瑞银料港银上半年业绩可略优于预期中银(2388.HK)估值吸引

格隆汇 07-19 15:49

瑞银发表研究报告,预期香港银行业今年上半年的业绩会较该行原先预期略好。截至今年5月,银行业的贷款增长率为3.1%,而最近的银行同业拆息(HIBOR)增长理应能部分抵销首季净息差回软的影响。另外,港股交投及基金销售复苏,或可提振港银与市场相关的手续费收入,并认为潜在的资产质素压力尚未浮面。因此,该行预期香港银行业上半年的盈利按半年出现明显反弹,而按年增长则因为高基数效应而面对挑战。

随着该行的经济学家开始对美国减息的预期更高,该行亦正下调其净息差预期。但考虑到可能出现持续的资金流出压力,该行相信HIBOR不会在短期内急跌至先前的较低水平。同时,该行对香港银行业2020年的盈利预测下调4至5%,并料贷款增长维持温和,在2020年或有轻微反弹。在经济放缓的情况下,2019下半年至2020上半年或会出现更多资产质素压力。

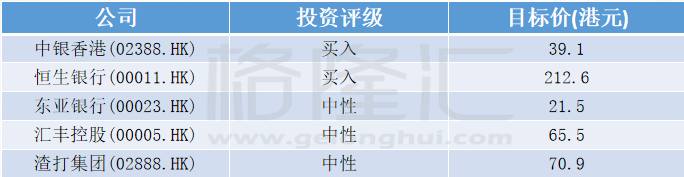

瑞银仍认为中银香港(02388.HK)估值吸引,其估值相当于明年预测市盈率不足10倍;另恒生银行(00011.HK)强劲的资本状况及股息,理应能抵御美国国债孳息率下跌的影响。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.