國藥集團為何要溢價私有化中國中藥?

下午2點半左右,國藥控股直線拉昇,一度衝漲6%;中國中藥更是大漲8%,現臨時停牌,報4.3港元,成交額2.41億港元。

(來源:wind)

消息面上,據媒體報道,由國藥控股牽頭的一個財團正計劃收購中國中藥,對該公司的估值至少為33億美元。

根據2020年中報,國藥集團是中國中藥的母公司和主要股東,持有其16.35億股,佔中國中藥總股本的32.46%;第二大股東為中國平安人壽保險股份有限公司,佔其總股本的12%;恆迪投資有限公司位列第三大股東,持有中國國藥2.7億股,佔總股本的5.36%。這三大股東總計持有中國中藥49.82%股份。

(來源:wind)

目前國藥集團正與平安保險集團和中國中藥執行董事王曉春合作,該財團計劃對中國中藥提出至少每股5.10港元的私有化報價,較其過去一個月的平均股價3.83港元溢價約33%。

中國中藥究竟什麼來頭?

中國中藥是國藥集團旗下唯一的中藥平台,2015年收購江蘇天江藥業後成為國內中藥配方顆粒行業龍頭,同時涵蓋中成藥、中藥飲片、中醫大健康、產地綜合服務等業務。目前,公司總共擁有1300多個成藥品規,700多個單味中藥配方顆粒品種,400多個專供出口的經典複方濃縮顆粒。

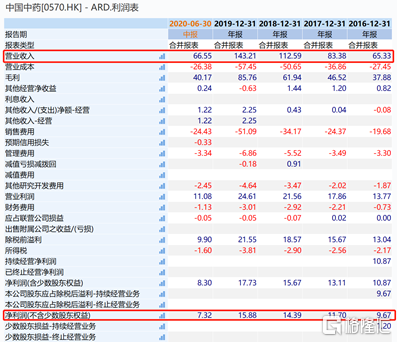

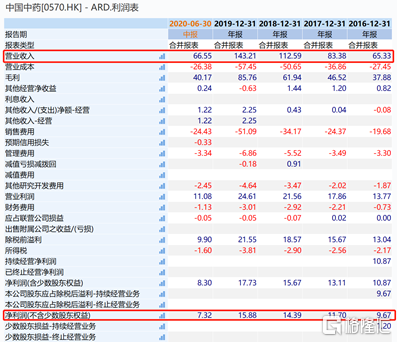

2020年上半年,中國中藥實現營收66.55億元,同比下降4.1%;淨利潤為7.32億元,同比下降14.8%,對於業績的下滑,主要是受到新冠肺炎疫情影響,業務開展不及同期所致。

(來源:Wind)

拆分來看,中藥配方顆粒業務是中國國藥第一大業務,營業收入達45.70億元,佔總收入68.7%;其次是中成藥業務,佔總收入19.6%;中藥飲片業務佔比8.5%;中醫藥大健康業務佔總收入0.6%;產地綜合業務佔2.6%收入。

國內中藥飲片銷售額由2015年的1602億增加到2019年的2732億人民幣,CAGR為14.3%。而中藥配方顆粒銷售額由2006年的約2.3億提升至2018年的119億,年複合增速達38.94%。

中泰證券認為,中國中藥配方顆粒需求仍將維持較快增長。短期來看,中藥配方顆粒對部分新型冠狀病毒患者的治療方面效果良好,納入多版新冠治療指南。中長期來看,中藥配方顆粒適用範圍很廣,且使用方便,未來將有更多偏好於中醫藥的患者選擇配方顆粒。其次,中藥配方顆粒屬於中藥飲片,目前不受藥佔比及藥品零加成規則的限制,醫療機構比較一換一使用。此外,中藥配方顆粒目前在中國屬於試點生產,政府如若放開配方顆粒牌照,有利於帶動配方顆粒需求。

(國內市場中藥配方顆粒市場規模(億元),來源:中泰證券)

不過,縱使中國中藥所處的中藥配方顆粒賽道前景較好,但在港股市場所獲得的估值卻一直低下。可以看到,中國中藥近2年的時間裏PE-TTM均不到15倍水平,相較於A股中藥板塊37倍,中藥飲片板塊110.56倍的估值水平,處於偏低狀態。

(來源:wind)

這恐怕是,國藥集團提出中國中藥私有化的主要原因。有消息稱,國藥牽頭的財團計劃最終讓中國中藥在A股上市,以利用內地股市估值較高的機會。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.