On July 2, the closing price of Tesla (TSLA.US) surged by more than 10.20% in the US stock market! This increase directly created a market value of over $60 billion!

The driving force behind Tesla's soaring stock price was the second-quarter delivery data it announced on July 2.

The data showed that Tesla delivered a total of 443,956 vehicles in the second quarter, with a year-on-year decline of 4.8%. The delivery volume has declined year-on-year for two consecutive quarters. Despite this, Tesla's second-quarter delivery volume of 443,956 units exceeded the generally expected delivery volume of 436,000 units. It is reported that this is the first time in the past four quarters that Tesla's delivery volume has exceeded market expectations, and the margin of exceedance is the largest since the fourth quarter of 2021.

According to FactSet data, this delivery performance is not only the first time in the past four quarters to exceed market expectations, but also the most significant deviation from market expectations since the fourth quarter of 2021. This strong data performance undoubtedly lays a solid foundation for Tesla's market performance in the second half of the year. The better-than-expected delivery volume also keeps Tesla at the top of the global electric vehicle sales rankings and enables it to overtake BYD, which once surpassed its sales volume.

For Tesla's future, Wall Street analysts have different opinions. Some analysts pointed out that although Tesla's second-quarter delivery volume exceeded expectations, its fundamentals are still worrying.

CFRA Research Vice President and Senior Equity Analyst Garrett Nelson said that the above-expectation delivery volume "greatly alleviated concerns about weak demand for electric vehicles. After the annual meeting in mid-June, where shareholders reapproved Musk's 2018 compensation plan, Tesla's stock continued to ride the positive momentum."

However, Wells Fargo analyst Colin Langan released a report on Monday saying that the company believes that "declining demand and reduced returns from price cuts lead to slower delivery growth." He advised selling Tesla stock and expects Tesla's automotive gross margin to decline because "the likelihood of price cuts and sales declines this year is higher."

unique cyclical pattern in Tesla's stock price

There is a unique cyclical pattern in Tesla's stock price before and after its earnings reports. The stock price usually declines by about 10% in the two weeks before the report, but then often experiences a significant rebound in the following two weeks after the report. This volatility pattern seems to be unique to Tesla and not a general market trend.

The data shows that in the past 12 earnings cycles, Tesla's stock price has, on average, performed better by nearly 10 percentage points in the two weeks after the report compared to the two weeks before the report. Specifically, the average gain in the two weeks after the report is 6.7%, while the average loss in the two weeks before the report is -2.9%. This difference becomes even more significant when annualized, highlighting the positive shift in market sentiment after the earnings report. It is worth noting that the S&P 500 index did not show a similar difference during the same period, further proving that this phenomenon is a unique market characteristic of Tesla.

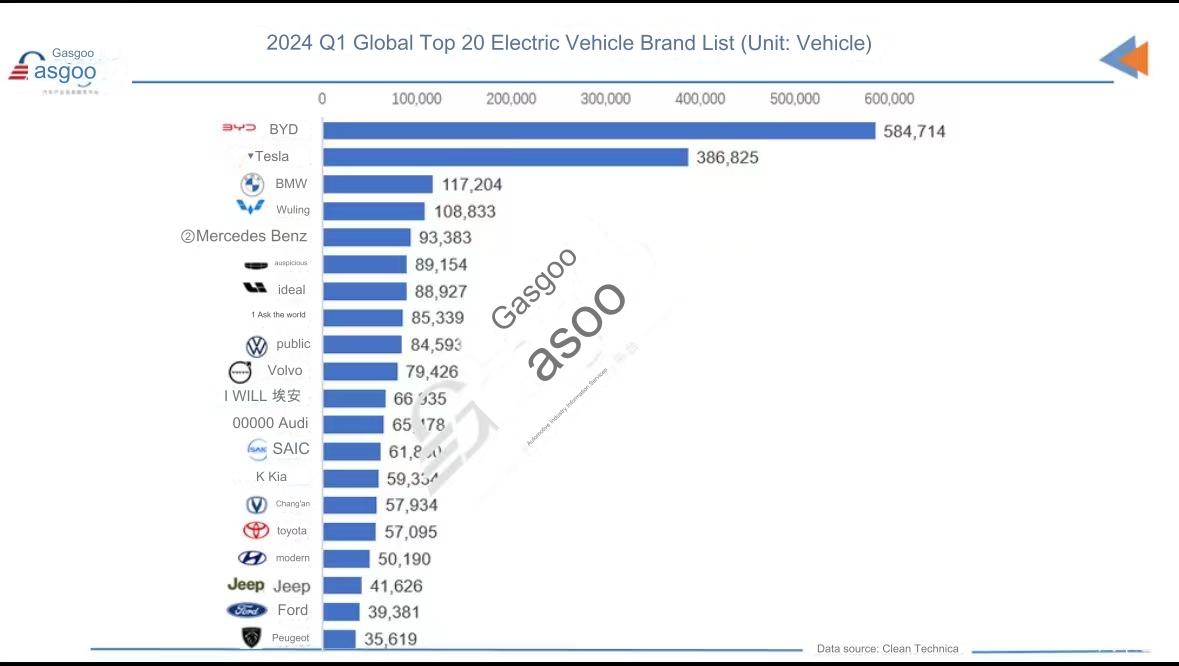

Global Electric Vehicle Sales Data

Counterpoint Releases Global Electric Vehicle Sales Data for the First Quarter of 2024, with Global EV Sales Growing by 18% Year-on-Year. Of which, sales of pure electric vehicles increased by 7%, while those of hybrid vehicles increased by 46%.

