華潤水泥控股(01313.HK ):期待產能瓶頸下的價格彈性 ,維持“買入”評級,目標價11.12港元

機構:興業證券

評級:買入

目標價:11.12港元

公司披露2020Q1業績:營業額約55.94億港元,同比減少25.5%;公司擁有人應占盈利約11.14億港元,同比減少25.2%;每股基本盈利15.9港仙。

水泥量跌價升,噸毛利同比增加,韌性極強。疫情影響下,Q1水泥&熟料對外銷量同比下降25.0%至1184萬噸。量的損失導致單噸水泥攤銷的固定成本變大,單噸水泥成本增加了9港元至233港元,以人民幣計價的成本增加約18元(測算值)。Q1單噸水泥售價同比增加26港元至408港元,以人民幣計價的售價同比增加約40元(測算值)。Q1單噸水泥毛利175港元,同比增加17元,毛利率42.9%,同比增1.4pct。

混凝土量跌價穩定。混凝土銷量同比下滑38.3%至159萬立方米,原材料成本增加明顯,單方混凝土成本增26港元,單方毛利下滑12元至94港元/立方米,毛利率18.4%。

費用控制得當。在疫情的不利影響下,Q1三費的絕對值同比下降了20.5%,特別是銷售費用下降最為明顯;費用率同比僅增0.9pct至13.0%;噸水泥費用同比僅增加5.6港元至61.2港元,已屬難能可貴。

我們的觀點:4月兩廣水泥需求加速,有望逐步進入旺季漲價節奏。需求增量來自於基建。我們維持此前的預判:兩廣龍頭在旺季的產能發揮已經接近瓶頸,若旺季疊加趕工,價格具備進一步走高的彈性,節奏快的話是二季度中後期,慢的話是四季度,價格彈性可類比去年四季度的華東市場。

看長,廣西出台暫停產能置換的徵求意見稿,產能無序擴張的隱患得以解除,競爭格局有望更加明朗。

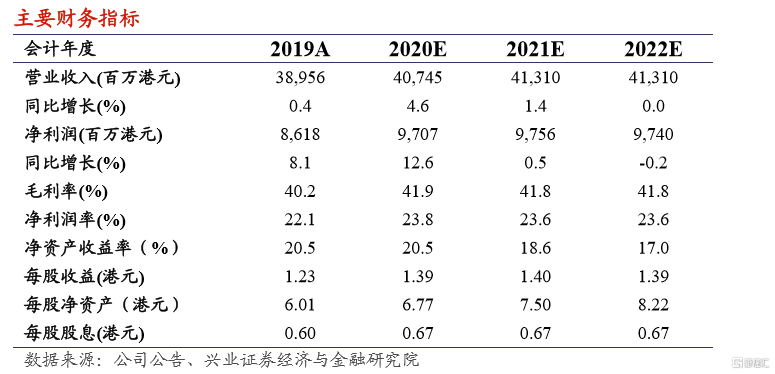

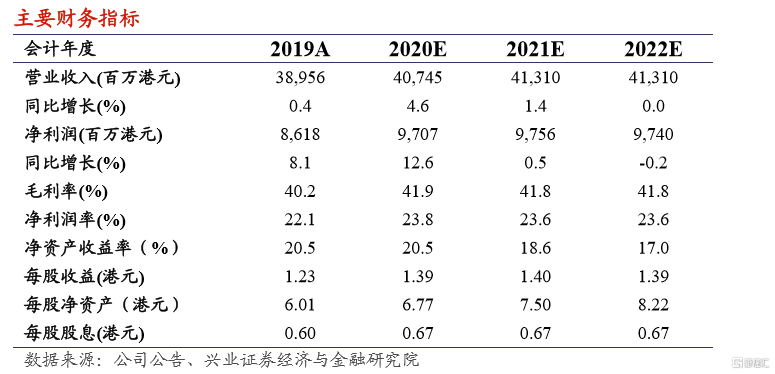

我們維持公司2020-2022年歸母淨利潤分別為97億、98億和97億港元的盈利預測判斷,最新收盤價對應2020年預測PE為7.3X,潛在股息率為6.6%。維持“買入”評級和11.12港元的目標價。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.