According to data from Investing.com, there have been 17 new listings on the Hong Kong Stock Exchange since 2024, raising a total of HKD 8.055 billion.

During the week of May 12th to May 18th, two companies, Maifushi and Hongying City Services, were listed and both performed well. In particular, Maifushi opened with a 3.21% increase and experienced two surges before closing at HKD 51.65, marking an 18.46% increase on the first day.

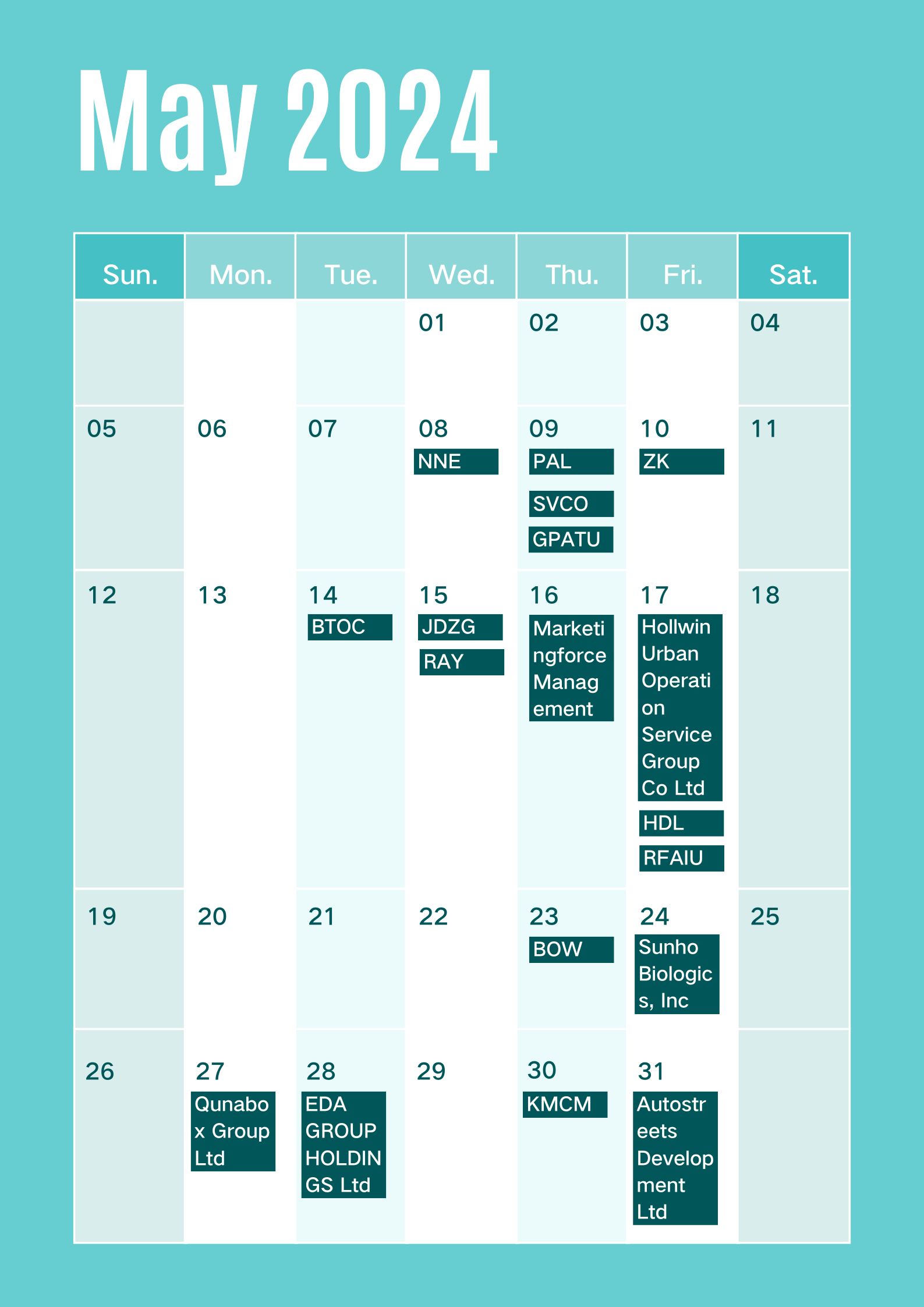

Hong Kong Stock Exchange May IPO Listing Schedule

(Source:Investing.com,2024.05.23)

(Source:Investing.com,2024.05.23)

Upcoming Listings:

1. Sunho Biologics, Inc (2898.HK)

Sunho Biologics, Inc (2898.HK) is scheduled to be listed on the Hong Kong Stock Exchange from May 16, 2024, to May 21, 2024, and is expected to debut on May 24, 2024. The global offering represents approximately 21.80% of the total shares outstanding, with an indicative market capitalization ranging from HK$2.115 billion. There is only one cornerstone investor participating in this offering, representing approximately 9.07% of the global offering, which is relatively low compared to recent IPOs. In terms of subscription funds, assuming no clawback, the total funds raised globally at the offer price of HK$13.50 per share is approximately HK$461 million, with the cornerstone investor contributing around HK$41.798 million and the remainder from international and public offerings.

2. Qunabox Group Ltd (0917.HK)

Qunabox Group Ltd (0917.HK) is set to be listed on the Hong Kong Stock Exchange from May 17, 2024, to May 22, 2024, with a listing date of May 27, 2024. The global offering represents approximately 7.50% of the total shares outstanding, with an indicative market capitalization ranging from HK$6.568 billion to HK$7.802 billion. Similar to the previous listing, there is only one cornerstone investor, accounting for approximately 14.51% of the global offering. The total funds raised globally at the offer price of HK$27.35 per share is approximately HK$539 million, with the cornerstone investor contributing around HK$78.182 million and the remainder from international and public offerings.

3. EDA Group Holdings Ltd (2505.HK)

EDA Group Holdings Ltd (2505.HK) is scheduled to be listed on the Hong Kong Stock Exchange from May 20, 2024, to May 23, 2024, with a listing date of May 28, 2024. The global offering consists of 97.625 million shares, including 9.763 million shares for the Hong Kong public offering. The price range is between HK$2.28 and HK$3.06 per share, with the upper limit indicating fundraising of approximately HK$298 million. The entrance fee for 1000 shares is HK$3090.85.

4. Autostreets Development Ltd (2443.HK)

Autostreets Development Ltd (2443.HK) is set to be listed on the Hong Kong Stock Exchange from May 23, 2024, to May 28, 2024, with a listing date of May 31, 2024. The company plans to offer 15 million shares globally, with 10% for public offering in Hong Kong and 90% for international offering. The offer price is expected to be no more than HK$11.20 per share, and not less than HK$10.20 per share, with trading units of 200 shares.