October 15, 2025, Following the release of its Q3 2025 financial results, global photolithography leader ASML (ASML.US) saw its stock surge in after-hours trading, closing at $1,009.81, up 2.71%. The stock hit an intraday high of $1,033, breaking the $1,000 mark and reaching a new two-month high.

(Image Source: uSMART HK app)

(Image Source: uSMART HK app)

Steady Growth in Earnings, Continued Expansion in EUV Demand

According to the company’s financial report, ASML’s third-quarter net sales reached €7.5 billion (approximately $8 billion), marking a 7% increase from the previous quarter. Net profit grew to €2.1 billion, a 15% year-on-year rise, with a gross margin of 51.2%, reflecting the company’s strong pricing power in the high-end photolithography equipment market.

The company also noted a significant increase in the shipment of EUV systems compared to the previous quarter, contributing substantially to revenue growth. Meanwhile, demand for DUV (deep ultraviolet) equipment in mature process nodes remained steady, with both Chinese and U.S. clients showing growth in equipment deliveries.

Strong New Orders and Clear Industry Recovery Signals

The report revealed that ASML’s new orders in Q3 amounted to €8.6 billion, far exceeding market expectations of €6 billion, and showing a substantial increase from the previous quarter's €5.8 billion.

Among these, EUV equipment orders were especially prominent, reflecting that major clients such as TSMC, Samsung, and Intel are accelerating their capacity expansion for advanced process nodes. Analysts believe this order rebound signals a significant recovery in semiconductor capital expenditure. Citigroup noted in their report that ASML’s order growth exceeded expectations, signaling the nearing end of the semiconductor industry’s inventory replenishment cycle and the beginning of a recovery phase in equipment investment.

Ongoing Investment in R&D, Accelerating Production of High-NA Equipment

ASML emphasized in its report that it will continue to increase its R&D investment in the coming quarters, particularly in High-NA (high numerical aperture) EUV photolithography technology. The company plans to complete mass production and delivery by 2026 to support the development of advanced processes below the 2nm node.

Currently, the price per High-NA unit is expected to exceed €300 million, about 50% higher than the current EUV systems. Industry experts believe this product could become a new pillar for ASML’s long-term growth. Additionally, the company is expanding its production capacity in the supply chain to meet growing customer demands, with the goal of shipping 90 EUV systems annually by 2026.

Positive Outlook, AI and Advanced Processes Driving Long-Term Growth

Looking ahead to Q4, ASML expects revenues to range between €7.2 billion and €7.8 billion, with full-year revenue growth expected to be in the low single-digit percentage range. Continued investment in AI, data centers, and automotive electronics will be key drivers of demand for photolithography equipment. Overall, ASML’s Q3 financial results demonstrate robust profitability and strong order momentum, boosting market confidence as its stock surpasses the $1,000 mark. With the continued advancement of EUV and High-NA technologies, the company is poised to maintain its leadership in the global high-end semiconductor equipment industry for the foreseeable future.

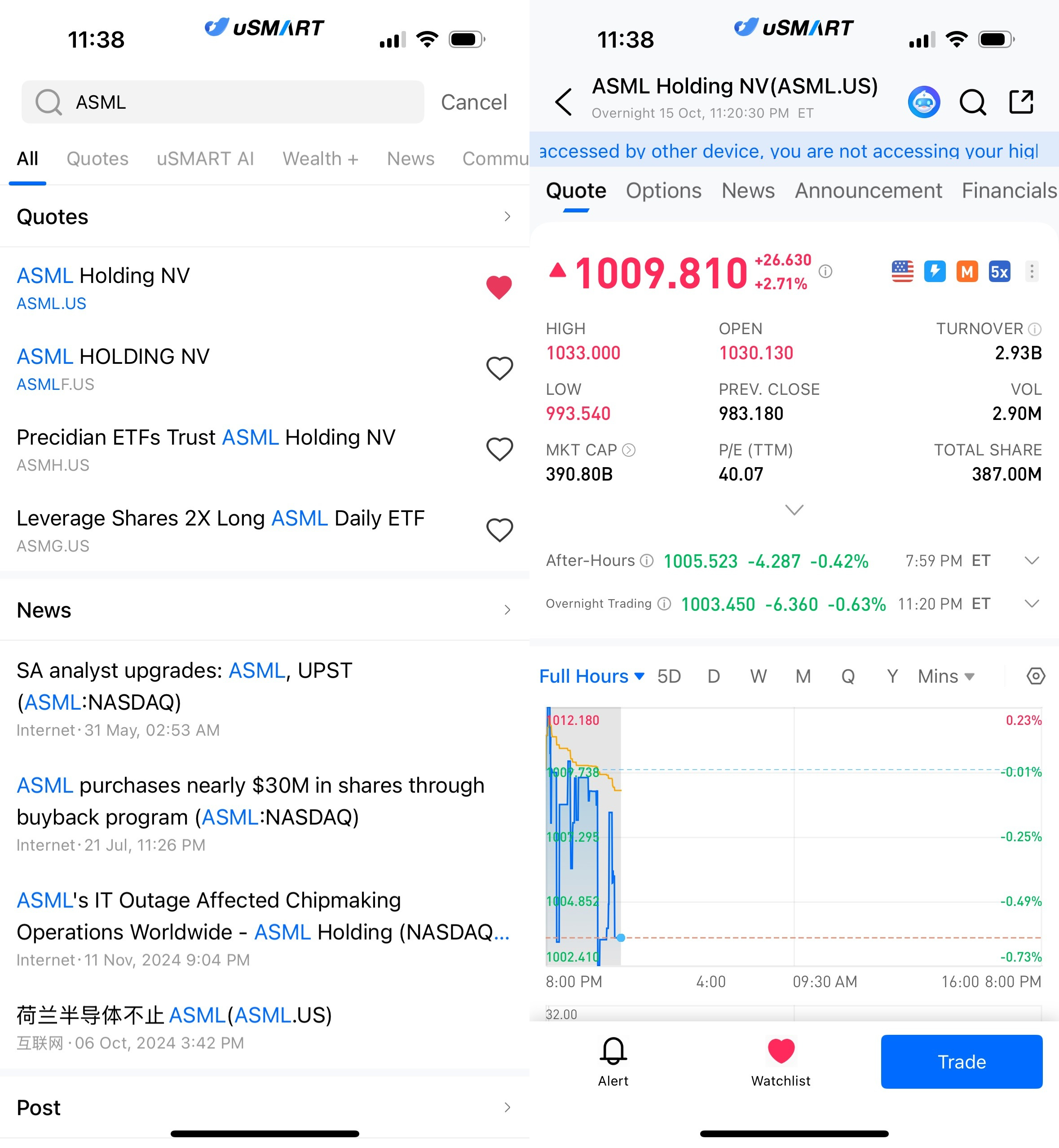

How to Buy ASML on uSMART HK

After logging into the uSMART HK app, click on “Search” at the top right of the page, input the stock code (ASML.US) to access the details page and view transaction details and historical trends. Then click the “Trade” button at the bottom right, select the “Buy/Sell” option, fill in the transaction conditions, and submit your order.

(Image Source: uSMART HK app)

(Image Source: uSMART HK app)