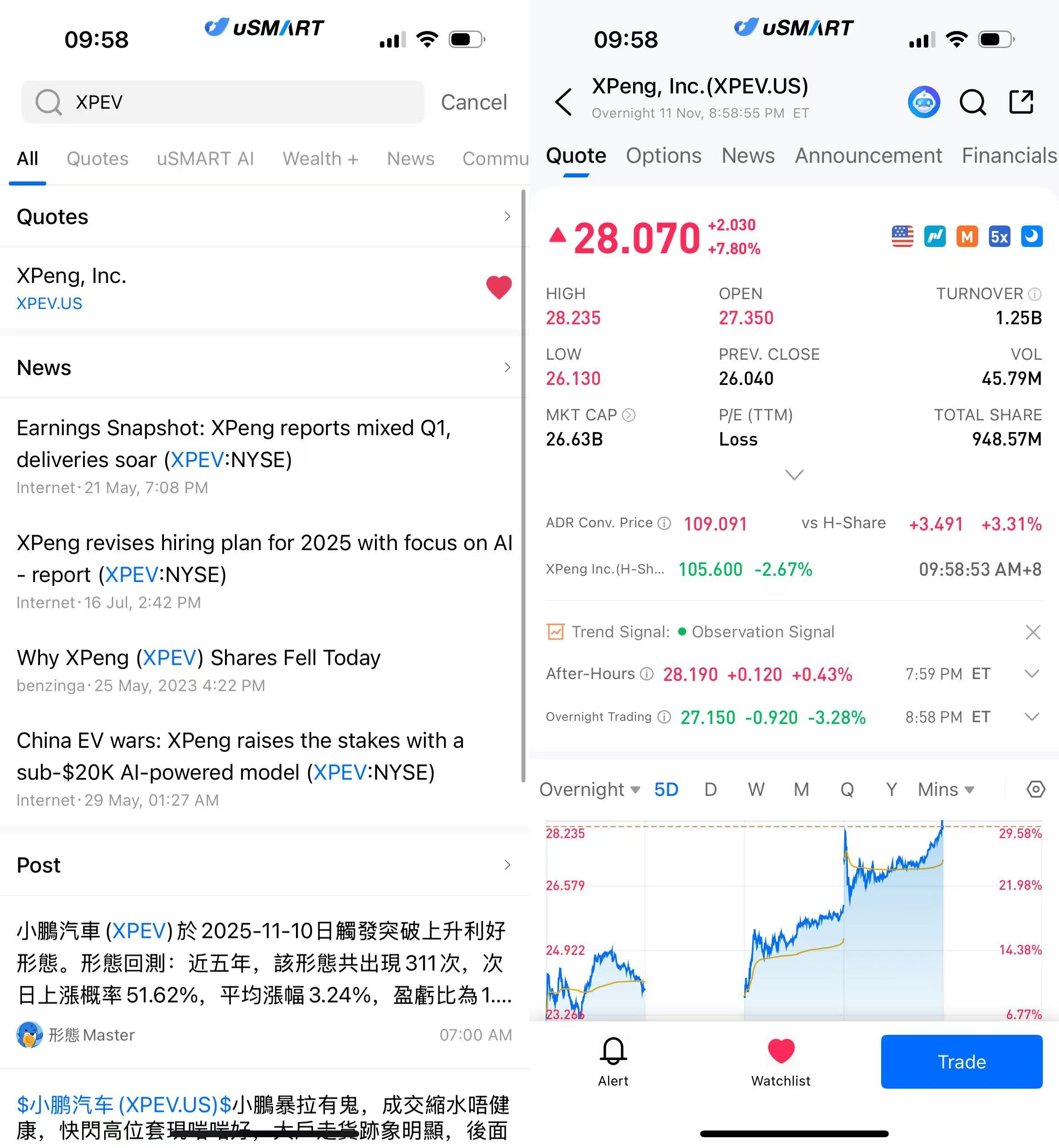

November 11, 2025 — XPeng Inc. (XPEV.US) shares extended their sharp rally on Monday, closing at US$28.07, up US$2.03 or 7.8% for the day — marking their strongest single-day gain in nearly two years.Over the past five trading sessions, the stock has soared more than 30%, rebounding from around US$21 to above US$28, with total turnover exceeding US$1.24 billion.Market observers attribute the surge to the company’s latest announcements in artificial intelligence, robotics, and flying car technologies.

