The Federal Reserve, also known as the Federal Reserve System, is the central bank and monetary policy-making institution of the United States. Its role in formulating monetary policy is to maintain economic stability and promote growth. By adjusting interest rates and other monetary policy tools, it attempts to influence the money supply and credit conditions to achieve price stability, maximum employment, and economic stability.

Inflation refers to the phenomenon of a decline in the purchasing power of money over time, typically manifested by a general rise in prices. Inflation has significant implications for individuals' purchasing power, businesses' decision-making, and the overall stability of the economy.

Monetary policy tools used by the Federal Reserve to control inflation include

· Interest rate adjustments

1. Federal Funds Rate: The Federal Reserve influences other interest rates throughout the financial system by adjusting the short-term lending rate between banks. When inflation rises, the Federal Reserve may increase the federal funds rate to curb excessive credit expansion and consumer spending, thereby mitigating inflationary pressures.

2. Reserve Requirement Interest Rate: The Federal Reserve adjusts the interest rate on reserve requirements, which directly affects bank deposit and lending rates. By increasing the reserve requirement interest rate, the Federal Reserve can encourage banks to tighten credit policies, reduce the money supply, and thus restrain inflation.

· Open Market Operations:

1. Repurchase (RP) Operations: The Federal Reserve conducts repurchase operations by repurchasing short-term government bonds and other financial assets to adjust the money supply in the market. When inflation rises, the Federal Reserve can conduct reverse repo operations, which involve withdrawing funds from the market to reduce liquidity and the money supply.

2. Asset Purchase Programs: The Federal Reserve can implement asset purchase programs by buying government bonds and other financial assets to increase liquidity and the money supply in the market. However, during periods of rising inflationary pressure, the Federal Reserve may reduce or halt asset purchase programs to contain inflation.

· Inflation Expectation Management:

1. Communication and Forward Guidance: The Federal Reserve communicates its monetary policy decisions and macroeconomic outlook to the market and the public through speeches, statements, and press conferences. By clearly conveying its stance and expectations regarding inflation, the Federal Reserve attempts to influence market participants' inflation expectations and guide market behavior to align with its inflation objectives.

Effectiveness of Monetary Policy in Addressing Inflation Pressure

The monetary policy of the Federal Reserve is generally considered relatively effective in controlling inflation. However, its effectiveness is influenced by various factors, including the economic environment, inflation expectations, and external shocks.

1. Economic Environment:

The effectiveness of monetary policy largely depends on the current economic environment. When economic growth is strong and inflation pressure rises, the Federal Reserve can implement contractionary monetary policy measures, such as raising interest rates and reducing asset purchase programs, to curb inflation. Historically, the Federal Reserve has successfully controlled inflation through such measures during certain periods, such as the price controls and expansionary monetary policy that led to high growth and low inflation in 1972.

2. Inflation Expectations:

Inflation expectations refer to market participants' expectations about future inflation trends. Inflation expectations play a crucial role in the effectiveness of monetary policy. If the market expects inflation to increase, market participants may adjust their behavior accordingly, such as raising price and wage demands. In such cases, the Federal Reserve's monetary policy may need to be more resolute and decisive to effectively control inflation.

3. External Shocks:

External shocks, such as fluctuations in energy prices, changes in commodity prices, or global economic turbulence, can significantly impact inflation and challenge the effectiveness of the Federal Reserve's monetary policy. These factors may be beyond the control of the Federal Reserve, making it difficult for monetary policy alone to effectively address inflation pressure.

