中航國際控股(00161.HK):私有化衝刺,只待要約接納達成

格隆匯APP獲悉,中航國際控股(00161.HK)14日發佈公告,其擬除牌及後續吸收合併事項相關議案已在股東大會上高票批准通過,這意味着其去年提出的擬私有化計劃,僅剩達至90%的H股有效要約接納一項重要條件即可實現。

為何中航國際控股此次要設置如此高的要約接納門檻?實際上,這一私有化達成條件是香港證監會為保障小股東權益,於18年修訂的《收購守則》中做出的進一步明確安排。

既然此舉是為保證小股東權益,想要成功私有化,大股東必須給出合理的要約價格才能服眾。中航國際控股此次私有化作價9港元,較停牌前最後交易日前30、60和180個交易日均價溢價率分別為81.31%、88.63%和92.08%,也大幅高於近年私有化先例平均溢價水平,包括近期宣佈私有化成為無條件的華能新能源(00958.HK)。

中航國際控股是多家A股上市公司的控股股東,但港股資本市場對多元經營企業給予較大的折價,在目前公司業態持續經營的情況下,預計未來股價被市場低估的可能性也將長期存在。近來,旗下深南電路(002916.SH)多次觸及A股漲停板,便有小股東質疑,坐擁如此優質資產,9港元作價是否太低。事實上,子公司的利潤要經過逐層分紅才能到達中航國際控股手中,且除深南電路,深天馬(000050.SH)這樣的績優股外,中航國際控股旗下還有受境內外宏觀經濟波動大幅影響的國際工程與貿易物流業務。

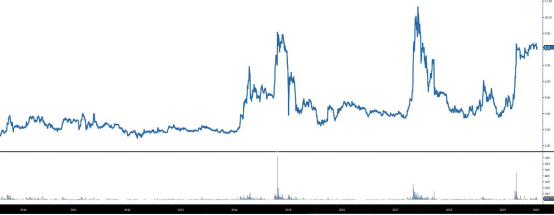

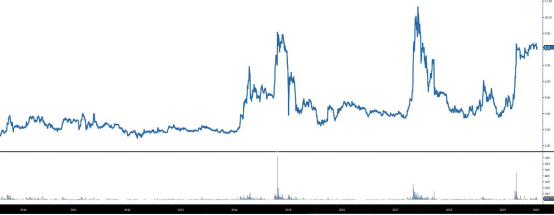

特別是,近期中航國際控股的股價波動,充分説明公司目前股價是基於私有化預期支撐。中航國際控股股價多年來一直在4港元附近浮動,9港元作價已經超過該股近十年絕大部分交易價格;該股股價曾於2015年4月和2017年11月達到9港元和11港元的高點,但彼時大盤也接近3萬點的歷史高位,且保持時間非常短暫。以中航國際控股的流通量看,高位股價時股東順利套現走人的概率很小。如今恆生指數受肺炎疫情、中美貿易戰等持續影響,處於波動下行區間,9港元的要約價格對投資者來説是一個實現溢價出售,避險獲利的好機會。

(中航國際控股近十年股價走勢圖;資料來源:彭博)

從中航國際控股歷史股價推斷,相信絕大部分股東的入手價格不超過5港元。此時接納要約,9港元出手可獲巨利,此外,該股最新收報8.08港元,距離9港元的要約價格還有一定空間,擇機補倉,並在3月4日前接納要約還可錄得收益,同時助力90%H股有效要約接納條件的達成。距離首個要約接納截止日期3月6日還有不到兩週時間,不少持貨股東仍在躊躇,認為可以多觀察幾日,確保萬無一失才接納要約,還有股東認為可“搭便車”,坐享其成,然而,90%的H股有效接納條件的達成需要所有股東協力完成,若不立即行動,可能因錯過接納時機而無法及時獲得對價。在此還要提醒各位股東,雖然要約接納截止日為3月6日,但因香港股票交收與結算採用T+2制度,故股東在接納要約前需做足功課,最晚也要於3月4日前辦理接納要約,切莫因一時大意,錯失良機。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.