“裝傻”還是“健忘”?

uSMART盈立智投 03-23 20:27

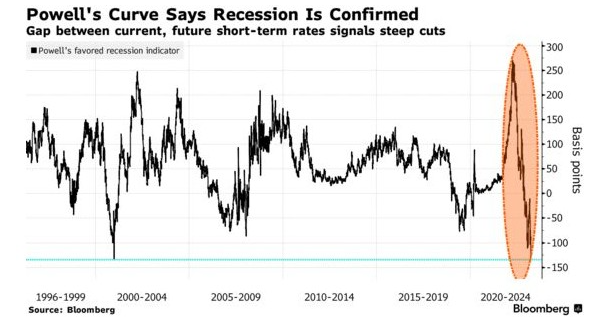

美國經濟衰退是必然的,今年降息也是必然的。這是美聯儲主席鮑威爾一年前強調的債券市場指標傳遞出的信息,該指標被認爲是揭示美國經濟問題的最佳指南。

3個月期美國國債的預期利率比當前利率下降了134個基點。這低於2001年1月創下的歷史最低點——大約在美國經濟陷入衰退前兩個月。

鮑威爾在2022年3月的時候表示,“坦率地說,美聯儲系統的工作人員進行了很好的研究,實際上是說要關注短期——18個月——的收益率曲線。這對收益率曲線有100%的解釋力。這很有道理。因爲如果它是倒掛的,那就意味着美聯儲要降息,意味着經濟疲軟。”

美國公債週四延續漲勢,此前美聯儲將基準利率上調25個基點,交易商加大押注美聯儲將很快逆轉路線並開始降息。他們確信,美聯儲將在9月降息,至少抵消本週的加息。

市場觀點與美聯儲預期將至少加息一次的指引,以及鮑威爾表示他預計今年不會降低借貸成本的言論形成了鮮明對比。

道明證券策略師Jan Groen週三表示“考慮到迄今爲止的緊縮政策和銀行信貸緊縮,美聯儲降息的速度可能會比市場目前預期的更快。”“由於我們繼續預計經濟將在第四季度陷入衰退,我們仍然認爲,美聯儲將在12月的會議上開始降息。”

收益率曲線倒掛更加陡峭

兩年期美國國債收益率繼週三下跌23個基點後,週四下跌7個基點至3.87%。兩年期美債收益率的跌幅超過了10年期公債收益率的跌幅,令收益率曲線深度倒掛的部分再度變陡,許多觀察人士將此部分視爲衰退指標。在經濟開始收縮之前,這部分曲線通常會回升至零以上。

掉期交易員認爲,美聯儲不會再次加息的可能性約爲50%。此前,美聯儲自2022年3月16日決定加息25個基點以來,已加息4.75個百分點。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.