Controversies Regarding the Federal Reserve's Ability to Combat Inflation

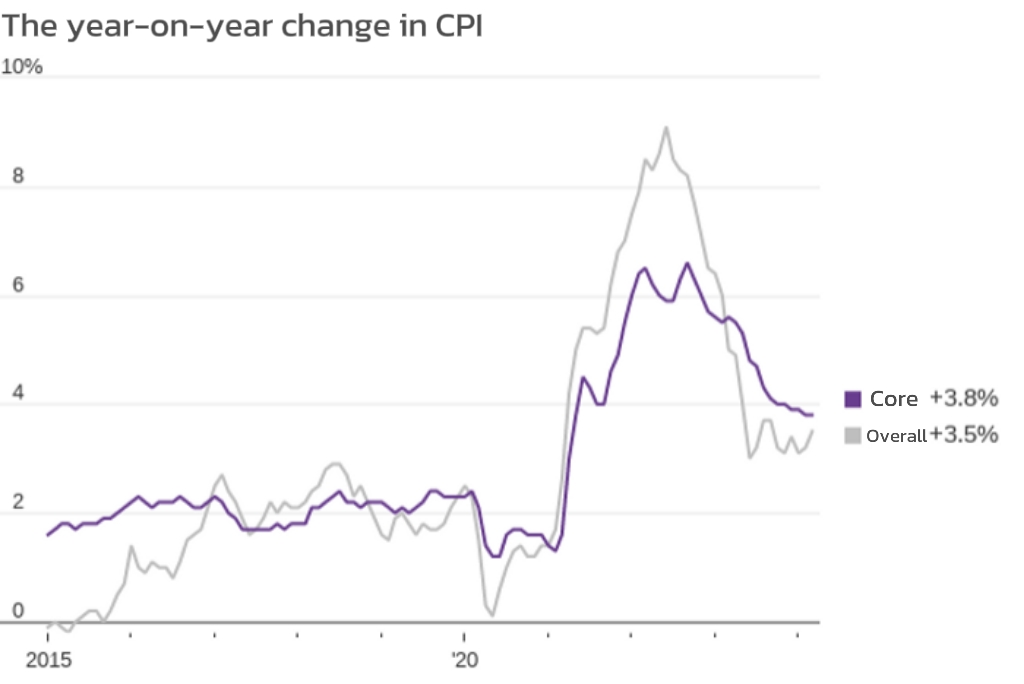

During the period of January to March 2024, the U.S. core inflation maintained a 0.4% month-on-month growth rate. From this perspective, U.S. core inflation seems to have continued its rebound trend since August of the previous year, and the gap between inflation and the Federal Reserve's 2% inflation target is widening.

(Source: U.S. Department of Labor, 2024-04-11)

(Source: U.S. Department of Labor, 2024-04-11)

Concerns about the U.S. economic outlook have intensified due to the rebound in inflation. Some economists even warn that the tightening policy adopted by the Federal Reserve to combat inflation may have a negative impact on the U.S. economy and even increase the risk of a recession.

Historical experience indicates that U.S. economic recessions are often accompanied by uncontrolled inflation and tight monetary policy. In the 1970s, the United States experienced a period known as "stagflation," where economic growth stagnated while inflation remained high. To curb inflation, then Federal Reserve Chairman Paul Volcker significantly raised interest rates, which resulted in two recessions in the United States in 1980 and 1981-1982.

Currently, the U.S. economy is facing similar risks again. Since 2022, the Federal Reserve has raised interest rates several times, pushing the target range for the federal funds rate to 5.00%-5.25% to address inflation pressure. However, the latest data shows that inflationary pressures have not been effectively alleviated, putting the Federal Reserve in a dilemma.

BMO Capital Markets' U.S. Rate Strategy Director, Lin, pointed out that if inflation data continues to remain high, the Federal Reserve may have to continue raising interest rates to achieve its 2% inflation target, despite the risk of triggering an economic recession. Donald, Chief Economist at Allianz Investment Management, also warned that the possibility of the Federal Reserve maintaining high interest rates until an economic recession is increasing.

In reality, the overly tight policy of the Federal Reserve has already had a noticeable negative impact on the U.S. economy. High interest rates have dampened consumer and investment demand, leading to a significant cooling of the real estate market and increased volatility in the financial markets. The banking crisis in March further revealed the vulnerability of the financial system in a high-interest-rate environment. Lowering interest rates hastily could reignite inflation and bring greater uncertainty to the economy. However, maintaining high interest rates could further exacerbate the risk of an economic recession. The Federal Reserve is caught in a dilemma.

Future Outlook

The Federal Reserve needs to strike a balance between maintaining financial stability and achieving inflation targets to alleviate downward economic pressure and avoid an economic recession. In addressing inflation, strategies such as gradual interest rate hikes, adjustments to monetary policy tools, and transparent communication can be employed. The Federal Reserve needs to cautiously assess economic data and market conditions and flexibly adjust its monetary policy to balance these factors in order to achieve the dual goals of inflation and economic stability.