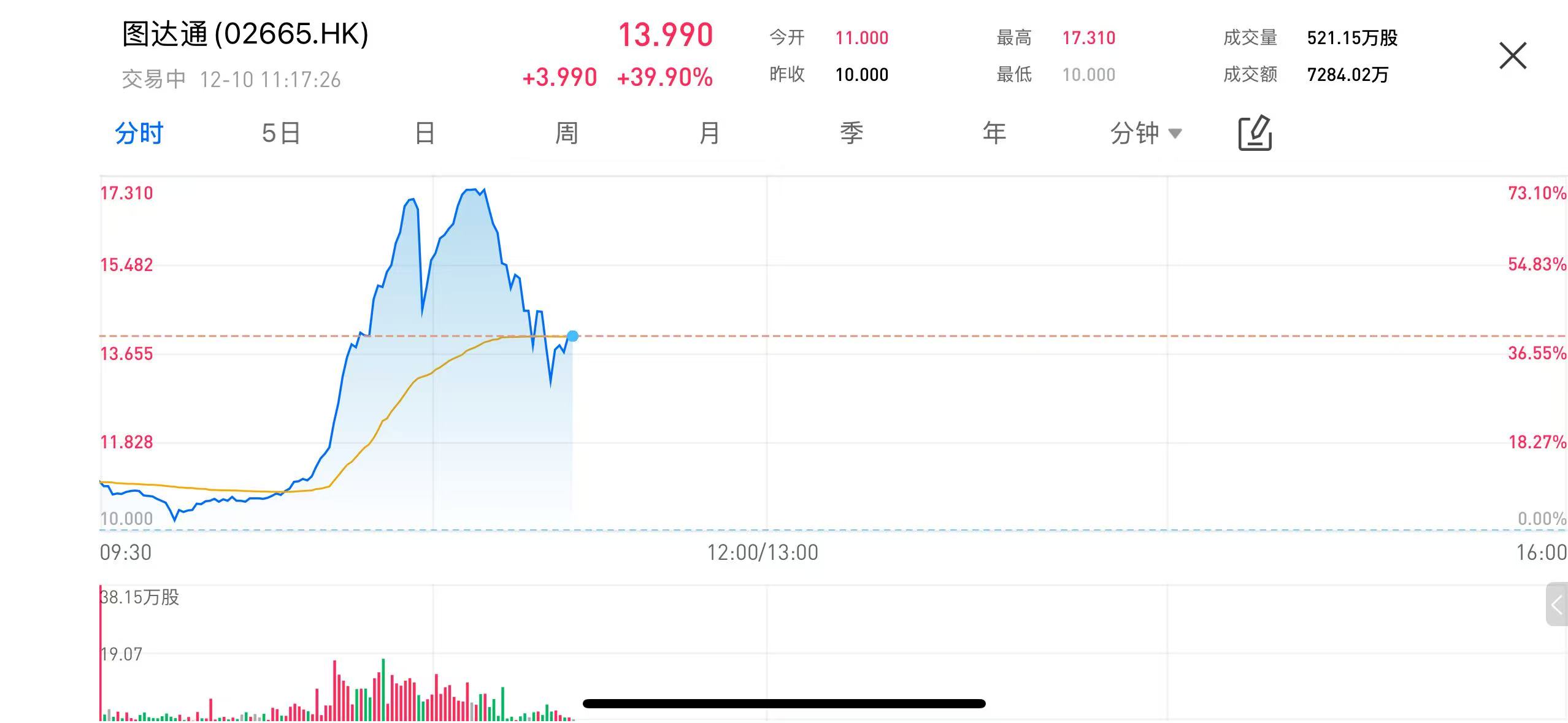

10 December 2025 - Innovusion (02665.HK) officially listed on the Hong Kong Stock Exchange today, with its share price showing a strong upward surge during the morning session, becoming a focal point of the market. As of 11:17, the share price was quoted at HKD 13.99, marking a 39.9% increase from the listing price of HKD 10. Earlier in the session, the price climbed to HKD 17.31, a gain of over 70%, positioning it as one of the best-performing new listings in today's Hong Kong stock market.

(Image source: uSMART HK app)

Favorable Sector Conditions Drive Concentrated Capital Inflow

Innovusion's listing coincides with the accelerated adoption of intelligent driving technology and the rising penetration rate of LiDAR. This timing, combined with heightened attention on new listings, has resulted in significant capital inflow on its first trading day. As new energy vehicles evolve towards higher-level assisted driving, LiDAR is increasingly transitioning from an "optional technology" to a standard feature in premium models, sustaining upward demand in the industry.

In recent years, several LiDAR companies have listed in Hong Kong, gradually clarifying the competitive landscape. Innovusion, leveraging its strengths in mass production scale, technological accumulation, and cost control, has achieved early large-scale shipments in the automotive market, establishing itself as a key sector leader attracting investor focus.

Strong Mass Production Capabilities and Improved Gross Margin as Key Highlights

Innovusion's prominent mass production and commercialization capabilities form a crucial basis for investor confidence in its long-term growth. Data shows that the company delivered approximately 230,000 LiDAR units in 2024, leading the industry. For the first nine months of 2025, deliveries reached about 181,000 units, representing a year-on-year increase of approximately 7.7%, indicating stable demand.

With expanding production capacity and optimized supply chains, the company's cost structure continues to improve. Its gross margin has remained positive for multiple consecutive quarters. For a hardware technology enterprise in a phase of rapid expansion, achieving and maintaining a positive gross margin is seen as a significant indicator of commercial maturity. It also provides support for the market to assign higher growth valuations.

