Shouhui Group (02621.HK) launched its IPO from May 22 to May 27, 2025. The company plans to issue 24.3584 million shares, with an offering price range of HK$6.48 to HK$8.08 per share. Each lot consists of 400 shares, and the shares are expected to commence trading on the Hong Kong Stock Exchange on May 30, 2025.

Shouhui Group :it is a personal insurance intermediary service provider that operates a digital platform for life insurance transactions and services, delivering online insurance solutions to customers.

Offering Structure:24.3584 million shares (90% international offering, 10% public offering), with a 15% over-allotment option

Price Range: HK$6.48 to HK$8.08 per share

Lot Size: 400 shares per board lot, with an entry cost of HK$3,264.59

Subscription Period: May 22 to May 27, 2025

Expected Listing Date: May 30, 2025

IPO Sponsors: CICC and Huatai International

(Source: Shouhui Group's Prospectus)

Company Overview

Shouhui Group, founded in 2015, is a leading personal insurance intermediary leveraging digital platforms to enhance insurance transaction and service efficiency. Through its three flagship platforms—"Xiaoyusan" (direct online sales), "Kacha Bao" (agent distribution), and "Niubao 100" (partner distribution)—the Group offers diversified life insurance solutions across multiple sales channels. As of end-2024, Shouhui had distributed over 1,900 insurance products (including 280+ customized products) spanning long-term life, critical illness, medical, and short-term coverage, with 306 products currently available. The company has incubated more than 14 insurance service IPs and built an extensive network serving 3.5 million policyholders and 5.8 million insured individuals, including 1.6 million active policyholders and 2.4 million active insureds—demonstrating strong market influence and customer trust.

Financial Highlights

Shouhui delivered robust financial performance with revenue surging from RMB806 million in 2022 to RMB1.634 billion in 2023, then stabilizing at RMB1.387 billion in 2024. Gross margins remained healthy at 34.8%, 33.8%, and 38.1% respectively, reflecting effective cost management. Adjusted net profit skyrocketed from RMB75 million (9.3% margin) in 2022 to RMB253 million (15.5%) in 2023, sustaining at RMB242 million (17.4%) in 2024—highlighting consistent profitability enhancement.

uSMART Launches "HK IPO Fee Waiver Offer" – Enjoy Zero-Cost IPO Subscriptions

0% interest* on margin subscriptions, with up to 10x leverage

0 handling fee for cash subscriptions

Grey market trading supported

*Interest-free margin applies to subscription amounts of HKD 10 million or below.

^Handling fee waived for cash subscriptions.

This promotional offer is effective from May 20, 2025, until further notice. Some popular IPOs may not be eligible for the offer. Actual interest rates and handling fees are subject to the details shown in the uSMART App at the time of subscription. Government and exchange-related fees will still be charged as usual. The company reserves the right to amend, suspend, or terminate the above offer, terms, and conditions at any time without prior notice to customers. All interpretations shall be subject to the company's final discretion.

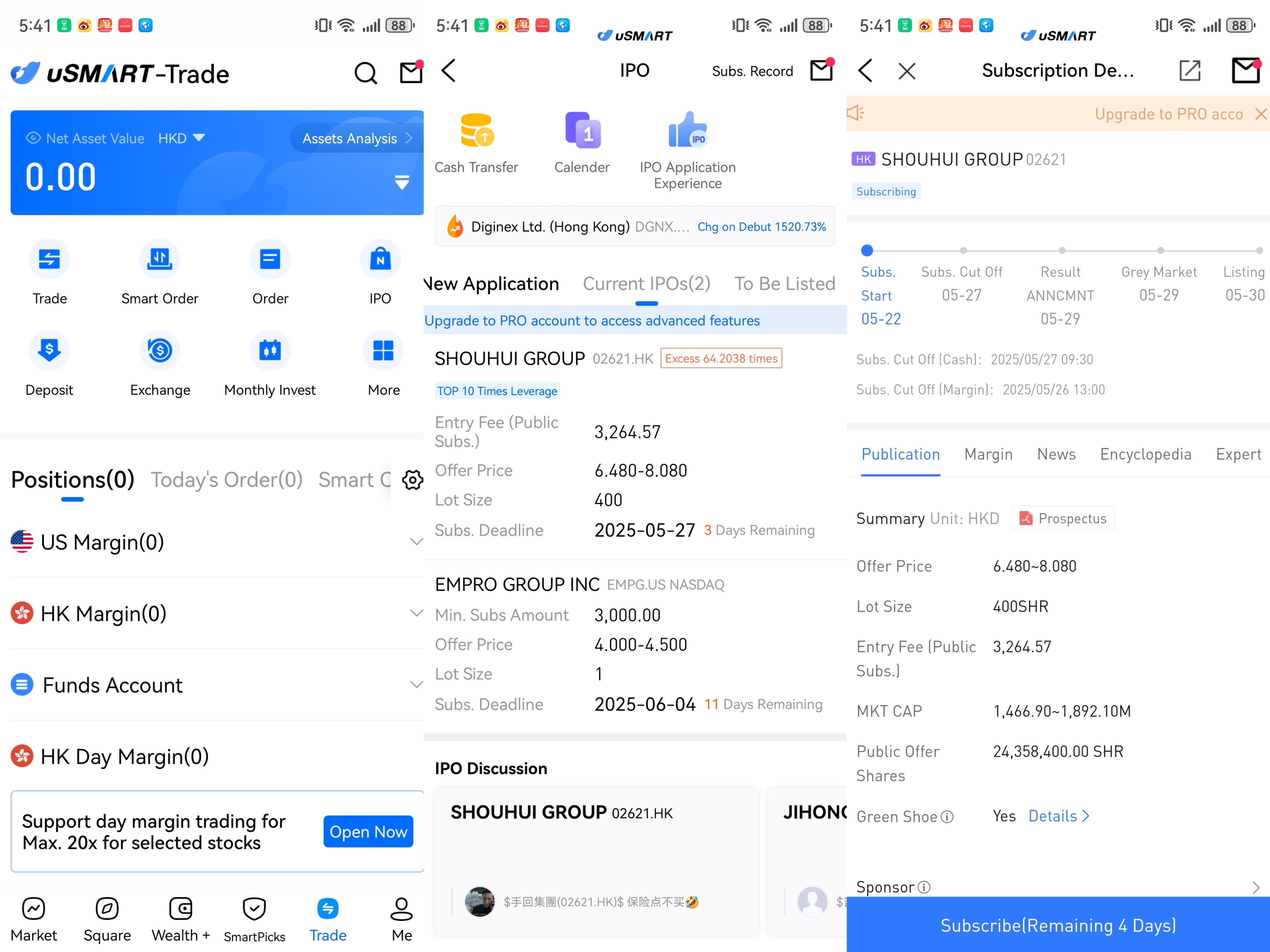

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)