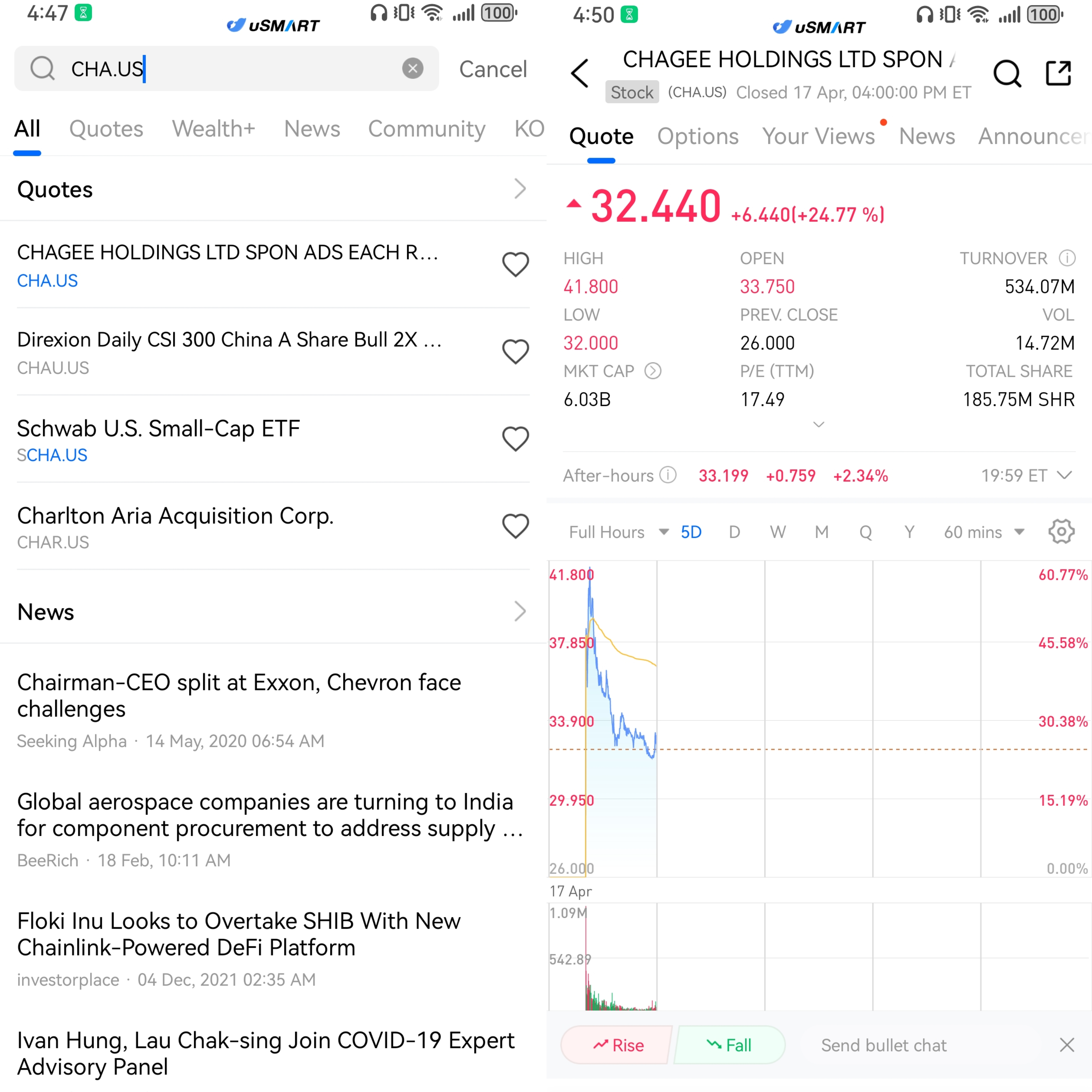

On Thursday, April 17, Chinese new-style tea brand CHAGEE (stock symbol: CHA) officially went public on the Nasdaq Stock Exchange. On its first trading day, the IPO opened over 20% higher at $33.75. The stock continued to climb during the session, hitting an intraday high of $41.80, marking a peak gain of 49%. The company’s valuation briefly surged to around $5 billion. CHAGEE ended its debut session up nearly 16%, closing with a market capitalization of approximately $6 billion.

Company Overview

Founded in 2017, CHAGEE specializes in premium freshly brewed tea beverages, aiming to blend traditional Eastern tea culture with modern beverage trends. The brand follows a single-product focus strategy, with its core category “Original Leaf Fresh Milk Tea” accounting for 91% of its gross merchandise value (GMV). Notably, 61% of its GMV comes from its top three best-selling products. Its flagship item, “Boyah Juexian,” has sold over 600 million cups. Product development emphasizes simplicity and standardization, focusing on classic flavors to support scalable expansion and prolong product lifecycles. This strategy has optimized the supply chain and helped the brand rapidly grow a loyal customer base. As of 2024, CHAGEE operates 6,440 stores globally, with over 98% located in China. Its international presence is primarily concentrated in Southeast Asia.

Financial Information

In 2022, CHAGEE’s GMV was RMB 1.29 billion. By 2023, it had soared by 734.3% to RMB 10.79 billion, and in 2024 it further increased by 172.9% to RMB 29.46 billion. Revenue jumped from RMB 490 million in 2022 to RMB 4.64 billion in 2023—an 843.8% increase—and reached RMB 12.41 billion in 2024, representing year-on-year growth of 167.4%. From 2022 to 2024, CHAGEE recorded the fastest GMV growth among Chinese freshly brewed tea brands with over 1,000 stores. The company plans to open an additional 1,000 to 1,500 stores in 2025, continuing its aggressive expansion strategy.

Opportunities and Challenges

Before officially accepting IPO orders, CHAGEE had already secured initial investment interest totaling $205 million. The IPO was fully subscribed, with investor demand several times the available shares. Investors included Chinese funds and multiple globally renowned long-term institutional investors, demonstrating strong confidence in the company’s business model and international growth potential.

However, behind the high valuation lies the real challenge of a potential slowdown in expansion. While overseas markets are growing rapidly, their overall contribution remains relatively small, and domestic store saturation is becoming apparent. The key challenge ahead is maintaining a compelling “growth story.” Market capital isn’t just a reward for past performance—it’s a bet on the company’s ability to deliver on future promises.

How to Buy CHAGEE on uSMART

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)