Zhou Liu Fu: Chinese Mainland Mid‑to‑High‑End Jewellery Retailer

Offering structure: 46.808 million shares globally, of which 4.6808 million shares (10 %) will be offered to the Hong Kong public and 42.1272 million shares (90 %) by way of international placing.

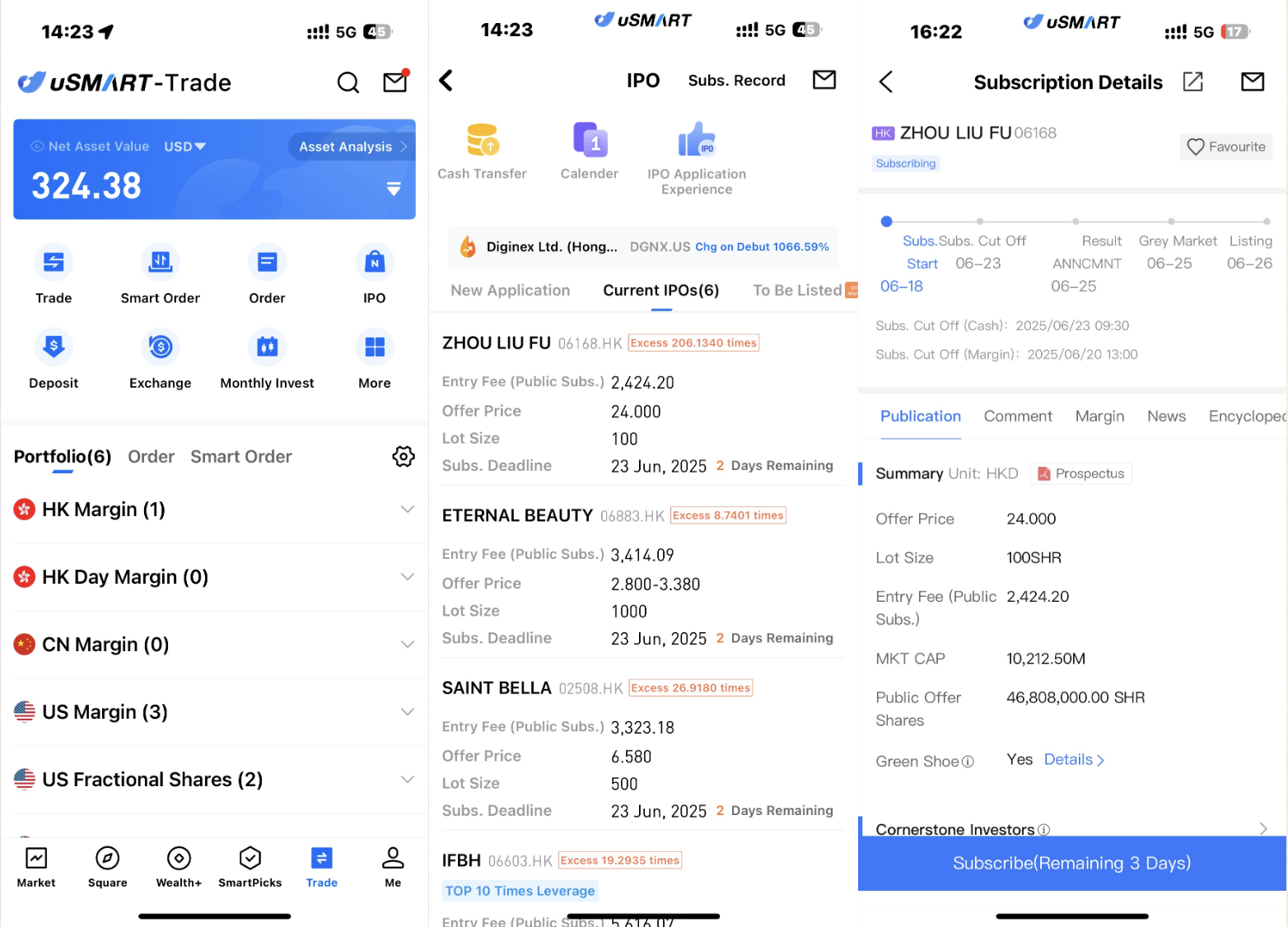

Offer price: HK$24 per share; one‑lot entry cost approximately HK$2,424.2.

Subscription period: 18 June 2025–23 June 2025.

Listing date: Expected 26 June 2025.

IPO sponsors: CICC and CSC International.

(Source: Zhou Liu Fu's prospectus)

Company Profile

Founded in 2004 and headquartered in Shenzhen, Zhou Liu Fu is one of China’s fastest‑growing gold‑jewellery retailers. Leveraging a light‑asset, three‑pillar model—self‑operated stores, franchise stores and authorised suppliers—the Group operated 4,034 offline outlets nationwide as of end‑2024, spanning 31 provincial‑level regions. Southern China accounts for 2,758 stores, putting the brand fourth in the country by store count. Zhou Liu Fu caters to mid‑to‑high‑end consumers, with gold jewellery consistently contributing more than 70 % of revenue. Collaboration with popular IPs and KOLs plus an “old‑for‑new” trade‑in service keeps the brand youthful. Its self‑developed SAP system and POS network deliver real‑time franchise data, informing supply‑chain management and product design.

Financial Highlights

The prospectus shows rapid growth over the past three years. Revenue rose from RMB 3.102 billion in FY 2022 to RMB 5.718 billion in FY 2024, a CAGR of 35.8 %. Gross margin improved from 18.5 % to 25.9 % owing to scale and product‑mix optimisation. Adjusted net profit surged from RMB 57.52 million in 2022 to RMB 706.3 million in 2024, lifting net margin from 1.8 % to 12.4 %. Operating cash flow stayed positive for three consecutive years, with a RMB 708.5 million net inflow in 2024, underscoring self‑funding capacity amid expansion. As of end‑2024, cash and equivalents were RMB 1.331 billion and the gearing ratio hovered around 29 %, providing ample fire‑power for channel roll‑out and digital upgrades.

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$10 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 20 May 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

How to Subscribe for Hong Kong IPOs via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks. After logging in, tap “Trade” at the bottom‑right, choose “IPO Subscription,” select the target IPO, tap “Public Offer,” enter the share quantity and submit your order.

(Source: uSMART HK)