From specific models, Tesla and BYD took up all five spots in the top five sales rankings.

Tesla's sales were dismal in the first quarter of 2024, with both year-on-year and quarter-on-quarter sales experiencing a rare decline. Despite this, the Tesla Model Y still maintained its throne as the top-selling electric vehicle globally, with a lead of nearly 120,000 units over BYD Song. BYD Song, BYD Qin Plus, and BYD Seagull were the top three best-selling models for BYD, ranking second, third, and fifth globally respectively.

From a brand perspective, BYD maintained its position as the world's top-selling electric vehicle brand in the first quarter, thanks to the price reduction trend. However, Tesla's sales declined in the first quarter due to the fading delivery wave, production line upgrades at its California factory, a fire at its Berlin factory that led to a temporary shutdown, and supply chain issues caused by the Red Sea conflict. Despite this, Tesla's electric vehicle sales were still three times that of third-place BMW.

Mercedes-Benz benefited from the strong offensive of its EQA, EQB, and GLC PHEV models, with its March sales (38,069 units) setting a new record, which also helped it climb two positions to fifth place in the first quarter thanks to the surge in sales of the new M7.

AITO's sales surged more than 6.3 times year-on-year, but its upward momentum was stymied by its direct competitor, Ideal, whose sales also surged 66.7% year-on-year, pushing it up to seventh place.

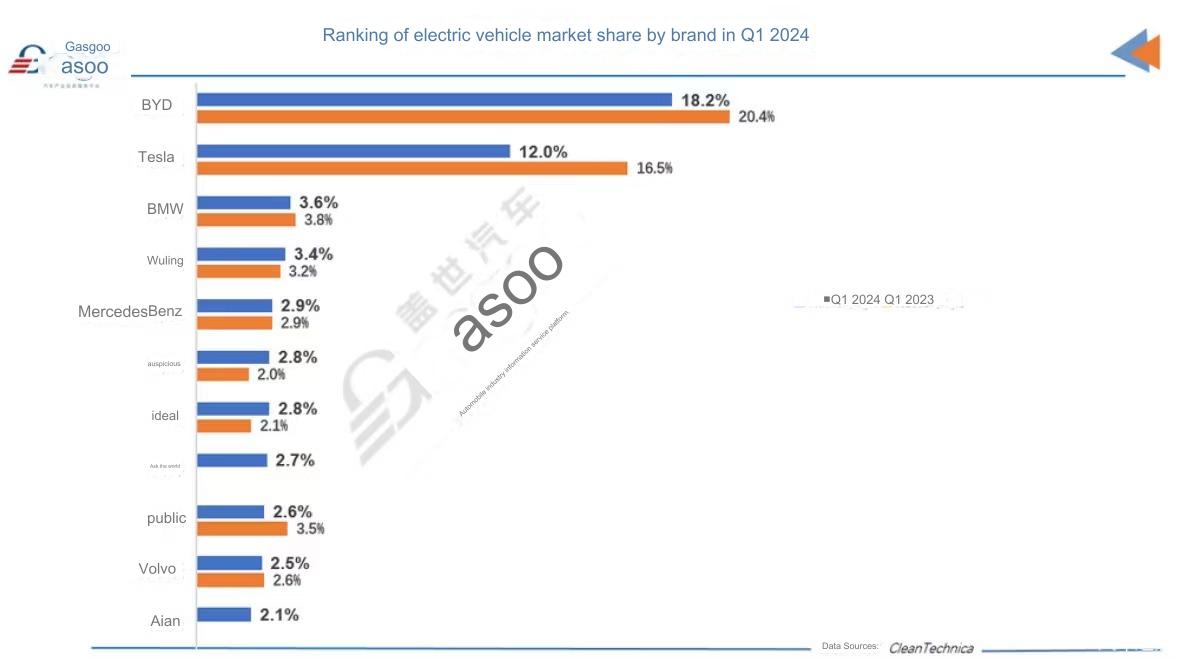

In terms of market share, both BYD and Tesla saw a decline in their market share in the first quarter of 2023 compared to the same period last year, with BYD's share dropping from 20.4% to 18.2% and Tesla's plummeting to 12%. The two giants combined accounted for 30.2%, lower than the 36.9% in the same period last year.

BMW, Wuling, and Mercedes maintained their positions in the top three to five in terms of market share, with little change in their market share compared to the same period last year. The top five groups combined market share dropped from 46.8% in the same period last year to 40.1%, reflecting the overall intensification of market competition.

AITO and EV Aion emerged as new players in the global electric vehicle market, capturing 2.7% and 2.1% of the market, respectively.

Geely and Ideal achieved market share growth of more than 0.8% and 0.7% year-on-year, while Volkswagen saw a decline of 0.9%.

How to invest in Tesla on uSMART?

After logging in to the uSMART HK APP, click on the option at the top right corner of the page to select "Search", enter "TSLA", and you will be directed to the details page to learn about the trading details and historical trends. Click on the bottom right corner "Trade" and select the "Buy/Sell" function. Finally, fill in the transaction conditions and submit the order. The pictured instructions are as follows: