緊信用!抱團散!殺估值!A股風格轉變,白酒蒸發4000億

春節前一路暴漲、春節後首個交易日就大挫近4%的白酒板塊,在本週繼續回調,連續3個交易中已累計回調超10%。

截至今日發稿,中證白酒指數跌近7.5%,創下中證白酒指數2020年7月16日至今的最大單日跌幅。整個白酒板塊總市值較上億交易日蒸發了4000億元有餘。

板塊內成分股方面,山西汾酒、酒鬼酒跌停,五糧液、瀘州老窖、洋河股份跌逾8%。

而白酒股的絕對中心——貴州茅台,全天震盪走低,一度跌超7%,最終收跌6.99%,亦是自去年7月16日以來的最大單日跌幅。

在橫跨春節假期的2月8日至19日(上週五)的5個交易日內,北上資金(滬股通)連續淨賣出貴州茅台,資金累計流出約30億元。而今日,貴州茅台再遭北上資金淨賣出近3億元。

除白酒板塊外,醫藥板塊以及前期的熱門抱團股如美的集團、中國中免、海天味業等今日也紛紛大跌。

可見,主流資金加速調倉是抱團板塊下跌的主要原因。而資金投資風格轉換背後的主要原因,一個是前期抱團股的暴漲已計入了較滿的預期,而近期並新的利好釋出,因此抱團股本身已經存在估值過高的現象;

另一個主要原因,自然是央行繼續收緊的貨幣政策。目前市場上的各類投資者對於宏觀流動性的敏感度都非常高,對流動性邊際轉緊的背景下對A股估值的下壓存在普遍的擔憂。

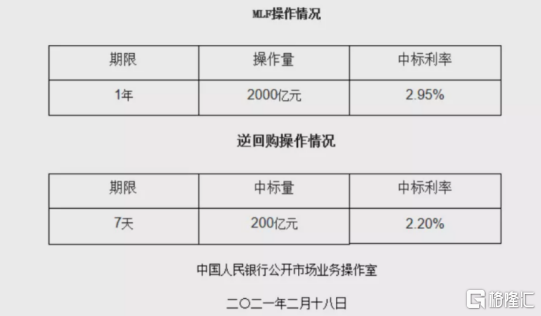

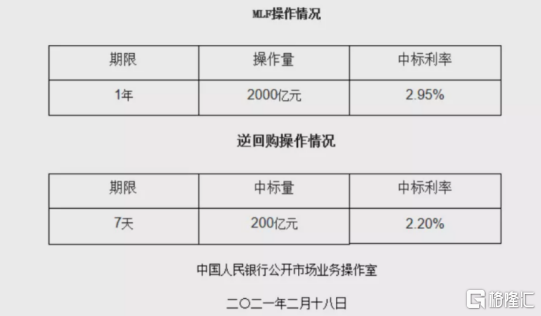

節後開市當天,央行便開展了2000億元中期借貸便利(MLF)操作,即在春節後逐步回籠現金;以及200億元逆回購操作,中標利率持平於2.2%。

與此同時,國債期貨在今年1月底破位持續走低,打破了債熊接近尾聲的市場預期。10年期國債期貨主力合約今日再跌0.06%。

在流動性收緊、市場上資金不足的情勢頗為明顯的情況下,前期暴漲以至於出現較大估值泡沫的板塊——白酒、醫藥,自然在殺估值時首當其衝。

相反,前期較冷的有色、化工股今日集體飆漲。有色金屬指數以超過7.5%的漲幅領漲市場。

個股方面,板塊內包括北方稀土、天山鋁業、江西銅業在內的20支個股漲停。紫金礦業漲逾7%、洛陽鉬業漲逾6.5%。

不過,以銀河證券為代表的券商認為,股市流動性的拐點尚未到來,不必對貨幣政策的微調草木皆兵,只有貨幣流動性持續大幅收緊才可能使股市進入熊市。而貨幣政策目前仍保持“靈活精準、合理適度”的基調,穩健中性的基調並沒有變,居民財富增配股市的大趨勢尚未發生變化。

而據民生證券分析,近期抱團板塊的下跌體現了市場主流資金在加速調倉,主要原因有兩個:一是前期強勢板塊股價已計入的預期較滿,近期未有明顯進一步利好,高估值本身就是調倉換股的原因。二是部分高確定性標的估值體系從市盈率相對盈利增長比率、利潤收益率切換為貼現率,而貼現率上行就是估值最大的敵人,然後會通過同業公司比較,帶動板塊內估值水平一同下行。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.