機構:廣發證券

評級:買入

核心觀點:

公司披露 2020H1 業績公告。20H1 收入和歸母淨利分別實現人民幣28.23 億元(YoY+5.6%)和 3.36 億元(YoY-20.1%),遊戲及教育收入穩定增長,毛利率同比下滑 3.56pct 至 66.22%,銷售費用率及管理費用率同比略減,研發費用率同比增長 1.36pct 至 20.2%。

遊戲收入正向增長。20H1 收入和經營性利潤分別實現 16.5 億(YoY+4.5%)和 9.44 億(YoY-0.5%),毛利率略升至 96.1%,銷售費用率同比提高 0.7pct,管理費用率和研發費用率分別提高 0.2pct 和 2.4pct。儲備有 4 款取得版號新遊,預計 2020 年底前將推出《魔域傳説》、《魔域手遊Ⅱ》、《風暴魔域》等新遊。

教育:20H1 收入同比+8.53%至 11.38 億,經營性虧損同比+33.59%至 3.77 億,同比擴大主要由於員工工資增加及疫情停課後用户活躍度增加使服務器費用增加;毛利率下降 8.5pct 至 25.1%。普米:20H1 平板出貨量增速較市場增速+20.5%。Edmodo:用户數大幅增長,埃及項目若落地預期將帶來較大增量。國內:加強用户覆蓋及變現基礎,推動 SaaS 業務變現。20H1 公司旗艦軟件平台 101 教育 PPT 平均月活躍用户超過 100 萬,網教通平台月活躍用户峯值達 500 萬。

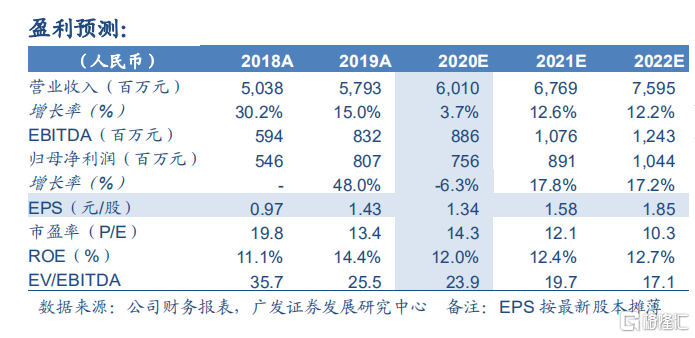

維持“買入”評級。預計 20~21 年歸母淨利分別為人民幣 7.56 億元、8.91 億元,當前股價對應 PE 分別為 14.3 倍、12.1 倍。經典遊戲仍增長,多款新遊待上線,教育探索多元變現方式。根據分部估值,遊戲業務給予 2020 年 10 倍 PE,國內教育給予 2020 年 10 倍 PE,普米給予 2020 年 15 倍 PE,Edmodo 按此前收購估值的 70%估值(主要考慮尚未盈利,給予 70%估值折讓),得到合理價值 31.4 港元/股。

風險提示:老遊戲增長放緩,新遊表現不達預期;普米新項目落地及收入確認時間導致收入波動,國內教育業務進展不達預期,虧損擴大。