In 2025, the Hong Kong stock market continues to show strong "popularity" and "profitability." Following a series of blockbuster stocks such as Midea Group, Ying'en Biotech-B, Blueco, Chifeng Gold, and Gu Ming, a new round of IPO enthusiasm is emerging. Against the backdrop of policies supporting companies going global, many domestic companies, including Bawang Tea, are speeding up their financing through the Hong Kong and U.S. stock markets to advance their internationalization strategies.

Heavyweight IPOs Expected in the Second Quarter

According to the latest data, more than 40 A-share companies have initiated plans for H-share listings, with several industry-leading firms expected to debut on the Hong Kong stock market in the second quarter:

- CATL (Contemporary Amperex Technology Co., Limited): A global leader in power batteries, with an H-share financing scale expected to reach $5 billion, potentially becoming the largest IPO in Hong Kong since Kuaishou's listing in 2021.

- Junda Co., Ltd.: A global giant in the photovoltaic cell market, holding a 17.9% market share, with a market capitalization of over 9 billion yuan on the A-shares market.

- Boreton Technology: A leader in the Chinese new energy wide-body dump truck market, with a market share of 18.3%.

- Mingji Hospital: The largest private and profit-driven comprehensive hospital group in East China.

- Green Tea Group: A well-known Chinese leisure dining chain.

- Quantopian Technology: A leading domestic provider of AI-driven digital solutions.

A Strong Lineup of Companies with Submitted Applications

According to reports, 17 A-share companies have officially submitted listing applications to the Hong Kong Stock Exchange, including:

- Haitian Flavouring & Food Co., Ltd. (food and beverage sector)

- Muyuan Foods (leading pig farming company)

- Lens Technology (core supplier of consumer electronics)

- Seres (new energy vehicle company)

- Dongpeng Beverage (leading functional beverage company)

- Hengrui Medicine (innovative pharmaceutical leader)

- Sanhua Intelligent Control (automotive parts supplier)

Three Main Drivers Behind the Rush to List in Hong Kong

First, there is generally a high premium for H-shares in the A-share market, and listing in Hong Kong helps companies achieve a more reasonable valuation while providing shareholders with new exit channels. Second, A+H-listed companies can directly enter the Hong Kong Stock Connect after completing the stabilizing period (usually 30 days), whereas non-A+H companies need to become part of the Hang Seng Composite Index before they can access this channel. This system advantage significantly enhances the appeal of listing in Hong Kong. Furthermore, the Hong Kong Securities and Futures Commission and the Stock Exchange of Hong Kong recently announced they would optimize the listing application review process, especially providing fast-track approval channels for qualified A-share companies, further shortening the listing timeline. As the internationalization process of Chinese companies accelerates, the Hong Kong stock market, with its high degree of internationalization and efficient financing, is becoming the preferred platform for mainland companies to go global.

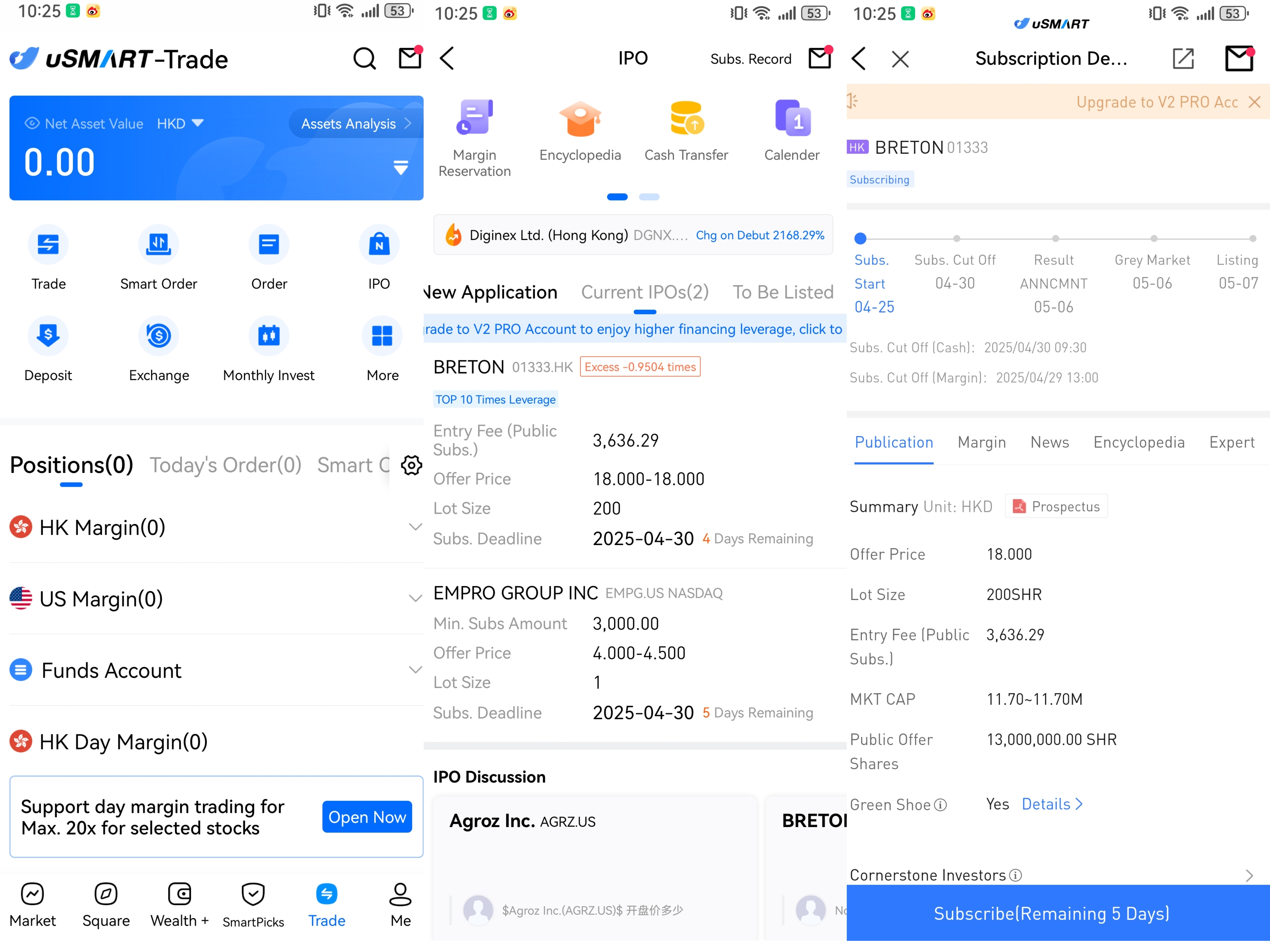

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)