On October 20 (U.S. Eastern Time), Apple Inc. (AAPL.US) shares surged strongly, hitting an intra-day high of USD 264.38 before closing at USD 262.24, up 3.94% for the day — marking a new all-time high for 2025.Apple’s market capitalization is now approaching USD 4 trillion, further solidifying its position as the world’s most valuable listed company.

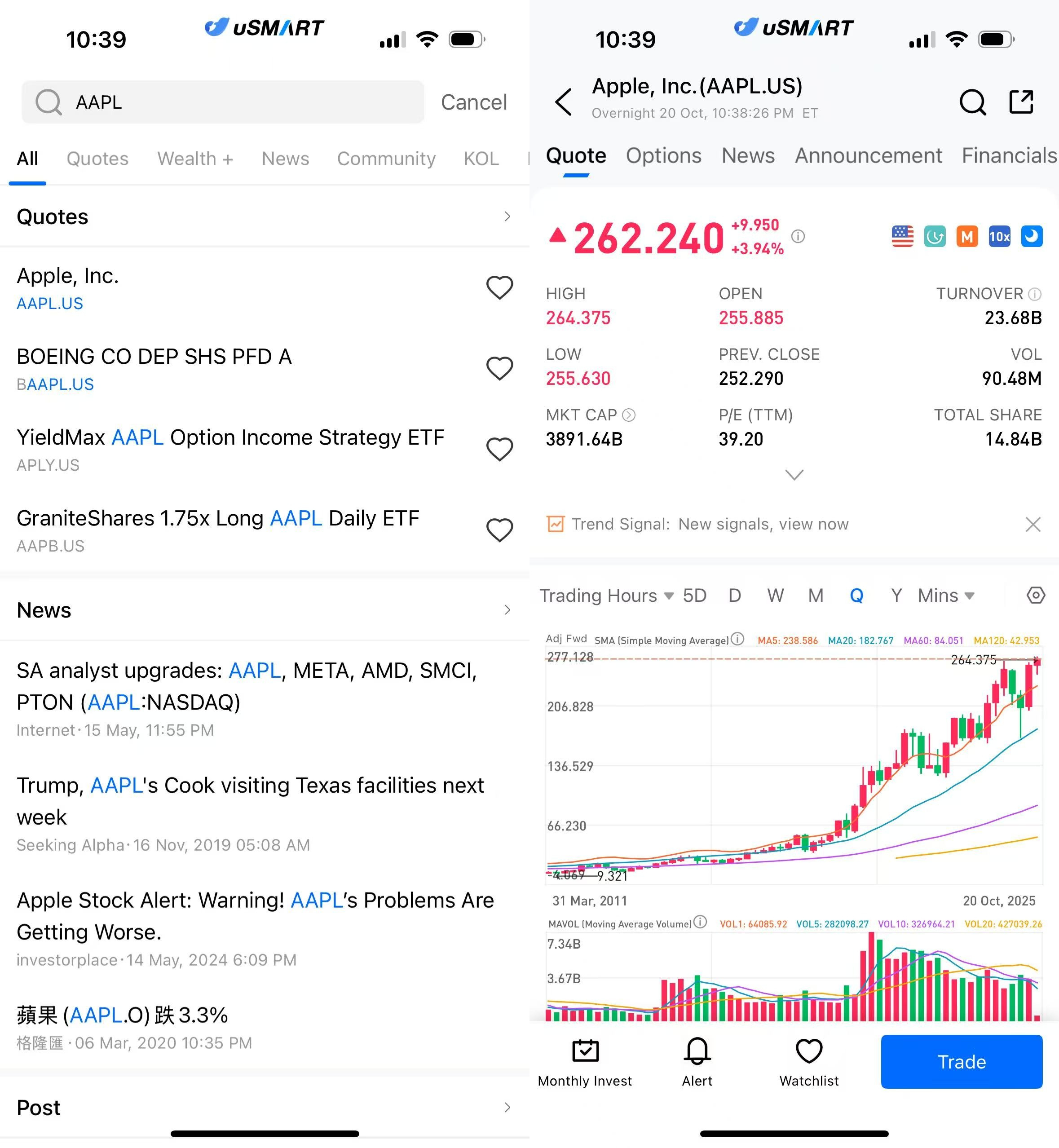

(Image Source: uSMART HK app)

iPhone 17 Sales Boom Boosts Market Confidence

According to multiple international media reports, Apple’s newly launched iPhone 17 series has seen robust sales globally, especially in the U.S. and China, with first-week sales up more than 14% year-on-year compared to the previous generation.

The strong product momentum has driven optimism for Apple’s fiscal Q4 earnings, becoming the key catalyst behind the recent stock rally.By enhancing AI photography, smart interaction, and battery optimization, Apple continues to strengthen its dominance in the premium smartphone segment, laying the groundwork for future service and ecosystem revenue growth.

Market Sentiment Improves as Apple Leads Tech Rally

With inflation cooling and rate-cut expectations rising, U.S. stock market sentiment has improved, sending the tech sector broadly higher.Apple led the gains, helping lift the Nasdaq Composite in continued rebound.

Capital flow data showed a significant net inflow into Apple shares last week, with both mutual funds and ETFs increasing holdings.Analysts note that Apple’s stable profitability and strong brand moat make it a top choice among investors seeking defensive growth exposure.

Institutions Turn Bullish — Target Prices Raised to USD 300

Several investment firms have raised Apple’s price targets to the USD 280–300 range.Market analysts highlight Apple’s three-engine growth model — “AI + Hardware + Services” — with services revenue expanding steadily, providing strong valuation support.Consensus estimates suggest that Apple’s next fiscal quarter revenue could grow around 5% year-on-year, with profit margins remaining healthy.

Eyes on Upcoming Earnings Report

Apple is set to announce its quarterly earnings at the end of October.Investors are closely watching the sustainability of iPhone 17 demand, the rollout of Vision Pro, and AI feature integration.If results beat expectations, the stock could set fresh highs; if not, short-term pullbacks may occur.Overall, Apple’s solid cash flow and innovation cycle keep it a core long-term holding for institutional investors in the tech sector.

How to Buy Apple on uSMART HK

After logging into the uSMART HK app, click on “Search” at the top right of the page, input the stock code (AAPL.US) to access the details page and view transaction details and historical trends. Then click the “Trade” button at the bottom right, select the “Buy/Sell” option, fill in the transaction conditions, and submit your order.

(Image Source: uSMART HK app)

(Image Source: uSMART HK app)