On May 9th, two major second-tier cities, Hangzhou and Xi'an, have successively lifted housing purchase restrictions. Currently, among the provinces and cities in the country that still maintain housing purchase restrictions, apart from the four first-tier cities of Beijing, Shanghai, Guangzhou, and Shenzhen, only Hainan Province and Tianjin City remain partially open.

On May 10th, Hong Kong's property stocks surged collectively near the midday session, continuing their strong performance. As of the midday session on the 10th, Shimao Group (00813.HK) surged nearly 60%, Country Garden Holdings (03383.HK) rose nearly 17%, CIFI Holdings (00884.HK) rose over 15%, Sunac China Holdings (03377.HK) rose nearly 15%, Longfor Group (03380.HK) rose over 13%, and Agile Group Holdings (02772.HK) rose nearly 12%.

The real estate industry is seeing a flurry of policy releases

|

Some regions introduce real estate control policies |

|

|

May 9th |

Hangzhou issued a notice titled "Notice on Optimizing and Adjusting Real Estate Market Control Policies," proposing measures such as completely lifting housing purchase restrictions, expanding the scope of first-time homebuyer eligibility, and optimizing the points-based household registration policy. |

|

May 9th |

Xi'an issued a notice titled "Notice on Further Promoting the Stable and Healthy Development of the Real Estate Market," completely lifting housing purchase restrictions. |

|

May 6th |

Shenzhen issued a notice titled "Notice on Further Optimizing Real Estate Policies," implementing zoning-based optimization of housing purchase restrictions. The market is highly concerned about the fundamental trends after the implementation of these policies, and CITIC Securities believes that by mid-2024, housing prices in core cities and core regions are expected to stabilize. |

|

April 30th |

Beijing and Tianjin announced the optimization of housing purchase restriction policies. Tianjin explicitly stated that local residents with household registration in the city will no longer need to verify their eligibility when purchasing newly-built residential properties of 120 square meters or larger within the six districts of the city. In Beijing, the Beijing Municipal Commission of Housing and Urban-Rural Development announced that under the existing housing purchase restriction framework, families that have reached the maximum limit of home purchases are allowed to buy an additional property outside the Fifth Ring Road. |

|

April 28th |

Chengdu announced that starting from April 29th, the qualification for home purchases will no longer be reviewed for housing transactions within the entire city of Chengdu. |

By mid-2024, housing prices in core areas of key cities are expected to stabilize. It is anticipated that under the new policy orientation, the real estate control policies in first-tier cities will be further optimized towards the central urban areas, while second-tier cities will see a comprehensive lifting of housing purchase restrictions, leading to an accelerated formation of this pattern.

Development prospects for the real estate sector

· Policy support:

The political stance towards the real estate market is clear, and supportive policies will continue to be introduced. Policies in first and second-tier cities will continue to be optimized, and it is expected that more supportive policies will be implemented in the future, providing development opportunities for real estate stocks.

· Improvement in fundamentals:

The fundamentals of the real estate industry have reached a bottom range, with limited downside potential. Valuations of real estate stocks are at historically low levels, indicating that the bottom for real estate stocks has been largely established. As real estate sales data improves and real estate companies gradually resolve their debts, the industry's fundamentals and performance are expected to recover, driving a sustained recovery in real estate stocks.

· Focus on first and second-tier cities:

Optimization of policies and the demand for improved products in these cities will provide continuous land acquisition opportunities for real estate companies, contributing to the development of real estate stocks.

· Oversold rebound:

With ongoing policy support, real estate stocks are expected to experience an oversold rebound that is likely to last for a period of time. As real estate sales data improves and real estate companies resolve their debts, the industry's fundamentals and performance will be restored, further driving the recovery of real estate stocks.

· Market confidence and valuation recovery:

The expression of policy stance during political meetings and the expansion of optimized policies to a wider range of cities are expected to boost market confidence and restore the fundamentals of the real estate market. This will provide room for valuation recovery in real estate stocks.