(Image source: uSMART HK app)

Technology-Driven Momentum: “Physical Intelligence” Takes Center Stage

At the 2025 XPENG AI Day, the company unveiled its long-term blueprint for “Physical Intelligence,” signaling a strategic shift from pure EV manufacturing toward becoming a “full-stack physical intelligence company.”

Key Announcements at the Event:

|

Project |

Key Highlights |

Strategic Significance |

|

VLA 2.0 AI Model |

Enables direct transformation from visual signals to actions, minimizing language mediation and improving autonomous decision-making for vehicles and robots. |

Enhances AI responsiveness and self-learning, forming the foundation for Robotaxi and smart cockpit systems. |

|

IRON Humanoid Robot Prototype |

Equipped with 82 motion-control joints, solid-state battery, and in-house developed control systems. |

Marks XPeng’s entry into embodied intelligence, expanding R&D capability beyond vehicles. |

|

Flying Car & Robotaxi Program |

Introduced a production-feasible flying car prototype and announced plans to launch three vision-only autonomous driving models by 2026. |

Bridges ground and air mobility to build a diversified intelligent mobility ecosystem. |

(Source: XPeng official press release, MotorTrend, Investors.com)

MotorTrend noted that XPeng’s showcase “reveals a new frontier for the fusion of AI and automotive technology,” highlighting its in-house hardware and algorithm capabilities as “potential competitive moats for the next era of intelligent mobility.”

Growing Momentum: Smart Driving and Cost Optimization Strengthen Outlook

XPeng has made steady progress in both intelligent driving technology and mass production. In October, the company delivered around 52,000 vehicles, up more than 50% year-over-year, marking a new monthly record.

Improving cost structure and expanding gross margins have strengthened its cash flow position.The company’s self-developed XPILOT and XNGP (Full-Scenario Navigation Guided Pilot) systems have already been rolled out in multiple cities across China. Through continuous data-driven training, these systems are enhancing real-world driving performance. XPeng plans to equip more models with vision-only autonomous driving solutions, accelerating the commercialization of its smart technologies.

As the integration of AI, automobiles, and robotics deepens, XPeng’s growth narrative is evolving from traditional EV manufacturing to a broader “intelligent mobility and physical intelligence ecosystem.”

Revalued by the Market: XPeng’s “Second Growth Curve”

The recent rally reflects a broader market revaluation of XPeng’s business model.

Once viewed primarily as one of China’s “new EV makers” alongside Tesla, NIO, and Li Auto, XPeng is now being reassessed as an emerging intelligent ecosystem platform as it pushes deeper into AI-driven innovation.

The company is rapidly building an integrated system that combines intelligence, hardware, and ecosystem synergy, spanning smart EVs, robotics, low-altitude mobility, AI chips, and operating systems.

Its joint development project with Volkswagen Group remains on track, with new EV models based on a co-developed platform expected to launch before 2026, paving the way for greater global expansion.

Although new ventures such as AI large models, robotics, and flying cars are still in early stages, they are creating XPeng’s “second growth curve.”

In the era of physical intelligence, XPeng is striving to transform from an automaker into a true intelligent technology enterprise.

If the company can maintain progress toward profitability and deliver on its innovation roadmap, its long-term growth narrative may gain further validation in the capital markets.However, execution risks remain. Robotics and flying car programs are still in development, and global EV price competition and policy uncertainty could bring short-term volatility.

Overall, XPeng’s technological narrative has been reignited — and its ability to turn innovation into tangible results will be the next key focus for investors.

How to Buy XPeng on uSMART

After logging into the uSMART HK App, tap the search icon in the top-right corner, enter the stock code (XPEV.US), and open the details page to view trading and historical information. Then tap “Trade” at the bottom-right, select the order type, enter your trading conditions, and submit your order.

(Image Source: uSMART HK app)