Amid a wave of business development (BD) licensing deals in the innovative drug sector, market attention toward China’s innovative pharmaceutical assets has continued to rise. Supported by improving sentiment, Hong Kong–listed healthcare and innovative drug stocks advanced broadly today, with multiple names posting notable intraday gains, reflecting a rebound in risk appetite.

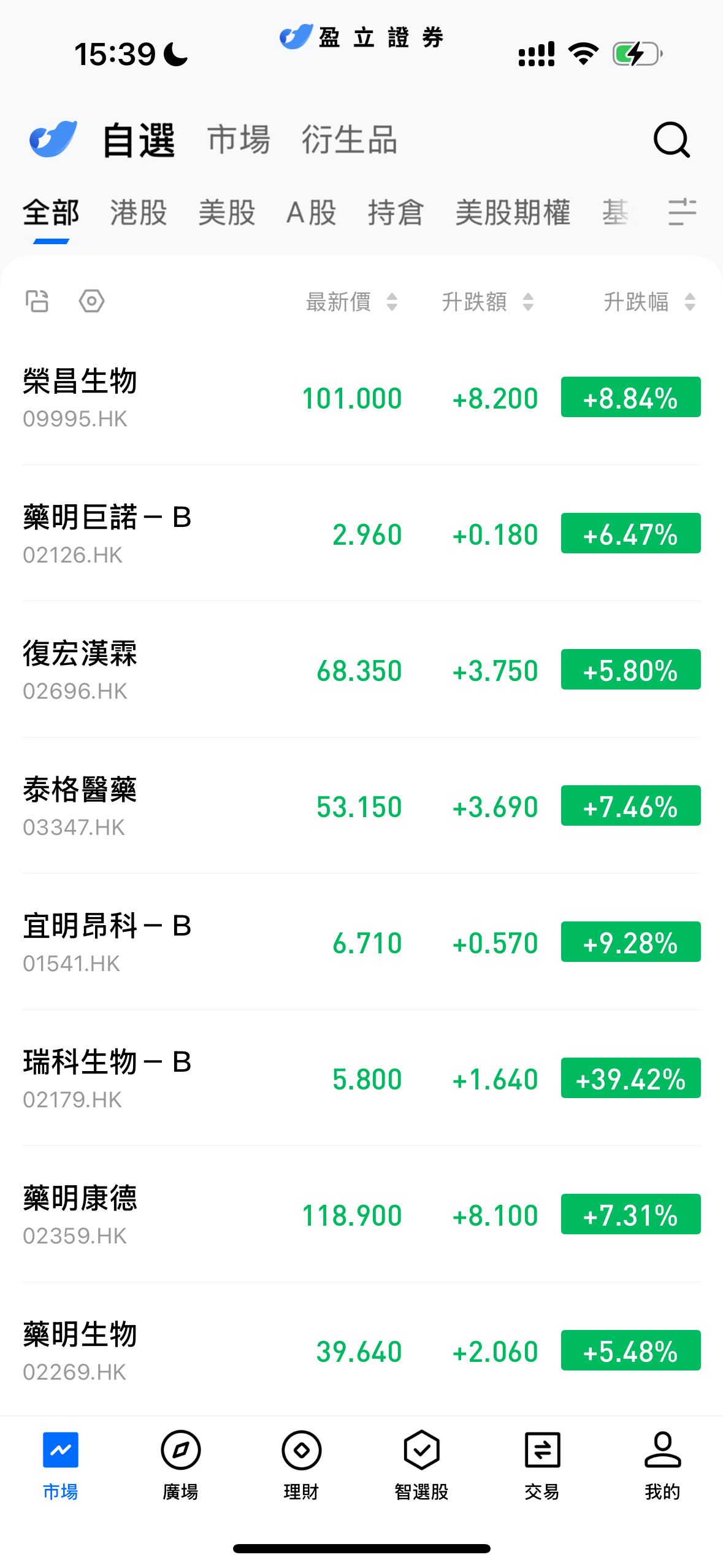

(Image source: uSMART HK app)

From a market perspective, RemeGen Co., Ltd. (09995.HK) maintained strong momentum, with its share price once rising more than 8%, again becoming a focal point of the sector. Rico Biotech-B (02179.HK) stood out with particularly strong performance, surging nearly 40% intraday to lead its peers. Meanwhile, ImmuneOnco-B (01541.HK), Tigermed (03347.HK), Henlius (02696.HK), WuXi AppTec (02359.HK), WuXi Biologics (02269.HK) and WuXi XDC-B (02126.HK) also moved higher, highlighting a broad-based rally across the healthcare and biotech space.

BD Deals Continue to Send Signals, Market Reassesses Innovation Drug Valuations

In recent weeks, outbound licensing activity in China’s innovative drug sector has accelerated, particularly in areas such as bispecific antibodies, antibody-drug conjugates (ADCs), and next-generation immunotherapies, with several large-scale cooperation agreements announced. These transactions not only provide meaningful upfront payments and milestone revenues, but also validate the technological strength of Chinese innovation pipelines on a global scale.

Market observers note that the impact of major BD deals is no longer confined to individual companies. Instead, their signaling effect is spreading across the broader innovative drug sector. On the one hand, continued collaboration by multinational pharmaceutical companies underscores growing recognition of China’s R&D capabilities; on the other, such deals help clarify commercialization pathways for Hong Kong–listed biotech firms, improving visibility on long-term cash flow prospects.

Signs of Capital Returning as Sector Sentiment Improves

From a trading perspective, after an extended period of adjustment, activity levels in Hong Kong’s innovative drug sector have begun to pick up, with capital selectively rotating back into high-beta biotech names. Today’s price action shows that leading gainers are largely companies with clear pipeline progress or potential BD catalysts, suggesting investors are once again focusing on innovation-driven assets with strong technological foundations.

At the same time, CXO and related industry chain players such as WuXi AppTec and WuXi Biologics also posted solid gains, reflecting improving expectations for the overall R&D cycle in the innovative drug industry.

Hong Kong Innovative Drug Valuations Remain Attractive

Following a pullback from previous highs, valuations across the Hong Kong innovative drug sector have declined meaningfully, with a noticeable gap still remaining relative to overseas peers. Against the backdrop of a strong rebound in global innovative drug assets, Hong Kong–listed biotech companies continue to trade at comparatively discounted levels.

As BD activity continues, core pipelines advance and internationalization accelerates, China’s innovative drug companies are expected to further strengthen their position within the global pharmaceutical innovation ecosystem. From a medium- to long-term perspective, the Hong Kong innovative drug sector still offers opportunities for valuation recovery and structural growth.