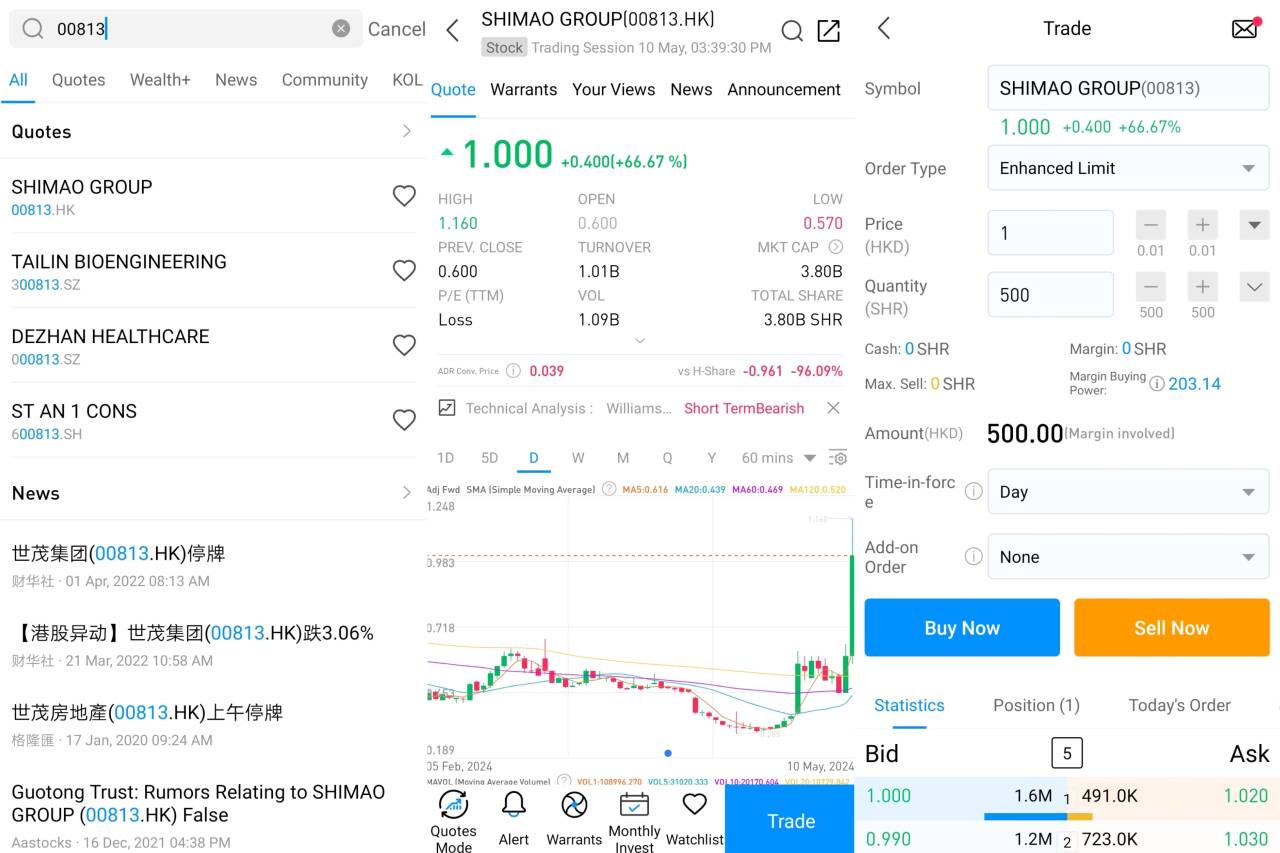

How to place a trade on uSMART mobile application?

After logging into the uSMART HK app, click on the top right corner of the page and select 'Search.' Enter the corresponding stock code to access the detailed page for trading information and historical trends. Click on 'Trade' in the bottom right corner and select the 'Buy/Sell' function. Finally, fill in the trading conditions and submit the order. Please refer to the image guide below for step-by-step instructions.

This diagram is provided for illustrative purposes exclusively

Source:uSMART