Since the beginning of this year, Hong Kong's IPO market has shown a clear rebound. In the first quarter alone, 15 companies successfully went public, raising a total of HKD 18.2 billion—a staggering 287% increase compared to the same period last year. The main sources of funding came from two Chinese mainland-based tea beverage brands, as well as companies in industries such as gold mining, aluminum production, and toy manufacturing.

"A+H" Model Gains Momentum: 2025 Emerges as Peak Year for A-Share Firms Listing in Hong Kong

On March 10 this year, Chifeng Gold successfully debuted on the Hong Kong Stock Exchange (HKEX), becoming the first company in 2025 to achieve a dual "A+H" listing. Soon after, Junda Shares was listed on the HKEX on May 8. Even more notably, two A-share giants—CATL (Contemporary Amperex Technology) and Hengrui Pharmaceuticals—are set to list in Hong Kong on May 20 and 23, respectively. In contrast, only three A-share companies—Midea Group, SF Holding, and Longpan Technology—completed dual "A+H" listings in all of 2024.

According to Times Finance, as of May 16, a total of 46 A-share companies have announced plans to issue H-shares or have already submitted listing applications to the HKEX. Among them, 26 firms filed their applications this year, accounting for 56.52% of the total—far surpassing the fewer than 10 applications recorded for the entirety of 2024. This highlights the strong momentum of A-share companies seeking Hong Kong listings in 2025.

Multiple Tailwinds Fuel the Listing Boom

Hong Kong's capital market is entering a new phase of revival. Driven by regulatory improvements, enhanced liquidity, and listing regime reforms, the city's IPO market has staged a full recovery, with annual fundraising volumes reclaiming the top global position this year. Since last year, the Securities and Futures Commission (SFC) and HKEX have streamlined IPO approval processes – particularly accelerating reviews for qualified A-share issuers – significantly boosting overall efficiency.

Concurrently, the AH premium has been narrowing steadily, enabling A-share firms to secure more reasonable and attractive valuations in Hong Kong. For mainland companies eyeing global expansion, a Hong Kong listing not only strengthens overseas fundraising capabilities but also accelerates internationalization strategies and overseas business development. Against the backdrop of intensifying homecoming trends among US-listed Chinese stocks, these factors collectively power the current wave of A-share listings in Hong Kong.

uSMART Launches "HK IPO Fee Waiver Offer" – Enjoy Zero-Cost IPO Subscriptions

- 0% interest* on margin subscriptions, with up to 10x leverage

- 0 handling fee for cash subscriptions

- Grey market trading supported

*Interest-free margin applies to subscription amounts of HKD 10 million or below.

^Handling fee waived for cash subscriptions.

This promotional offer is effective from May 20, 2025, until further notice. Some popular IPOs may not be eligible for the offer. Actual interest rates and handling fees are subject to the details shown in the uSMART App at the time of subscription. Government and exchange-related fees will still be charged as usual. The company reserves the right to amend, suspend, or terminate the above offer, terms, and conditions at any time without prior notice to customers. All interpretations shall be subject to the company's final discretion.

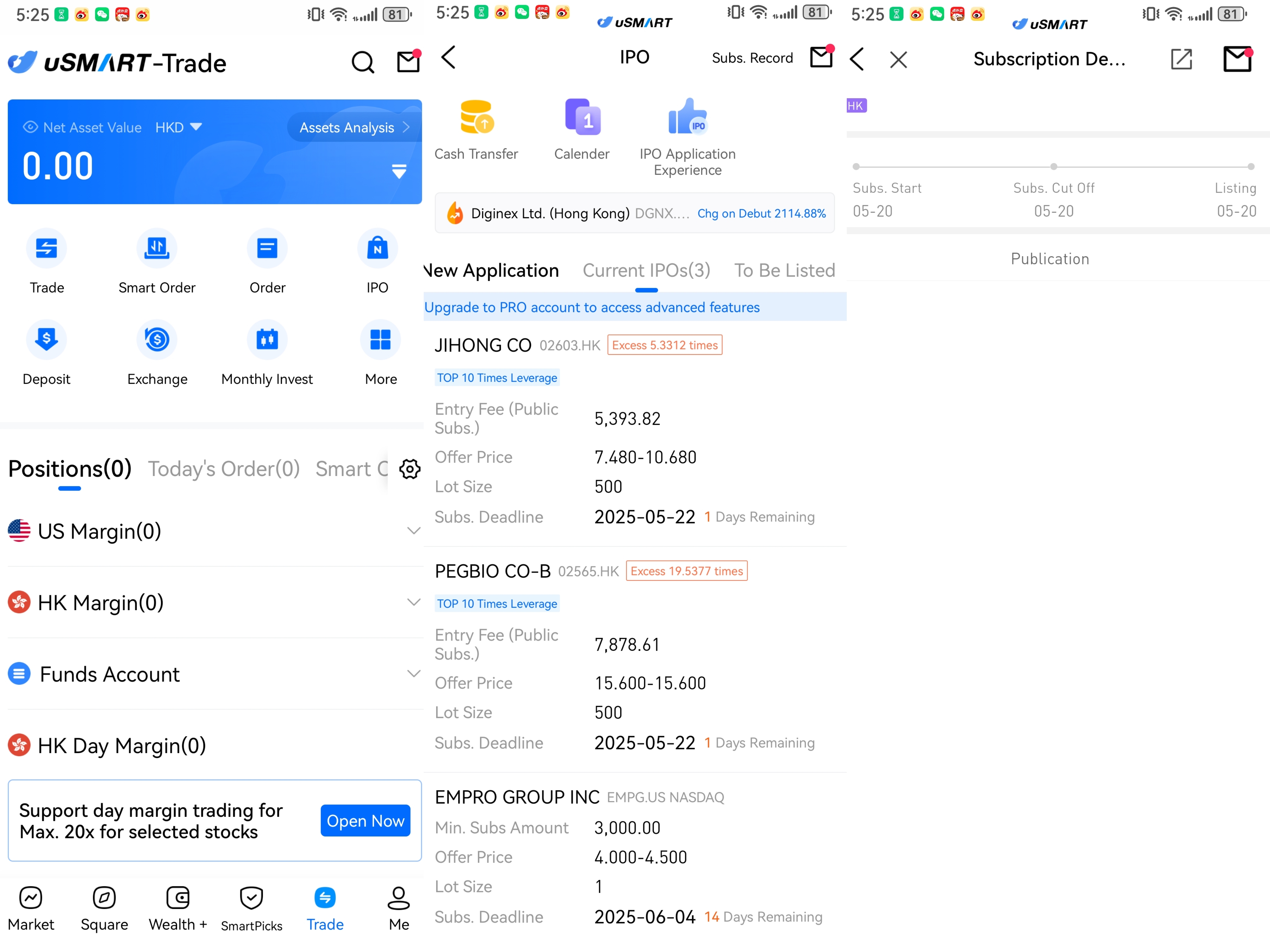

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)