On April 24th, Huaxia, Harvest, and Bosera Asset Management announced separately that their offshore asset management subsidiaries have obtained approval to jointly issue six virtual asset ETFs, with plans to list them on the Hong Kong Stock Exchange by the end of April.

This significant announcement marks a historic step for Hong Kong in the virtual asset business. It not only provides Asian investors with new investment choices but also signifies Hong Kong's solid progress in building an international virtual asset financial center. Hong Kong's determination and significance in taking the lead in establishing a virtual currency financial center will undoubtedly have far-reaching impacts.

Six Bitcoin physical asset ETFs approved by the Hong Kong Securities and Futures Commission

On April 24th, China Asset Management (Hong Kong) announced that BUU163 and BUU164 have received formal approval from the Hong Kong Securities and Futures Commission (SFC). The plan is to start issuing them on April 29th, 2024 (next Monday) and list them for trading on the Hong Kong Stock Exchange on April 30th.

On the same day, Bosera International Fund Management Company Limited (referred to as "Bosera International") and HashKey Capital Limited (referred to as "HashKey Capital") jointly applied for two virtual asset physical ETFs, and Harvest Global Investments Limited (referred to as "Harvest Global") applied for BUT244 and BUU885, all of which have also received formal approval from the Hong Kong Securities and Futures Commission. It is expected that trading will officially commence at the end of April, and the fee rates for the three products have also been disclosed simultaneously.

|

The First Batch of Virtual Asset Physical ETFs Listed in Hong Kong |

|||

|

Fund companies |

ETF |

Code |

Management fee |

|

Harvest Global Investments Limited |

BUT244 |

03439 |

0.3%,Management fee waived within 6 months of holding |

|

BUU885 |

03179 |

||

|

Bosera Fund Management Co., Ltd |

BUU104 |

03008 |

0.6%,Management fee waived within 4 months of issuance |

|

BUU105 |

03009 |

||

|

China Asset Management (Hong Kong) ) |

BUU163 |

03042 |

0.99% |

|

BUU164 |

03046 |

||

This is the first time such products have been launched in the Asian market, aiming to provide investors with investment returns closely tied to the spot prices of Bitcoin and Ethereum (net of fees and expenses).

The significance of the first batch of virtual asset ETFs listed in Hong Kong

· Opening up new investment channels

The listing of virtual currencies provides Asian investors with new investment choices. Traditional financial markets often have limited direct access to the cryptocurrency space, but Hong Kong's listing of virtual currencies offers investors a more convenient, transparent, and compliant way to participate in this field.

· Promoting the development of a digital asset financial center

As a leading financial center in Asia, Hong Kong is committed to developing a digital asset financial center. By listing virtual currencies, Hong Kong demonstrates its determination to promote digital asset innovation and development. This helps attract more digital asset companies and investors, making Hong Kong a key trading and investment hub for global digital assets.

· Enhancing international competitiveness

With the rapid growth of the global digital asset market, countries are competing to become centers for digital assets. As an international financial center, Hong Kong's listing of virtual currencies helps enhance its international competitiveness in the digital currency field. This not only attracts more investments and talent but also promotes innovation and development in Hong Kong's fintech industry.

· Facilitating the development of the fintech ecosystem

The listing of virtual currencies promotes the development of the fintech ecosystem. By introducing more virtual currency trading and investment opportunities, Hong Kong provides a broader development space for fintech companies and startups. This helps create more employment opportunities, fosters technological innovation, and drives the overall prosperity of the fintech industry.

