October 10, 2025 — Global financial markets were rocked on Friday after U.S. President Donald Trump posted a series of hardline statements on social media, accusing China of imposing restrictions on rare earth exports and threatening to slap up to 100% tariffs on Chinese goods. The move triggered widespread panic across markets, sparking what investors dubbed a new “Black Friday” crash.

U.S. Stocks Plummet; Nasdaq Sinks 3.6%

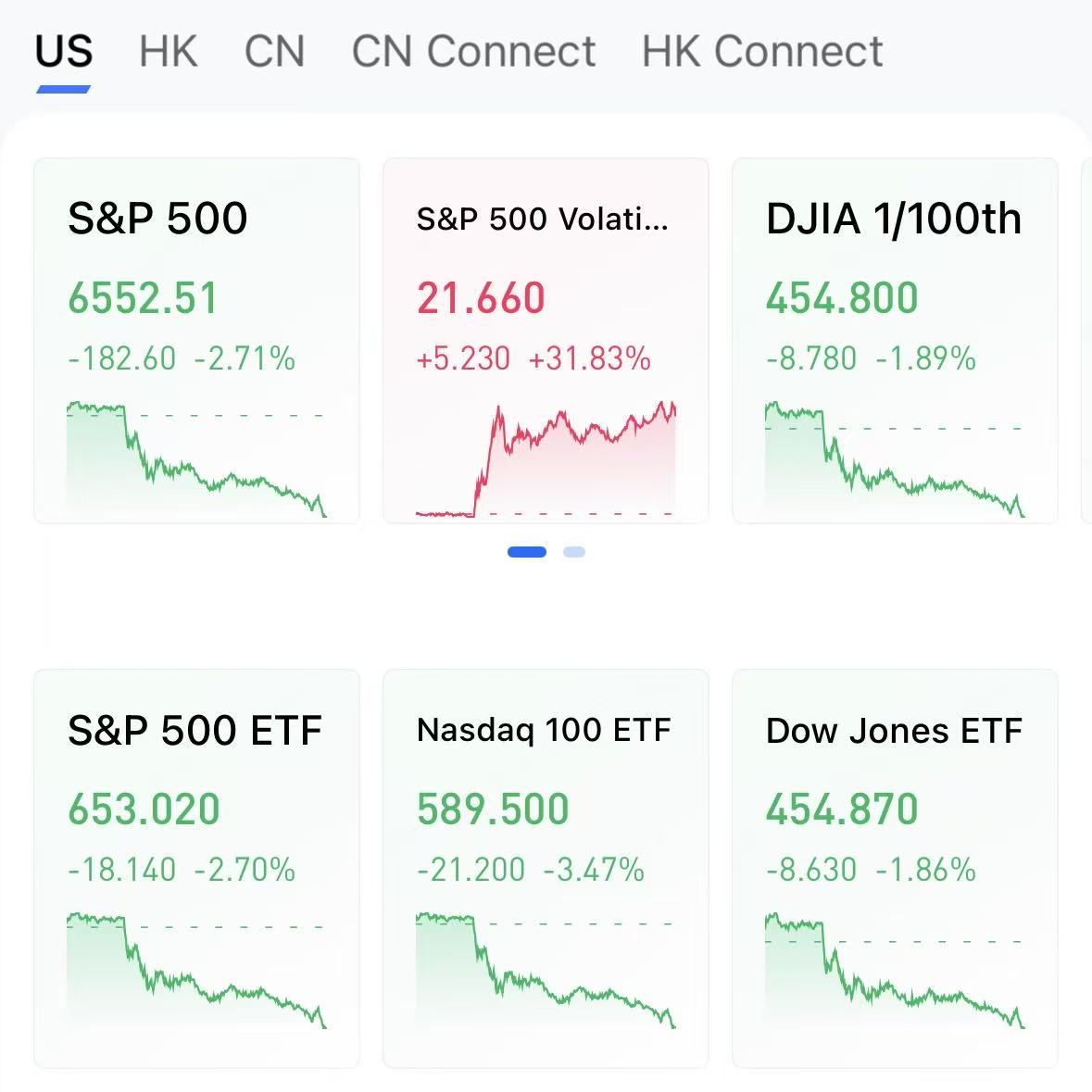

Wall Street suffered a sharp sell-off, with all three major indexes closing deep in the red.

