The Hong Kong stock market is one of the important financial centers in Asia and even globally. It features high internationalization, strong liquidity, sound and comprehensive regulation, convenient and efficient trading, and favorable tax policies. In such a market environment, adopting a high dividend investment strategy is a good choice. With the U.S. consumer price index easing and the increasing possibility of rate cuts by the Federal Reserve and global central banks, the relative advantage of high dividend stocks will likely increase. In summary, the Hong Kong stock market has good fundamentals and institutional advantages, making it suitable for long-term investment using a high dividend strategy.

What is a high dividend?

A high dividend refers to companies distributing higher profits to investors in the form of cash dividends. There is no specific definition of how much dividend payout qualifies as high dividends, but generally, a dividend yield of 5% can be classified as high dividends.

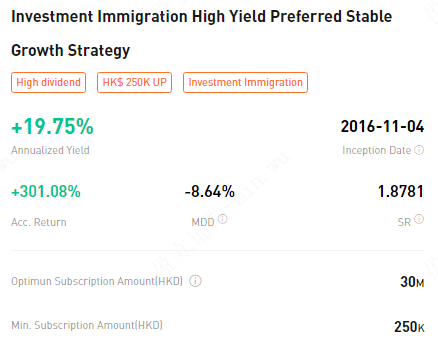

Introduction to the Investment Immigration High Yield Preferred Stable Growth Strategy

(Source:uSMART,2024.05.24)

(Source:uSMART,2024.05.24)

Foresight:High Dividend Allocation Value Highlighted

Over the past 4 years, the Hang Seng index has shown an overall downward trend. High-yield stocks,represented by banking stocks,have outperformed other industries during this period.As overall market risk appetite has decreased investment preferences have significantly favored a value style centered around high dividends.

Entering the third quarter of 2023,both the HongKong stock market and overseas markets have experienced various degrees of adiustments. On the macroeconomic front, the domestic economy gradually stabilized in the third quarter with month-on-month rebounds in the Producer Price Index(PPl),faster-than-expected growth in social financing,a Manufacturing Purchasing Managers Index(PMl)of 50.2 in September and the maintenance of loose domestic monetary policy.The domestic economy is still in the early stages of stabilization and recovery, and it is expected that market preference for high-yield stocks will continue.

Outlook:Through Multiple Bottoms-Hong Kong Stocks May Face Allocation Opportunities

Given the ongoing economic pressures,it is expected that the domestic monetary policy will remain relatively loose, but it will be constrained by currency devaluation and the high yields of u.S government bonds. As domestic policy support gradually confirms, with both Ppl and inventory cycles at historical lows, economic growth in the fourth quarter is expected to experience margina improvement.In addition, with effective control of U.S. inflation levels, the end of the interest rate hike cycle is only a matter of time, and the impact on the suppression of the Hong Kong stock market is gradually diminishing. The Hang Seng index's valuation and risk premium are at historical lows highlighting the allocation value of the Hong Kong stock market.

Scope

Hong Kong High Dividend Preferred Stable Growth Strategy primarily allocates to various high-quality assets that are closely related to the vital interests of China's national economy, such as utility stocks, banking stocks, infrastructure stocks, energy and chemical stocks, and power stocks. In anticipation of continued economic growth in China, stocks from related pillar industries are expected to achieve reasonable compounded investment returns over the long term, while also enjoying stable high dividend payouts from listed companies.

Investment Objective: We utilize our proprietary , high dividend yield quantitative model to screen and construct a stock pool comprised of high-yield companies based on dividend yield indicators, financial strength indicators, profitability, business stability, and market liquidity. Combined with a quantitative timing model that considers real-time market trends, fund flows, and momentum congestion, we make reasonable dynamic switches between the stock pool and existing holdings to achieve lower drawdowns or outperformance compared to market benchmarks.

Investment Scope: The strategy primarily invests in high-yield stocks with an average dividend yield higher than 5% over the past 3 years, aiming for stable dividend returns. In favorable market conditions, the strategy allows for timely allocation of up to 20% of funds to growth stocks with excellent fundamentals and higher growth than peers (but average dividend yield MAY NOT BE higher than 5% over the past 3 years), in order to achieve higher excess returns in bullish markets with active trading.

Investment Risk: This strategy primarily focuses on high dividend-yielding stocks, and market declines may occur due to unpredictable factors such as a sluggish macroeconomic environment, policy biases, or geopolitical instability, leading to a decrease in strategy net asset value.

The Performance of this Strategy

(Source:uSMART,2024.05.24)

(Source:uSMART,2024.05.24)

As of May 24th, the cumulative performance of this strategy has exceeded 300%.

