PEGBIO CO. is launching its IPO from May 19 to May 22, 2025, offering 19.28 million shares at an issue price of HK$15.60 per share. Each lot will consist of 500 shares, and the shares are expected to start trading on the Hong Kong Stock Exchange on May 27, 2025.

PEGBIO CO: The biotech company, focused on innovative therapies for chronic diseases

Offer Allocation: plans to allocate 90% of the offering to international investors and 10% to public investors, with no over-allotment option.

Offer Price:The issue price is HK$15.60 per share, with a lot size of 500 shares, and the entry fee is approximately HK$7,878.66.

Offering Period: May 19–May 22, 2025

Listing Date: May 27, 2025

IPO Sponsors: Min Yin Capital and Agricultural Bank of China International.

(Image source: PEGBIO CO. IPO Prospectus)

Company Profile

PEGBIO CO. (Suzhou) Limited, established in 2008, focuses on the independent research and development of innovative therapies for chronic diseases, with a strong emphasis on metabolic disorders. The company's core product, PB-119, is one of the earliest long-acting GLP-1 receptor agonists developed in China, primarily used for first-line treatment of type 2 diabetes and obesity. In September 2023, the new drug application for PB-119 was accepted by the National Medical Products Administration (NMPA), with commercialization expected in China by 2025. As of 2024, PEGBIO has completed 9 rounds of financing, raising a total of approximately USD 50.3 million and RMB 1.05 billion, with a post-investment valuation of RMB 4 billion.

Financial Information

PEGBIO currently has no approved products available for commercial sale and did not generate any revenue from product sales over the past year. In 2024, the company's net loss widened to approximately RMB 283 million, an increase of about 1.5% compared to 2023, reflecting its continued focus on intensive R&D investments. Facing persistent losses and funding pressures, PEGBIO plans to raise capital through its IPO to support the development of its core projects. According to the prospectus, approximately 50.2% of the net proceeds will be used to advance the commercialization and indication expansion of the core product PB-119, approximately 34.5% will be used for the further development of another major candidate, PB-718, around 5.3% will be allocated for R&D of other pipeline projects, about 1% will be invested in business expansion and international market development, and the remaining 9% will be used for working capital and general corporate purposes.

uSMART Launches "HK IPO Fee Waiver Offer" – Enjoy Zero-Cost IPO Subscriptions

- 0% interest* on margin subscriptions, with up to 10x leverage

- 0 handling fee for cash subscriptions

- Grey market trading supported

*Interest-free margin applies to subscription amounts of HKD 10 million or below.

^Handling fee waived for cash subscriptions.

This promotional offer is effective from May 20, 2025, until further notice. Some popular IPOs may not be eligible for the offer. Actual interest rates and handling fees are subject to the details shown in the uSMART App at the time of subscription. Government and exchange-related fees will still be charged as usual. The company reserves the right to amend, suspend, or terminate the above offer, terms, and conditions at any time without prior notice to customers. All interpretations shall be subject to the company's final discretion.

How to subscribe to Hong Kong IPOs via uSMART HK

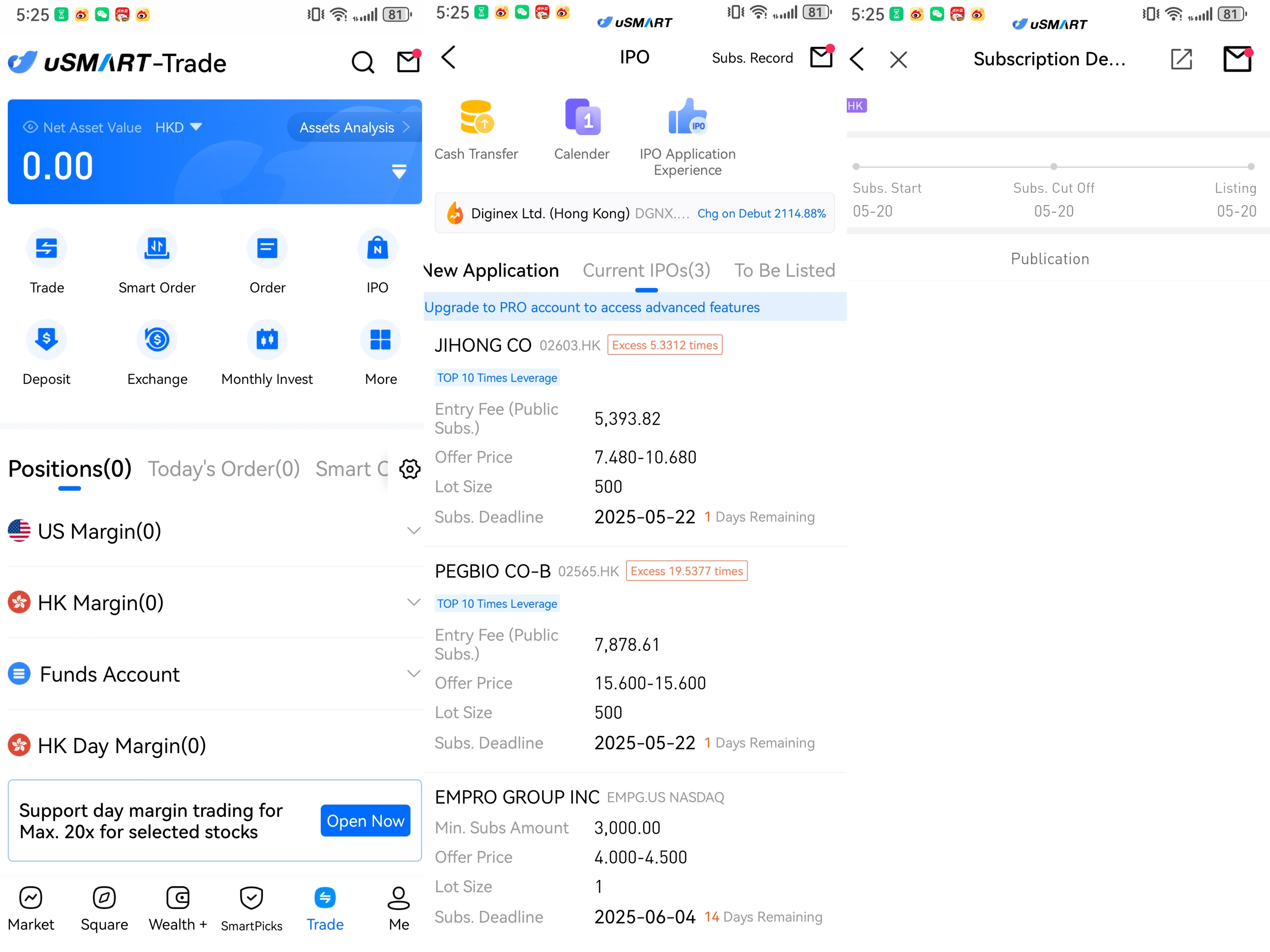

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)