The Dow Jones Industrial Average plunged 878 points to 45,479.60, down 1.9%. The S&P 500 fell 2.7%, while the Nasdaq Composite tumbled 3.6%, marking its steepest single-day decline since April.

(Image source: uSMART HK app)

(Image source: uSMART HK app)

Trump wrote that China’s rare earth export restrictions had “severely damaged U.S. manufacturing,” threatening to impose 100% tariffs on Chinese imports and cancel his planned meeting with Chinese President Xi Jinping. The announcement stoked fears of renewed U.S.-China trade tensions, prompting investors to dump equities across sectors.

Bitcoin Flash Crash: Crypto Market in Turmoil

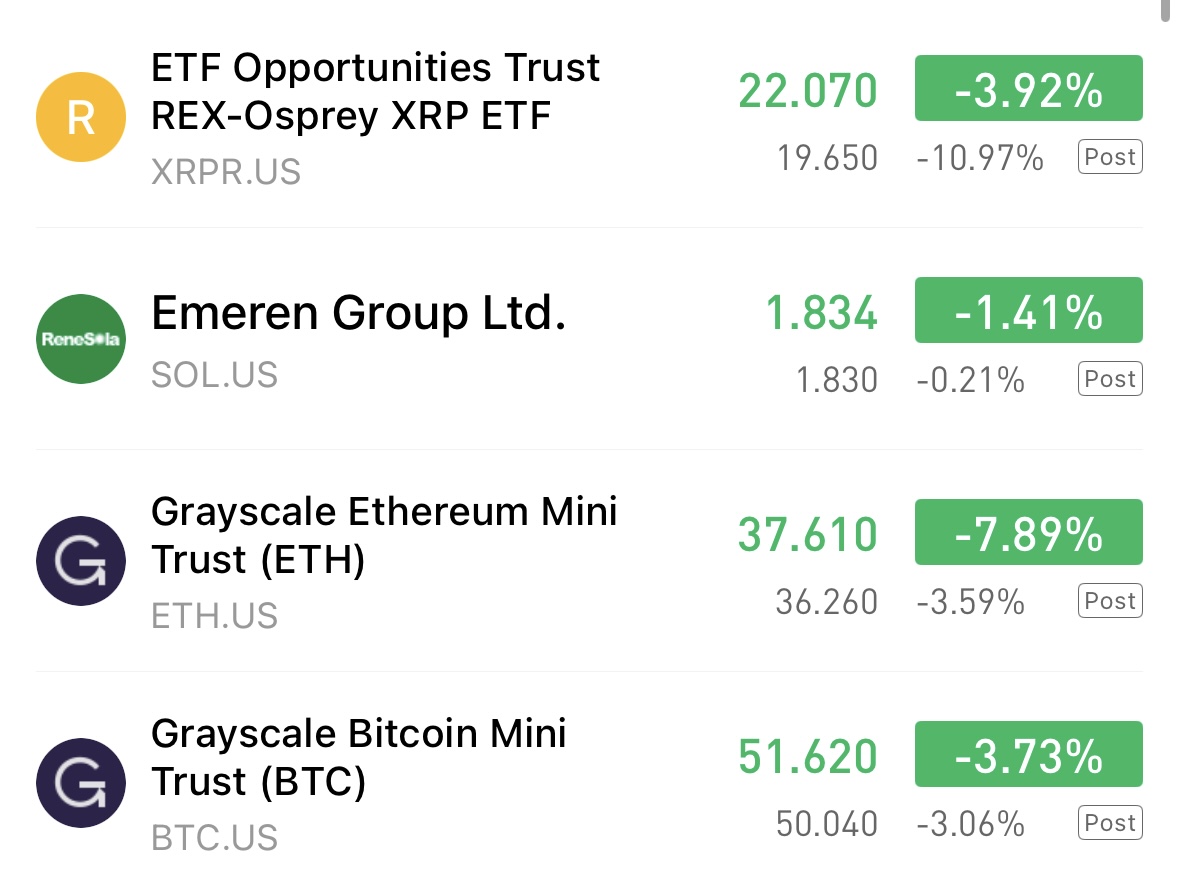

The cryptocurrency market also experienced extreme turbulence.

