Oil prices soared today due to geopolitical instability and regional supply disruptions. Data showed that WTI October crude oil futures closed up 3.5% at $77.42/barrel; Brent October crude oil futures closed up 3.1% at $81.43/barrel.

The combination of the two pieces of news has heightened market concerns about supply disruptions.

Libya halts oil production

It is reported that the eastern Libyan government announced on August 26 that all oil fields, terminals and oil facilities faced "force majeure" and stopped all oil production and exports. The dispute stems from the struggle between the eastern Libyan government and the Tripoli government for control of the Libyan central bank, because it is related to the management of billions of dollars in revenue from the energy pillar industry.

The country with the largest oil reserves in Africa

According to Xinhua News Agency, Libya is the country with the largest oil reserves in Africa. Libya’s political situation has continued to be turbulent since 2011, which has had a great impact on the oil industry, which is the backbone of the country’s economy. Data released by the Libyan National Oil Company in 2023 show that Libya's daily oil production averaged 1.24 million barrels per day. In November 2023, Libyan Minister of Gas and Oil Mohamed Aoun announced that Libya seeks to increase oil production to 2.1 million barrels per day and natural gas production to approximately 4 million cubic feet per day in the next five years.

It is reported that Sharara, Libya’s largest oil field, has stopped production. According to data compiled by the media, Libya's oil production in July was 1.15 million barrels per day, while Sharara's average daily production was 270,000 barrels, accounting for 23% of the country's total oil production. The suspension of Sharara extraction will significantly reduce Libya's oil production.

Citi said rising risks of light, sweet crude supply disruptions could boost Brent crude prices as Libyan oil exports are cut and Libya's divided elites fight over the central bank's independence and control of oil revenues. It rose to around the mid-range of US$80 to US$89 per barrel.

Conflict escalates in the Middle East

On the morning of Sunday (August 25), a large-scale exchange of fire broke out between Israel and Lebanese Hezbollah, causing tensions in the Middle East to escalate sharply.

Israel said that after determining that Hezbollah was preparing to launch missiles and rocket attacks into Israeli territory, the Israeli military carried out preemptive air strikes against the armed group, thwarting a larger attack. More than 100 Israeli fighter jets attacked more than 40 Hezbollah launch sites in Lebanon.

"This morning, we discovered that Hezbollah was preparing to attack Israel. After reaching a consensus with the (Israeli) Defense Minister and the Israel Defense Forces Chief of Staff, we instructed the Israel Defense Forces to take action to eliminate the threat." Israeli Prime Minister Benjamin Netanyahu said.

The Israeli military said airstrikes destroyed thousands of Hezbollah rocket launchers. Most of the launchers were aimed at northern Israel, with some targeting central Israel.

In response to Israeli claims that Hezbollah's attack was thwarted by a pre-emptive strike by the Israeli army, Hezbollah refuted and said that the armed group had successfully launched the drone as planned.

Hezbollah said it fired 320 rockets and a series of drone strikes against Israel, hitting 11 military targets. This is the "first phase" of retaliation for Israel's assassination of senior Hezbollah military commander Fuad Shukr last month. Other Hezbollah responses to Shukur's killing will take "some time," suggesting the conflict may continue to escalate. The Israel Defense Forces said about 200 rockets were fired from Lebanon into Israel. Distant explosions lit up the horizon as Israeli air raid sirens blared. Meanwhile, thick smoke billowed over houses in Khiam, southern Lebanon.

Although this fierce exchange of fire has not yet led to a full-scale war, it has exacerbated the already tense situation in the Middle East. Egypt will hold high-level talks on Sunday aimed at brokering a ceasefire in the 10-month-old Gaza war between Israel and Hamas, which diplomats hope will ease regional tensions.

According to news on the 6th, Bagheri, Chief of Staff of the Iranian Armed Forces, stated that Iran will not forget the assassination of former Hamas leader Haniyeh, and Iran and other resistance forces will certainly respond to this. He said that Iran has not fallen into the enemy's games and provocation traps. Iran will decide on its own to respond, and other resistance forces will also act independently.

Citi said refinery maintenance and additional supply from OPEC+ could curb overshooting in crude prices, but the hit to sweet and light crude oil price differentials was likely to last longer. The next big move in oil prices will depend in part on what Israel and Hezbollah do next, analysts added.

Expectations of U.S. interest rate cuts boost market sentiment

At the Jackson Hole annual meeting held last Friday, Federal Reserve Chairman Powell issued a clear dovish signal: the inflation rate is only half a percentage point higher than the Fed’s 2% target, and the unemployment rate is also rising. The time has come." The remarks solidified expectations that the Federal Reserve would cut interest rates for the first time at its September 17-18 meeting, which also spurred a rebound in oil prices. Lower interest rates typically make U.S. dollar-denominated commodities more attractive and stimulate economic activity, supporting higher oil prices. The possibility of easing monetary policy has boosted sentiment across the oil market, driving the recent rise in oil prices.

Will geopolitical conflict detonate the oil market?