SPAC Merger Listing Draws Attention

Innovusion's listing via a SPAC merger has also made it a rare recent case of a technology SPAC listing in the market. This route offers greater flexibility compared to a traditional IPO, creating more operational room for future financing and global expansion for the company.

Alongside the accelerated global development of intelligent driving, Innovusion is actively expanding collaborations with overseas automakers and deepening partnerships with international autonomous driving solution providers. The market widely believes that the advancement of overseas operations will become a new growth driver for the company.

Broad Prospects, Yet Attention Needed on Competition and Profitability Timeline

Despite the impressive debut performance, the market also notes potential risks such as intensifying industry competition and customer concentration. The LiDAR sector is characterized by rapid technological evolution, with competitors continually investing in cost reduction, performance enhancement, and product upgrades, indicating that competitive pressure remains significant. Furthermore, fluctuations in procurement cycles of major clients could impact the company's short-term revenue.

Overall, Innovusion's market debut performance reflects investor recognition of the LiDAR industry's prospects and its commercialization capabilities. Short-term share price fluctuations are primarily driven by the new listing effect and sector popularity. Mid-to-long-term performance will depend on the further clarity of delivery scale, cost control, customer expansion, and the path to profitability.

Against the backdrop of continued favorable industry trends, if Innovusion can sustain its technological and mass production advantages, it is positioned to further consolidate its industry standing in the new round of competition. Its strong first-day performance has also refocused market attention on LiDAR concept stocks within the Hong Kong stock market.

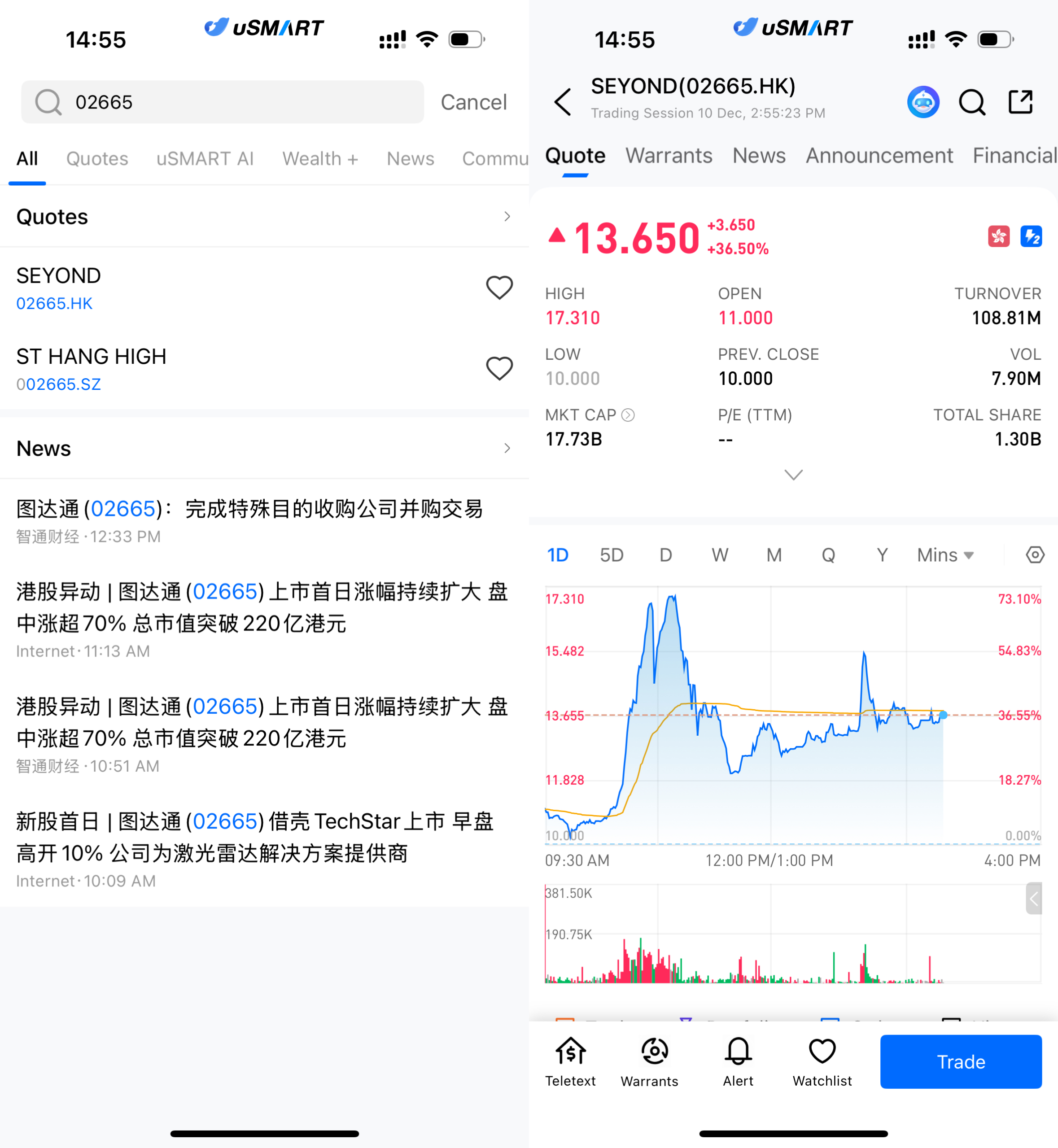

How to Buy SEYOND via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (02665.HK), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)