Bitcoin briefly plunged below $110,000, hitting its lowest level since 2023, before rebounding above $114,000. Major tokens including Ethereum, Solana, and XRP dropped between 15% and 30%.

According to CoinDesk, roughly $7 billion worth of crypto positions were liquidated in 24 hours.

Analysts noted that Trump’s tariff threats amplified market uncertainty, pushing investors toward safe-haven assets and triggering a massive liquidation wave across digital assets.

(Image source: uSMART HK app)

(Image source: uSMART HK app)

Hong Kong Stocks Lead Global Decline

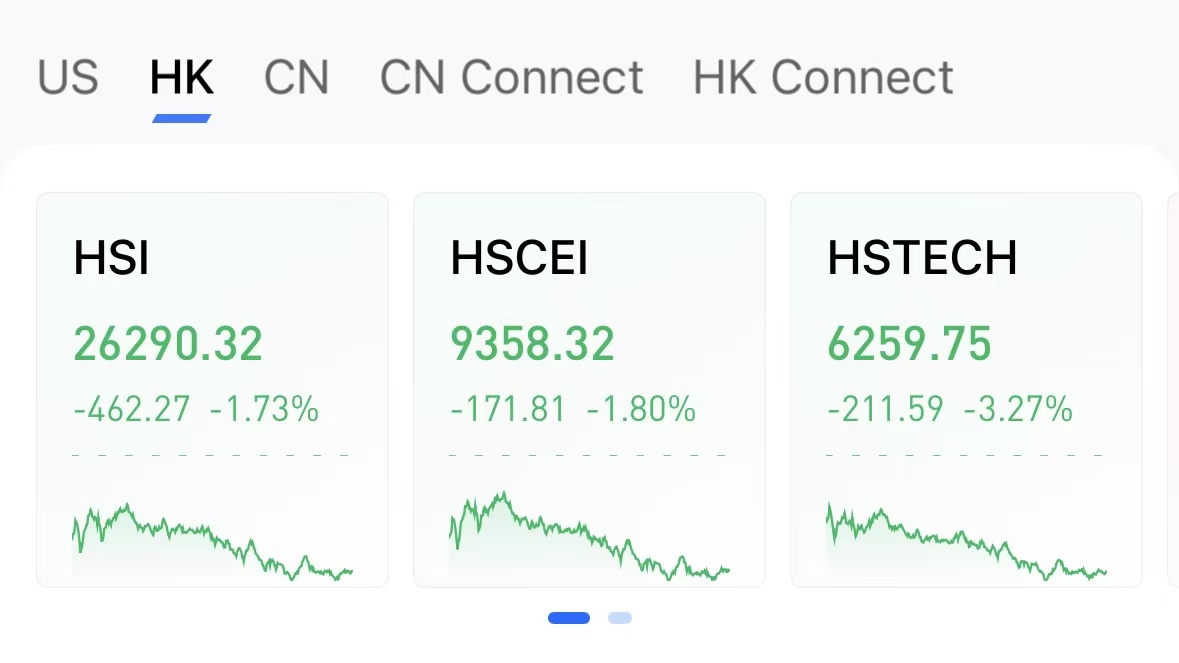

Hong Kong equities bore the brunt of the sell-off in Asia.

The Hang Seng Index sank more than 3% to 15,703 points, its lowest level since 2024.

Tech and financial heavyweights led the drop — Tencent Holdings slid 4.5%, while HSBC Holdings fell 3.8%.

(Image source: uSMART HK app)

(Image source: uSMART HK app)

Rising fears of worsening U.S.-China relations, combined with the Hong Kong government’s recent tightening of financial market regulations, fueled additional selling pressure and heightened investor anxiety.

Global Sell-off Spreads; Panic Grips Markets

The shockwaves extended well beyond Wall Street and Hong Kong.Major European and Asian stock markets also slumped, as mounting concerns over global economic prospects drove investors into risk-off mode.

Trump’s tariff threat raised alarms over a potential deepening of U.S.-China trade frictions, which could disrupt global supply chains and dampen economic growth.

Analysts cautioned that markets may remain volatile in the near term, urging investors to stay alert and manage risk prudently.