Shanghai Longcheer Technology Co., Ltd. (09611.HK) has launched its Hong Kong IPO, with the offering period running from January 14 to January 19, 2026. The company plans to offer a total of 52,259,100 H-shares globally, with a 15% over-allotment option. The maximum offer price is HKD 31.00 per share, with a minimum subscription of 100 shares, translating to an entrance fee of approximately HKD 3,131.26. The stock is expected to be listed on the Main Board of the Hong Kong Stock Exchange on January 22, 2026. Citigroup Global Markets Asia Limited, Haitong International Capital Limited, and Guotai Junan Securities Co., Ltd. are the joint sponsors for this IPO.

Longcheer Technology: A Global Leader in Smart Product ODM

Offering Ratio: Approximately 10% (5,226,000 shares, subject to reallocation) for Hong Kong public offering, and approximately 90% (47,033,100 shares, subject to reallocation) for international placing.

Offer Price: Up to HKD 31.00 per share; minimum lot size: 100 shares; entrance fee: approximately HKD 3,131.26.

Offering Period: January 14 – 19, 2026 (expected pricing date: January 20).

Listing Date: January 22, 2026.

IPO Sponsors: Citigroup Global Markets Asia Limited, Haitong International Capital Limited, Guotai Junan Securities Co., Ltd.

Company Overview

Longcheer Technology is a global leader in providing intelligent products and services, offering full-stack ODM solutions that include product research, design, manufacturing, and support to globally renowned brands. According to a Frost & Sullivan report, the company is the second-largest consumer electronics ODM manufacturer and the largest smartphone ODM manufacturer worldwide based on 2024 shipment volumes. Its product portfolio covers a wide range of intelligent devices, including smartphones, AIPC, automotive electronics, tablets, smart wearables, and smart glasses. Core customers include Xiaomi, Samsung, Lenovo, Honor, OPPO, and vivo.

Financial Information

According to the prospectus, Longcheer Technology’s revenues for 2022, 2023, and 2024 were approximately RMB 29.343 billion, RMB 27.185 billion, and RMB 46.382 billion, respectively. Net profits for the same period were approximately RMB 562 million, RMB 603 million, and RMB 493 million. For the first nine months of 2025, the company reported revenues of approximately RMB 31.332 billion and net profits of RMB 514 million. At the maximum offer price of HKD 31.00 per share, assuming no exercise of the over-allotment option, the company expects to raise net proceeds of approximately HKD 1.521 billion. The funds will be used as follows: 40% for expanding production capacity domestically and internationally, 20% for increased R&D investment, 10% for marketing and customer expansion, 20% for strategic investments or acquisitions, and 10% for working capital.

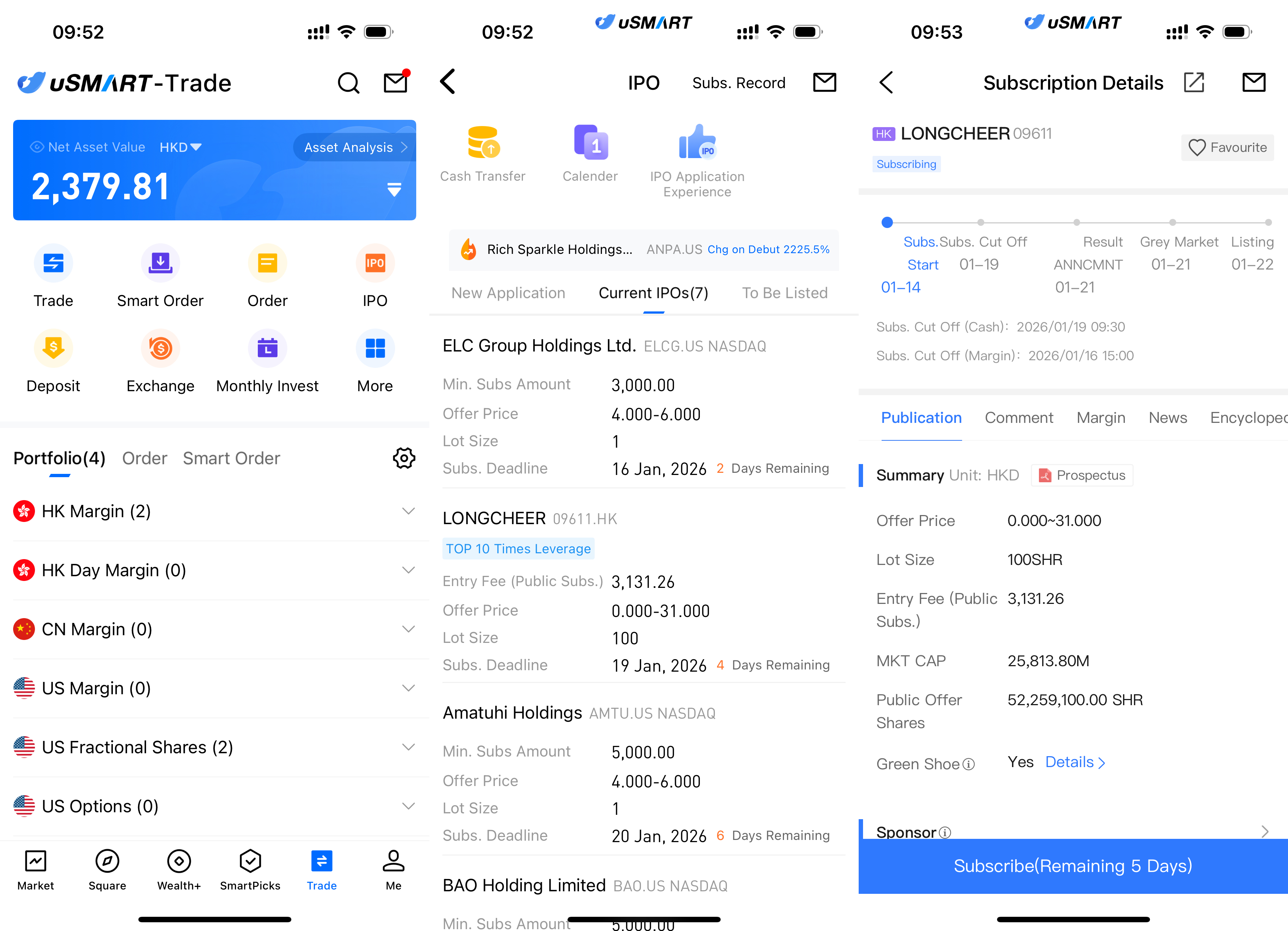

How to Subscribe for Longcheer via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select Longcheer, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)