板塊景氣度高,量利齊升。非洲豬瘟疫情導致豬肉供應缺口拉大,消費替代效應下禽養殖持續景氣。19年公司銷售肉雞9.25億隻,同增23.58%;銷售均價15.06元/公斤,同增9.93%;收入258.92億元,同增34.03%;預計完全成本約12元/公斤,單羽盈利5.5-6元,全年肉雞板塊盈利50-55億元。單四季度出欄2.9億羽,肉雞板塊盈利20億元。

新冠疫情影響短期禽價,預計20Q2後期價格有望回升。由於新冠疫情影響,1-2月雞價出現大幅回落,行業短期陷入深度虧損。但20年豬價持續高位將繼續對雞價形成支撐,疊加疫情影響後續逐漸減弱,消費回暖後有望在5-6月迎來價格拐點。

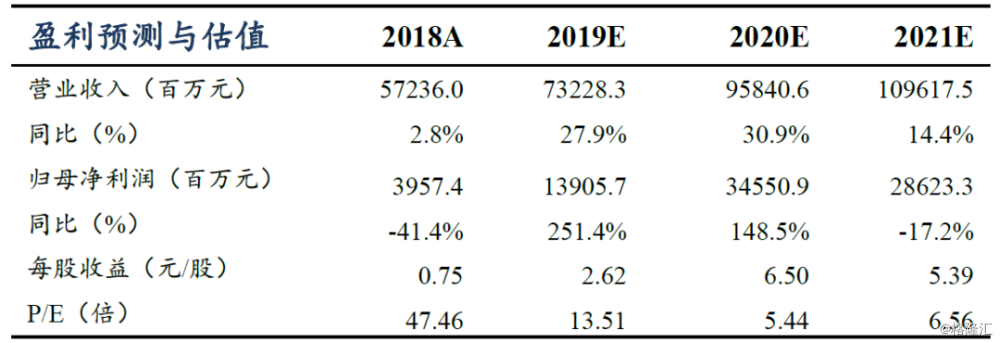

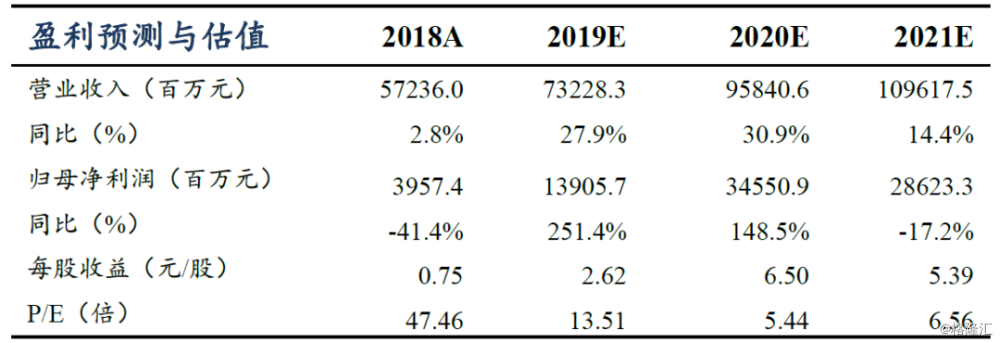

盈利預測與投資評級

我們預計19-21年公司實現營收732.28/958.41/ 1096.17億元,同增27.9%/30.9%/14.4%,歸母淨利139.06/345.51/286.29億元,同增251.4%/148.5%/ -17.1%,當前股價對應PE為13.5/5.4/6.6X,考慮到公司養豬板塊具備防疫、成本、資金、土地、人才儲備等多元優勢,有望把握此輪豬週期提升市佔率,成長動力充沛,維持“買入”評級!

風險提示

豬價波動,出欄不及預期,自然災害及疫情風險,原材料價格波動

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.