October 30, 2025 — Shares of Fiserv (FI.US) plunged by nearly 44% on Wednesday, marking the company’s largest single-day drop in nearly 40 years. This dramatic stock fluctuation caused its market value to evaporate by approximately $30 billion overnight. Although the immediate trigger for this crisis was the new CEO Mike Lyons retracting the earnings guidance, a deeper analysis reveals that the root cause lies in the company’s management failures, such as poor pricing strategies, over-promised growth, and neglecting customer needs.

(Image Source: uSMART HK app)

(Image Source: uSMART HK app)

New CEO Faces Trust Crisis

Lyons joined Fiserv in January 2025 and officially took over as CEO in May. In the earnings report released on Wednesday, Lyons announced a drastic revision to the company’s full-year earnings-per-share (EPS) forecast, lowering it from $10.15–$10.30 to $8.50–$8.60, a decrease of over 16%. The revenue growth forecast was also slashed from 10% to 3.5%–4%, which immediately triggered market panic. In Q3, revenue grew only about 1% year-on-year, falling short of Wall Street’s expectation of $5.36 billion, coming in at $4.92 billion. Adjusted EPS was $2.04, far below the expected $2.64.

| Indicator | Original Expectation | Revised Expectation |

|---|---|---|

| Earnings Per Share (EPS) | $10.15-$10.30 | $8.50-$8.60 |

| Revenue Growth Rate | 10% | 3.5%-4% |

| Actual Result | Expected Result | |

| Q3 Revenue | $4.92 billion | $5.36 billion |

| Adjusted EPS | $2.04 | $2.64 |

(Source: Fiserv Q3 Earnings Report)

Management Failures Lead to Customer Loss

This stock crash exposed major management blunders at Fiserv. Former CEO Frank Bisignano, though successful in driving rapid company expansion, set overly aggressive growth targets and implemented poor pricing strategies, which ultimately led to significant customer losses. In particular, the excessive "service fees" added to the flagship Clover payment terminals sparked dissatisfaction among merchants, many of whom switched to more competitive alternatives like Block’s Square and Toast, resulting in severe market share loss.

William Blair analyst Andrew Jeffrey pointed out that Clover’s growth diverged from payment processing volume growth, highlighting how the company neglected product innovation and long-term competitiveness in its pursuit of short-term financial goals, setting the stage for future market struggles.

Revenue Performance Falls Short, Corporate Culture Needs Reform

It wasn’t just the pricing strategy of Clover; Fiserv’s overall financial performance is also concerning. The company’s Financial Solutions division, which provides technology support to thousands of U.S. banks and credit unions, saw a 3% revenue decline in Q3, with profit margins plummeting to 42.5%, down from 47.5% the previous year. This division also faced technical issues earlier in the year, further frustrating investors.

During the earnings call, Lyons admitted that the challenges the company faces "are mainly self-inflicted." He stated that the company had previously overemphasized quarterly results, focusing on cost-cutting rather than product delivery and customer experience, causing management to lose its sensitivity to market demands.

Company’s Response and Future Outlook

In response to the crisis, Fiserv announced the reversal of its pricing adjustments for Clover, the introduction of a new technology strategy, and a large-scale leadership overhaul. The appointment of new CFO Paul Todd and three new board members signals the company is undergoing a deep "reset." Lyons emphasized that the company would work to address management shortcomings and rebuild trust with investors and customers.

Even industry giants can suffer catastrophic consequences from management errors. This incident not only highlights severe internal management issues at Fiserv but also serves as a warning to the entire fintech sector. Companies that prioritize short-term performance over long-term innovation and customer needs will ultimately pay a heavy price.

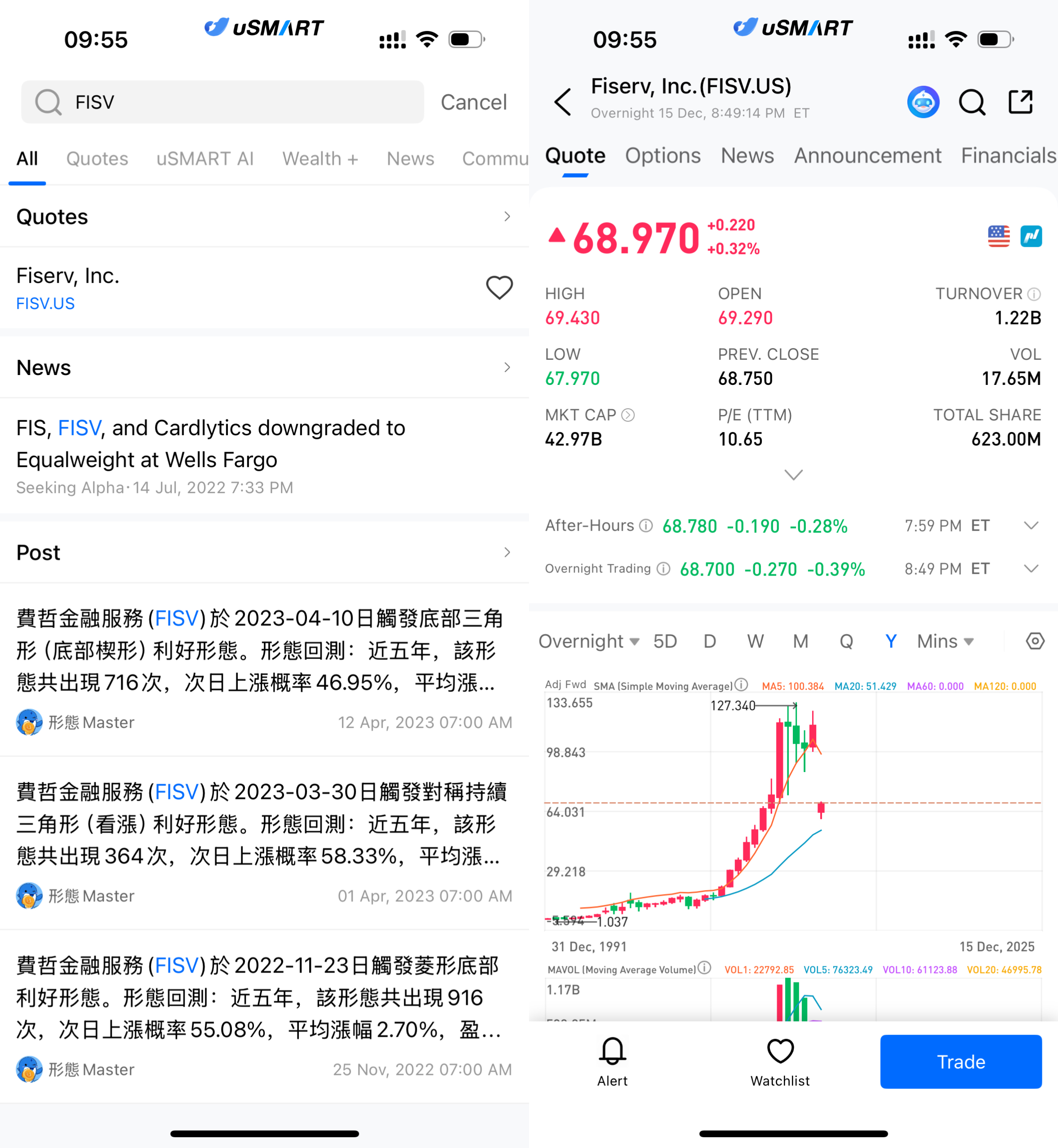

How to Buy Fiserv on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (FISV.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)