"21st Century Economic Report" pointed out that although the impact of geopolitics on global oil supply is usually short-lived, it sometimes lasts for several years, and even triggers cyclical changes in the oil market in advance, from a relatively loose to a relatively tight situation. If a local war breaks out between Israel and Iran, coupled with the intervention of the United States, it may accelerate the tension in global oil supply and demand, causing international crude oil prices to remain high for a long time.

Li Jie, a senior researcher in the energy and chemical industry of CCB Futures, said that if the geopolitical situation has no substantial impact on crude oil supply, its impact on oil prices is usually short-term.

Overall, oil prices have been fluctuating within a narrow range of around $80, as the long and short forces are basically balanced. Zhu Runmin, a senior economist in the oil industry, believes that the international crude oil price of US$80 per barrel is a reasonable level acceptable to both supply and demand and has a certain degree of sustainability. If oil prices break through this range in the future, it is unlikely to deviate significantly downward, and even if it declines significantly in the short term, it will be difficult to sustain. An upward breakthrough will take time to digest the existing excess production capacity, and geopolitical conflicts may further boost price increases.

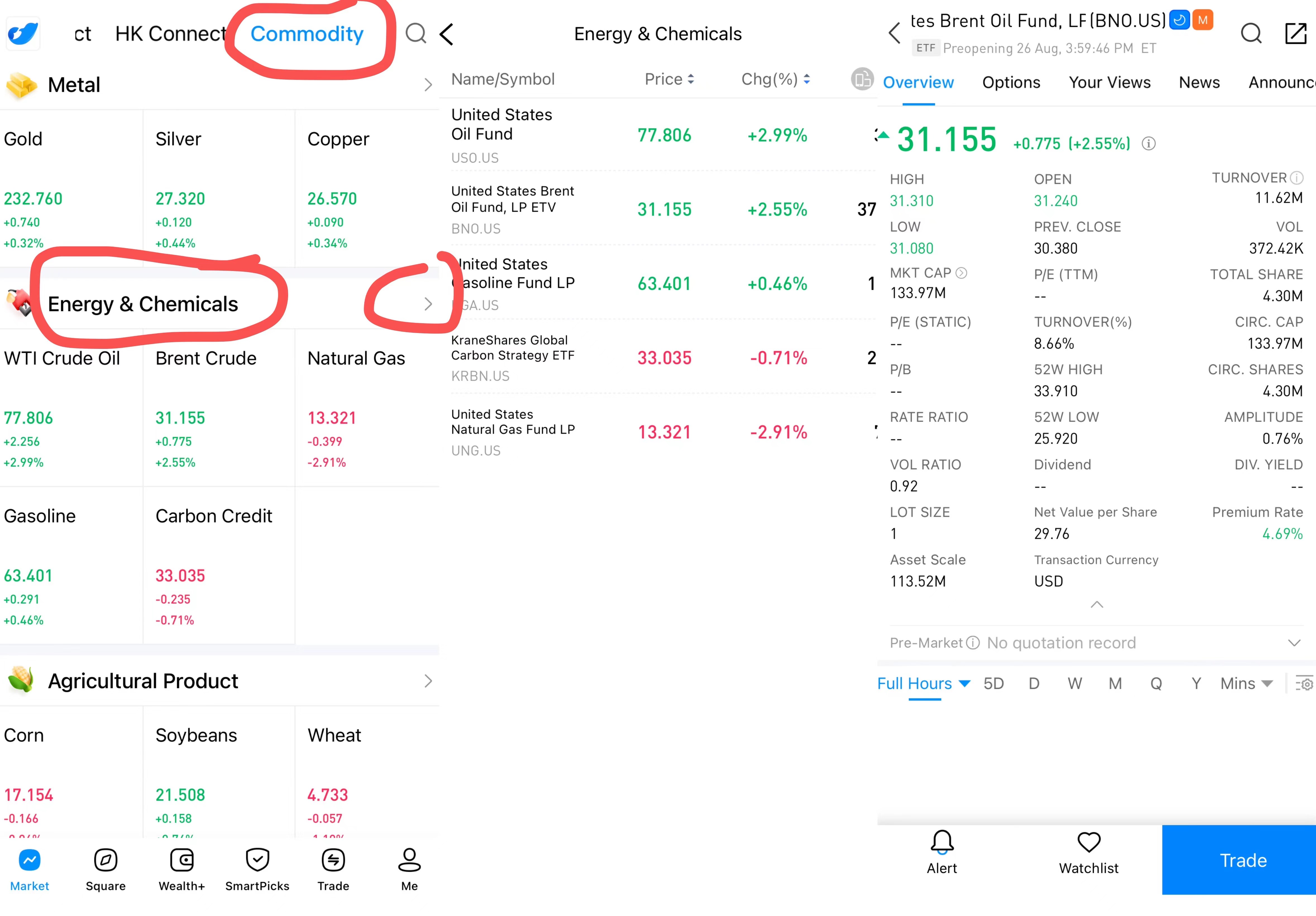

How to invest in crude oil ETFs on uSMART?

After logging in to the uSMART HK APP, click on "Commodity" from the top right of the page, click on the small corner icon to the right of "Energy & Chemicals" on the page, select the crude oil ETF you want to invest in, click in and fill in the transaction conditions before sending the order; Picture operation guidelines are as follows:

This picture is for illustrative purposes only