跌破卖出智能条件单

什么是跌破卖出?

与突破买入相反,跌破卖出指投资者通过设置指定的下跌的价格或跌幅比例,当达到投资者设定的条件后自动委托下单。一般是在持有股票,股价跌破指定价位时为止损而定。

止损卖出智能单目前支持美股盘前盘后交易。

操作说明

当你投资一只股票失误时,想要把损失限定在较小的范围内,以避免形成更大的亏损。这时可以通过【智能条件单】-【跌破卖出】设置一定条件,及时卖出,终止损失。

让我们来看看具体操作步骤:

STEP 1 选择股票

选择想要进行跌破卖出的股票,在订单类型选择跌破卖出。

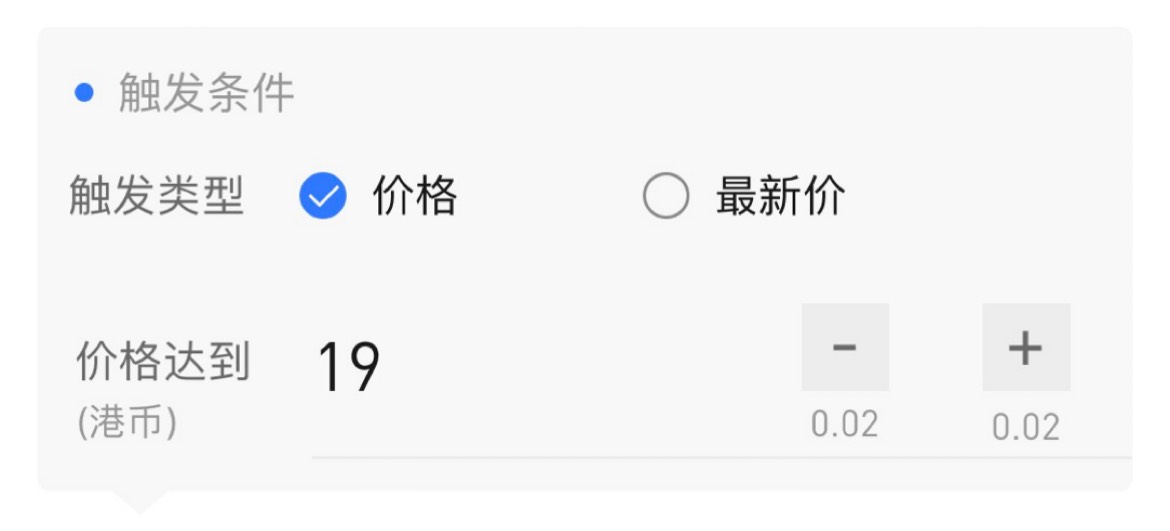

STEP 2 设置触发条件

选择触发条件,可选择价格触发或最新价触发,或选择最新价按下跌幅比例设置触发条件。一般为可承受的最大损失范围。

选择价格触发时,需手动输入价格。

选择最新价触发时,需填写比例,系统将根据填写的比例自动计算出对应股价。

根据对股票的分析,填写适当的价格或比例,一般为可承受的最大损失范围。当股价下跌到指定条件将触发执行卖出方向的委托。

STEP 3 设置委托条件

输入委托价格、委托数量。

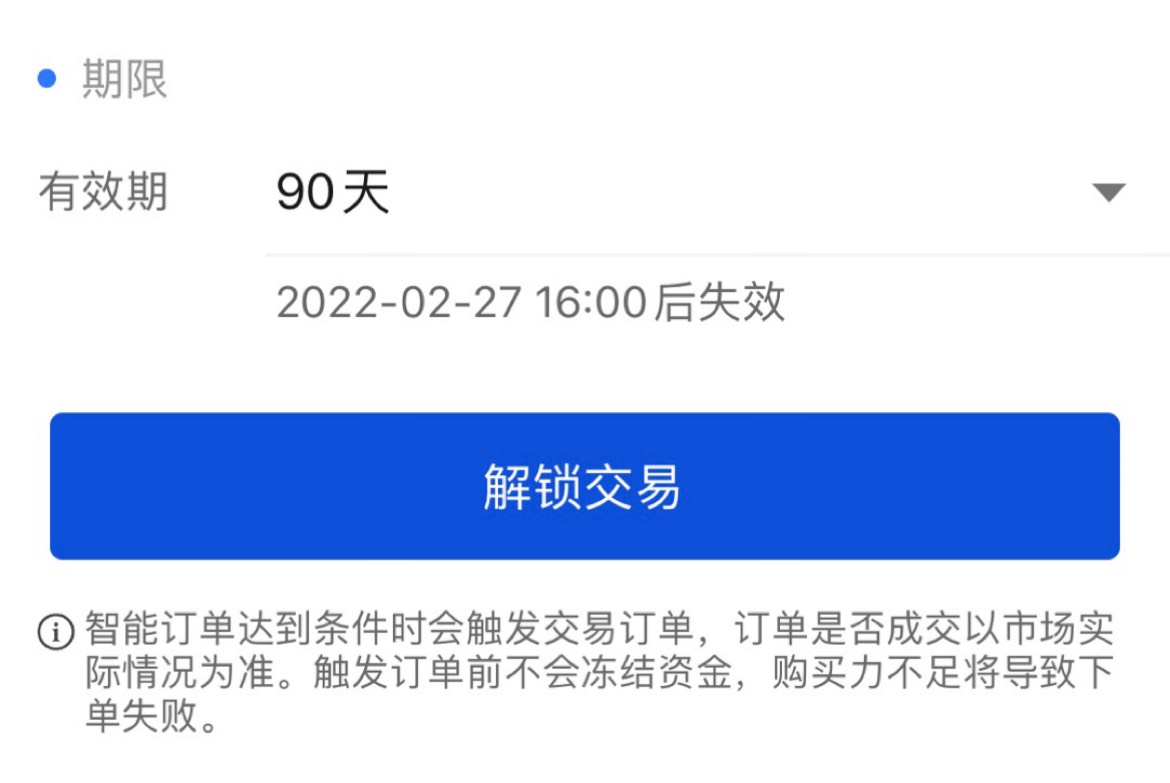

STEP 4 选择有效期并提交订单

选择有效期,目前可选择当天/2天/3天/1周/2周/30天/60天/90天,可通过改单延续有效期。

点击解锁交易,提交订单。已提交的订单可在智能条件单页面下查看,可以根据需要对订单进行修改。

*若跌破卖出已经触发,则不能进行修改,但您可以撤销订单重新下单。

可下单时间

任何时间

订单有效期

目前可选择当天/2天/3天/1周/2周/30天/60天/90天,可通过改单延续有效期。