BRETON (01333.HK) will launch its public offering from April 25 to April 30, 2025, intending to globally offer 13 million H-shares. The offer price is HKD 18 per share, with each board lot consisting of 200 shares. The shares are expected to begin trading on the Hong Kong Stock Exchange on May 7, 2025.

BRETON: A Rapidly Growing Electric Loader and Dump Truck Manufacturer

Offering Ratio: A total of 13 million H-shares will be globally offered, with 1.3 million shares offered in Hong Kong and 11.7 million shares offered internationally, plus an over-allotment option of 15%.

Offer Price: The offering price is HKD 18 per share, with each board lot consisting of 200 shares, resulting in an entry fee of HKD 3,636.31.

Offering Period: April 25 to April 30, 2025

Listing Date: May 7, 2025

IPO Sponsors: CICC and CMB International

(Image source: Boretton Prospectus)

Company Overview

Founded in 2019, BRETON focuses on providing innovative electric loader and electric dump truck solutions for the new energy construction machinery sector. The company is dedicated to designing, developing, and commercializing a range of electric construction machinery products, achieving significant market share. Boretton has established a variety of self-developed electric loaders and electric dump trucks, ranking third and fourth in the Chinese market for electric loaders and dump trucks, respectively. It holds the number one position in the global electric dump truck market, particularly leading in the shipment of electric dump trucks with a battery capacity exceeding 650 kWh.

Financial Information

BRETON has seen steady revenue growth in recent years, reflecting the company's continued development in the electric construction machinery sector. In 2023, the company achieved a revenue of approximately RMB 464 million, marking a 29% year-on-year increase compared to RMB 360 million in 2022. In the first half of 2024 (as of June 30), the company reported revenue of RMB 267 million. The company’s ongoing investments in technological research and development and market expansion have driven revenue growth, although these investments have also resulted in short-term financial losses. However, with increasing market share and further technological maturation, the company is well-positioned for strong future profitability.

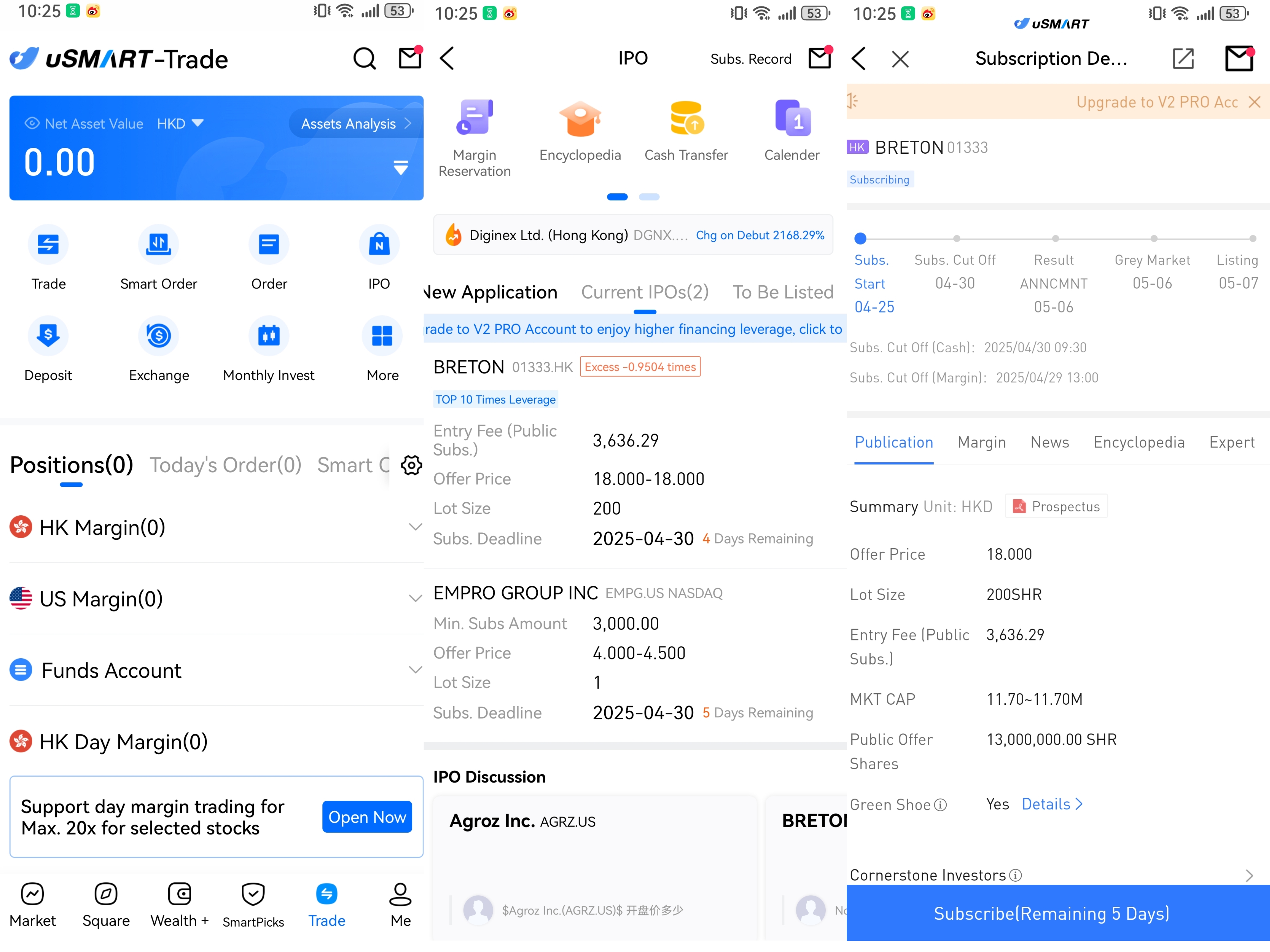

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)