The Taiwanese tea brand CHAGEE is set to go public in the U.S., potentially becoming the largest IPO in the tea beverage industry, sparking widespread attention. As an emerging Chinese tea brand, CHAGEE's U.S. listing has captured the attention of global investors, with many eager to seize this investment opportunity. So, how can you participate in an IPO in the U.S. stock market and grab this wealth opportunity? Let’s take a look at the specific process for participating in U.S. IPOs.

1.U.S. Stock Market Listing Process

New Stock Allocation and Lottery Results Announcement

The U.S. stock market opens at 9:30 AM EST. Between 9:00 AM and 11:00 AM, brokers will conduct the new stock allocation and announce the lottery results.

If you win the lottery, your funds will be used for stock settlement, and after the auction ends, retail investors can buy and sell the newly listed stocks.

If you don’t win, the frozen funds will be released immediately, and the funds can be used for T+0 trading.

Trading After U.S. IPO Listings

1.Auction Phase

The timing for this phase is not fixed, but it usually ends between 11:00 PM and 12:00 AM Beijing time. During this phase, investors can submit buy and sell orders, but these orders will not be immediately executed. The system matches the orders and determines the opening price.

2.Continuous Trading Phase

This phase typically ends between 12:00 AM and 4:00 AM Beijing time. After the auction phase concludes, the stock enters continuous trading, allowing investors to freely buy and sell the newly listed shares.

2. IPO Subscription Process

Before a company officially lists in the U.S., investors can subscribe to IPO shares in advance. If you win the lottery, you will purchase a certain number of shares at the offering price of the IPO.

1.Preparation Before Subscription

To participate in an IPO subscription, you need to contact your broker after the company submits its F-1 or S-1 filing. Typically, brokers such as Goldman Sachs, Merrill Lynch, and UBS will reach out to you if you are their client. If you are a client of these major underwriters, you can simply submit your subscription request to participate in the IPO.

2.Announcement of Lottery Results

The lottery results are usually announced on the listing day. Be sure to watch for system notifications and emails. Since the allocation time for U.S. IPOs is tight, there may be cases where the allocation is not completed before the official trading begins, causing the lottery results to be delayed. This is a normal occurrence. If you win, you can check the newly allocated IPO shares in your stock account's holdings page.

3.Free Trading

After the IPO opens at 9:30 AM EST, it enters the live auction phase, during which online trading is not possible. After the auction phase ends, the stock will begin regular trading, and the start time could be at any point during the market hours. Therefore, investors need to stay updated with relevant information.

3. U.S. IPO Lottery Allocation Rules

The U.S. IPO system follows a fair distribution policy and a weighted principle. This means that while efforts are made to accommodate retail investors, customers who subscribe to larger quantities of shares are more likely to receive an allocation. Typically, the lottery win rate for U.S. IPOs is around 60%-70%, but it may fluctuate depending on the demand and popularity of the IPO.

How to subscribe to U.S. IPOs via uSMART HK

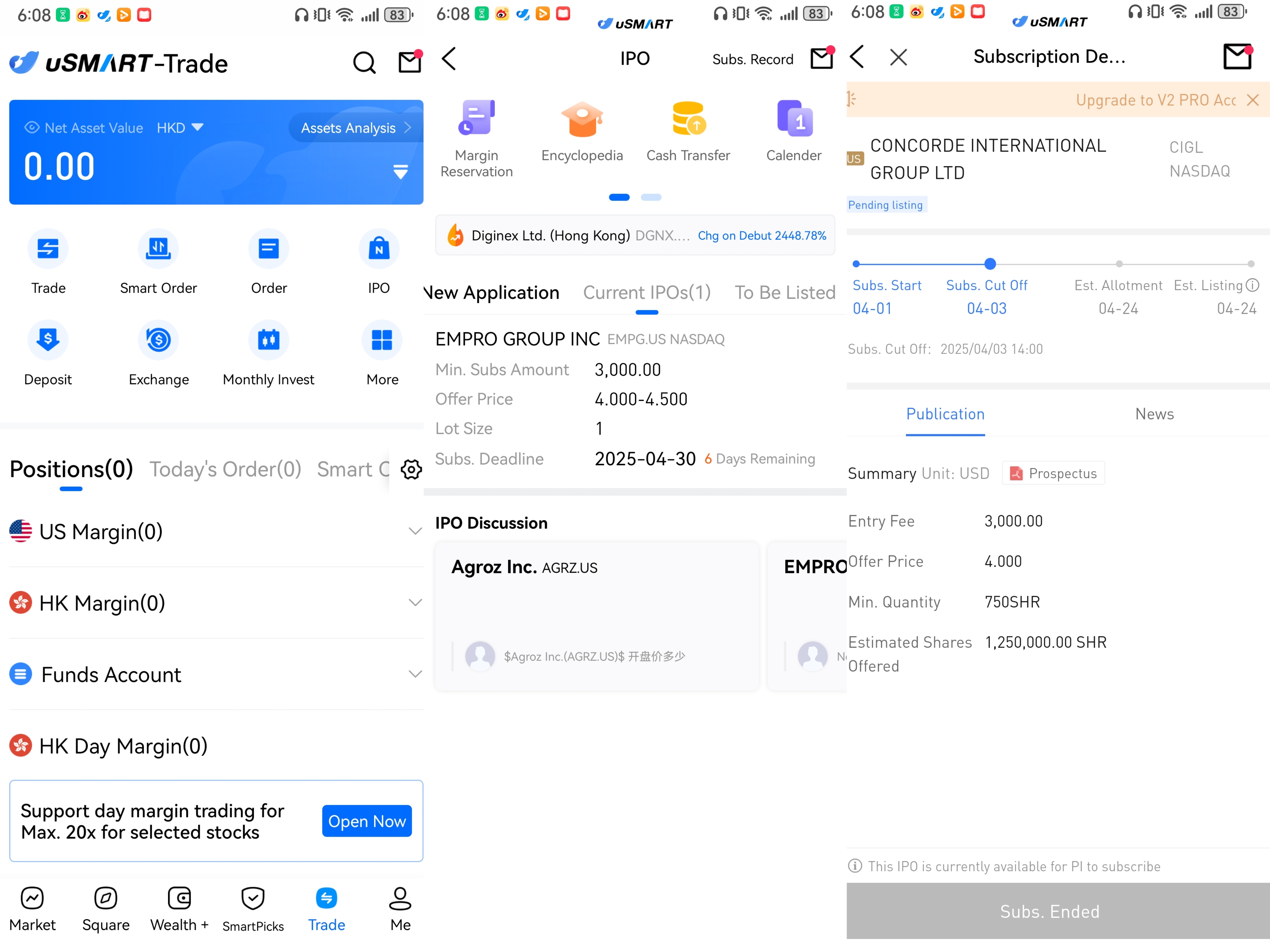

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image source: uSMART HK)