Recently, U.S. President Donald Trump announced a new round of tariffs on Chinese goods, triggering turbulence across global markets. This policy announcement and its implementation have had broad implications for the stock market, particularly for tech stocks and companies with close business ties to China.

As one of the world’s leading tech companies, Tencent was not immune to the volatility caused by the tariff policy. Beginning on April 2, the U.S. government officially introduced and implemented a “reciprocal tariff” policy targeting foreign trade partners. Upon the policy's announcement, global markets reacted sharply. On April 9, the tariffs officially took effect, with rates as high as 25% to 125%. With the confirmation of the news, concerns over the impact of Trump’s tariff measures deepened, leading to a broad market sell-off. Chinese concept stocks and tech companies bore the brunt of the decline, with Tencent’s share price in the Hong Kong market experiencing a significant drop that day.

However, on April 10, the situation took a sharp turn. The U.S. government announced a temporary suspension of tariffs on certain countries to allow room for further negotiations. This “signal of relief” quickly restored investor confidence, sparking a short-term rebound in the market. Many tech stocks, including Tencent, surged strongly that day. Despite the short-term bounce driven by positive sentiment, the market remains cautious about the future direction of Trump’s trade policies. Fears of an escalating China-U.S. trade conflict continue to weigh on the broader tech sector.

Seize Opportunities in Volatility — Build Your Tech Giants Portfolio at Zero Cost

Against the backdrop of the U.S. tariff hike on Chinese goods, uncertainty has become a key factor affecting Tencent’s global operations and share price performance. However, for investors who can respond quickly to market fluctuations, flexible portfolio strategies offer a way to manage risks and enhance returns.

Recently, uSMART launched a promotion for Hong Kong stock trading, offering zero commission and zero platform fee for purchasing the three most representative Chinese tech stocks—Alibaba, Tencent, and Meituan ("ATM").

This promotion not only lowers the investment threshold but also provides investors with a more efficient and convenient investment solution, helping them easily invest in the world’s most innovative tech companies.

For more details on the promotion, please refer to our information document

*Terms and conditions apply

How to Buy "ATM" on uSMART

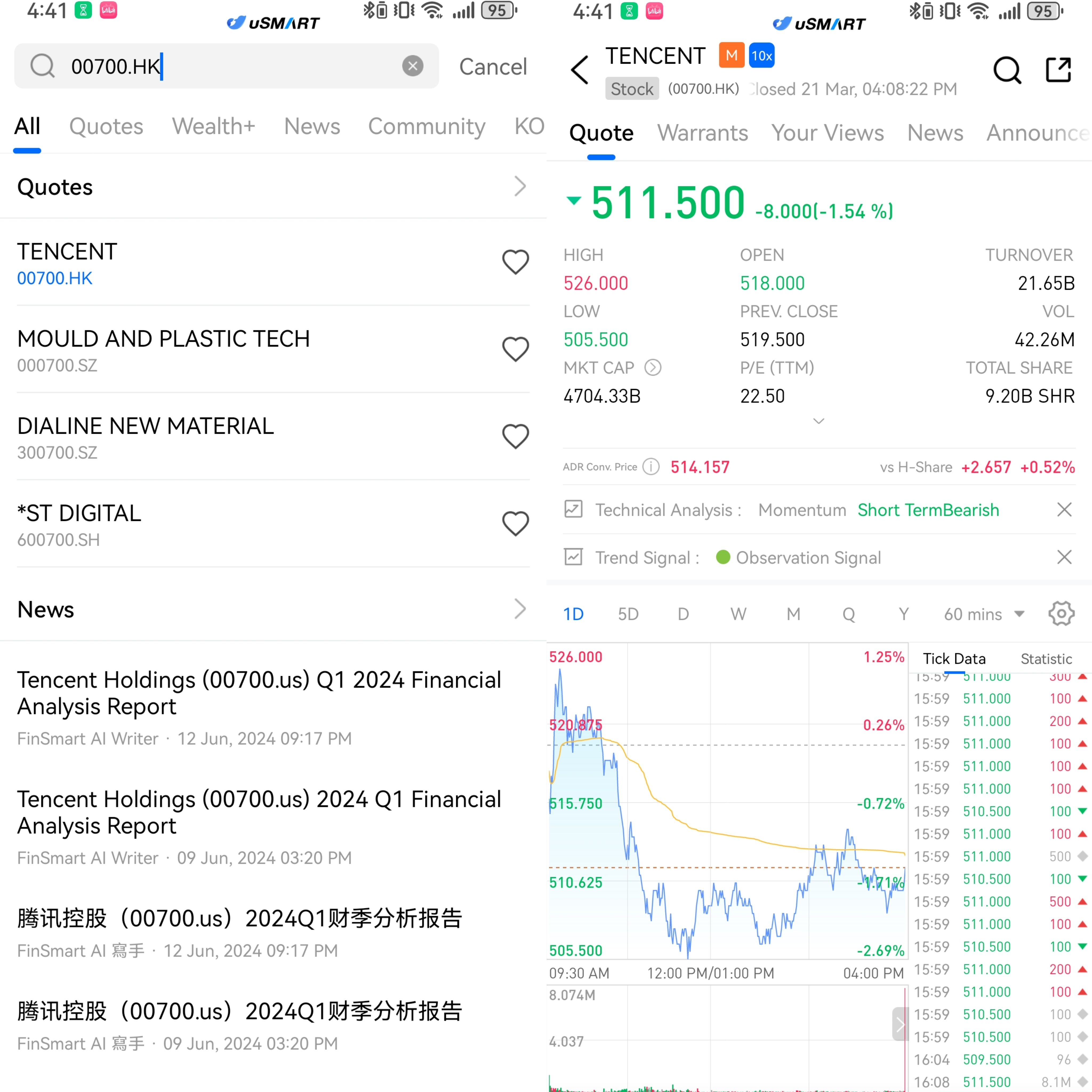

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)