吉利汽车(175.HK)7月销量降幅收窄产品结构持续改善维持“增持”评级目标价13.0港元

格隆汇 08-09 17:13

机构:西部证券

评级:增持

目标价:13.0港元

●核心结论

公司7月共销售9.1万台汽车,同比下滑24%,降幅较6月收窄5ppt。1-7月公司累计销售74.3万台车,同比下滑16%,达到我们全年预估销量的55%。

新车方面,星越销量攀升至约3000台,嘉际在3500台左右,符合我们预期。根据我们终端调研,公司在7月回收了商务政策,终端折扣小幅收窄,保价格基调依然明确。

领克品牌终端销量回暖,品牌形象提升。我们测算领克品牌上半年渠道库存累计下滑约0.8万台,截至7月底经销商库存系数普遍在1.5以内的健康水平。并且5-6月国六车切换期间,领克品牌促销力度小于其他品牌。分区域看,领克品牌上半年销量中一二线城市占比约65%,高于同业。8月2日,领克首款性能车领克03+上市,售价区间为18.58-22.88万元,价格带进一步上移。

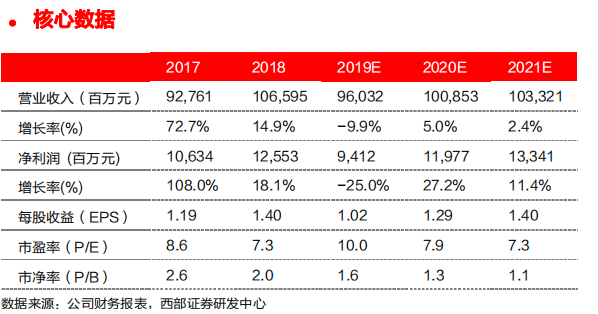

产品结构持续改善,维持“增持”评级。下半年公司即将上市的博越Pro(预售价格9.88-15.68万元)、VF12、SX12和领克05定位高于现有产品,下半年将进一步提振销量、改善产品结构。我们维持2019/2020年净利润预估94/120亿元,维持13.0港元的目标价,基于DCF模型,隐含2019/2020年11倍/9倍市盈率,重申“增持”评级。

风险提示:新产品销售不及预期、国六切换进度不及预期、车市价格战加剧。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.