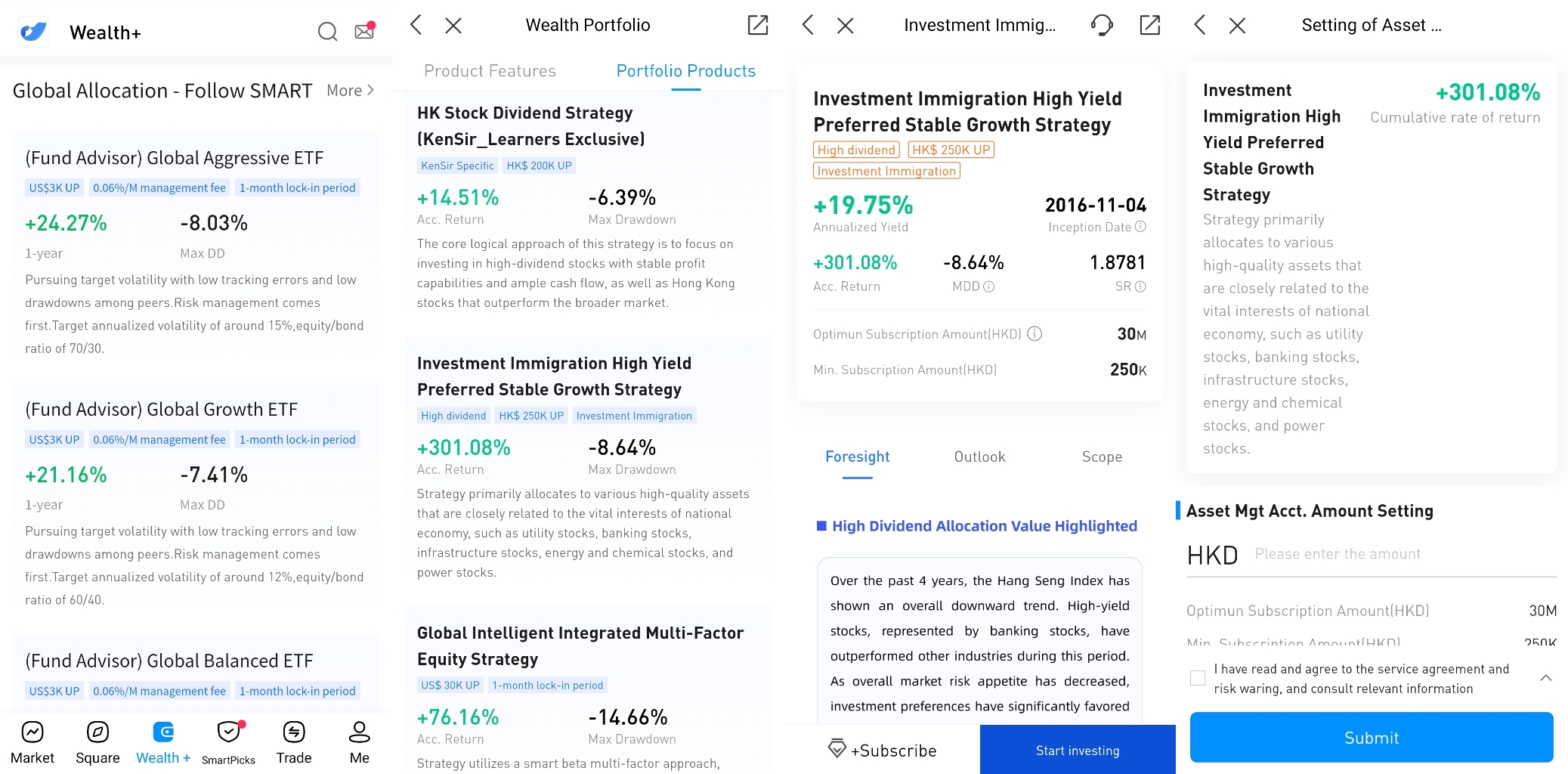

How to use the Investment Immigration High Yield Preferred Stable Growth Strategy on uSMART mobile application?

After logging into the uSMART HK APP, click on 'Wealth+' at the bottom of the page, scroll down to 'Global Allocation - Follow SMART,' click on 'More,' and in the portfolio products, find 'Investment Immigration High Yield Preferred Stable Growth Strategy' .Click to enter the details page to understand the details and historical performance, then click 'Start Investing' at the bottom, and finally submit the order after filling in the transaction conditions; the image operation guide is as follows:

This diagram is provided for illustrative purposes exclusively

This diagram is provided for illustrative purposes exclusively