香港交易所(00388.HK):現貨市場持續活躍,新經濟上市熱度高漲,維持“買入-A”評級

機構:華金證券

評級:買入-A

投資要點

◆ 市場表現:2021 年以來,港交所在市場景氣度高漲下表現持續亮眼。2020 年港交所大漲 71.64%(恆指-3.40%),開年以來,截至 2021 年 1 月 18 日收盤累計漲13.41%(恆指+5.99%)。股價持續新高的背後是市場對公司盈利能力的認可。

◆ 現貨市場持續活躍,互聯互通助力南下北上:根據港交所披露數據,2020 年全年ADT 同比+49%至 1295 億港幣,(截至 2021 年 1 月 15 日)今年 1 月日均 ADT同比+156%至 1938 億港幣。互聯互通持續放量,為港股市場景氣度添柴加火。南/北向資金來看,2020 年日均買賣總額同比+126%/+119%至 244 億港幣/913 億人民幣,今年 1 月累計同比+276%/+152%至 593 億港幣/1461 億人民幣。

◆ 新經濟開啟赴港上市新一輪浪潮:【總體】2020 年縱使疫情影響,香港地區 IPO熱度不減,全年 IPO 募集資金總額同比+26.51%至 3975 億港幣,位居全球交易所第二位(僅次於納斯達克),全球前十大 IPO 項目中港交所攬得 3 項。【新經濟赴港 IPO 潮】內企二次赴港上市有力支撐港股 IPO,2020 年 9 家內企二次赴港 IPO,合計募得 1313 億港幣,佔港交所全年 33%。其中不乏京東、網易等新經濟。同時泡泡瑪特、思摩爾國際等也選擇將香港作為首次 IPO 地區。【2021 年新經濟依舊火熱】中概股迴歸港股市場呼聲不斷,B 站擬向港交所申請二次上市,滴滴、知乎等亦傳出謀求香港上市。快手已通過上市聆訊,據媒體報道擬發行 4.159 億股,招股價上限 93 港幣,每手 50 股。

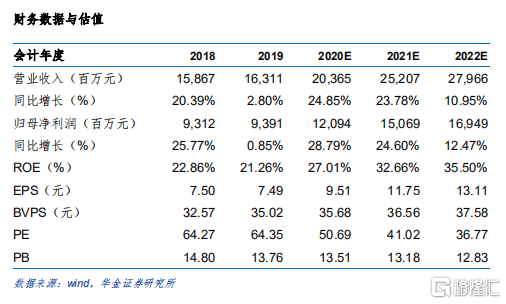

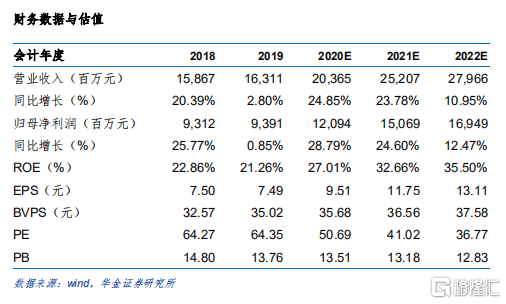

◆ 投資建議:新經濟陸續赴港上市,港股生態結構迎來持續改善。內地投資者對港股市場日益青睞,帶來港股市場流動性改善。港股市場交投活躍度超出我們此前預期,基於此我們將 2020-22 年歸母淨利潤分別上調 3.59%/15.27%/16.51%,長期可持續 ROE 由 25%上調至 30%,上調目標價至 553.61 港幣/股,維持買入-A 建議。

◆ 風險提示:與內地業務競爭加劇、區域/業務集中度過高、中美關係動盪。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.