The unlimited investment potential of Bitcoin:

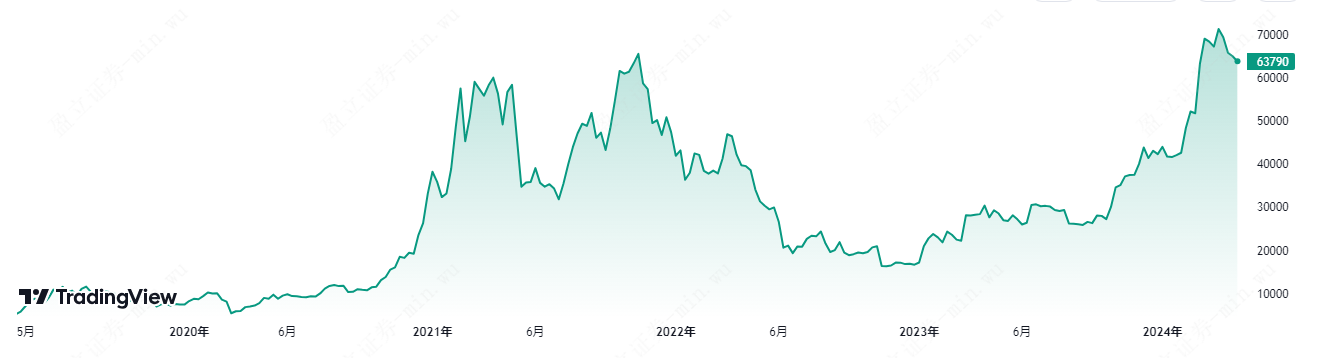

· Bitcoin's price has seen an annual increase of up to 200%

Looking at the price trend of Bitcoin over the past five years, its price has achieved a growth rate of up to 200% in the past year, reaching a peak of $73,794. The continuously growing asset size further highlights the importance of this investment asset and has attracted increasing attention.

(Source:tradingview.com,2024.04.25)

(Source:tradingview.com,2024.04.25)

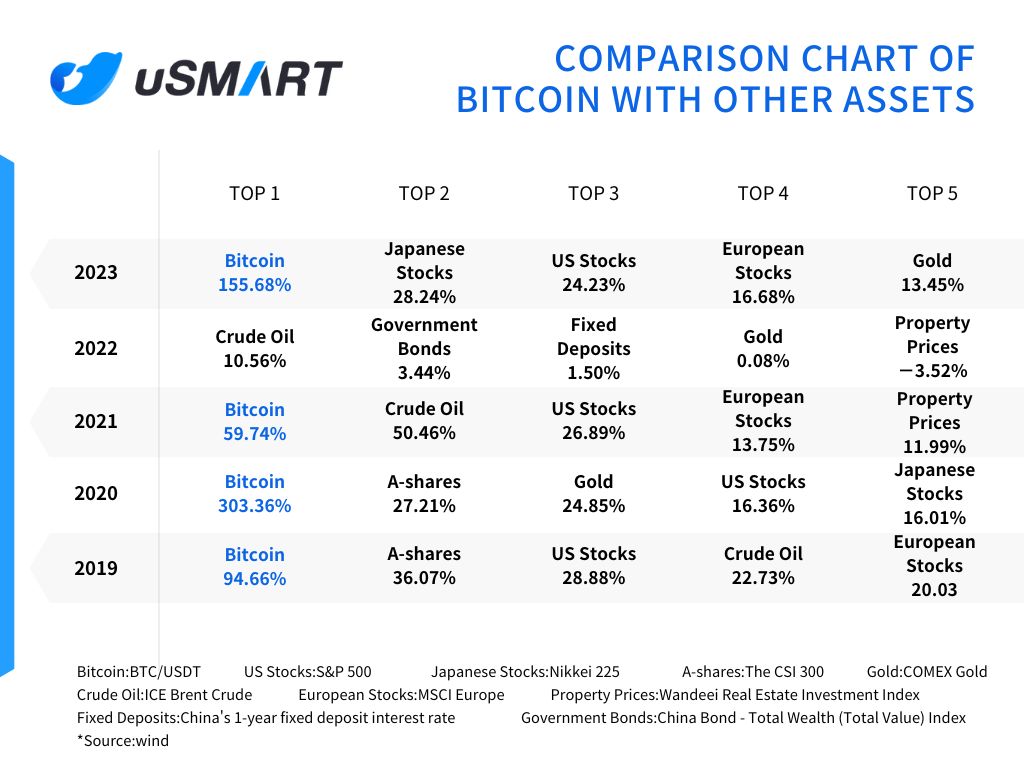

· Outperformed other major asset classes four times in five years.

· Surpassed silver to become the world's eighth-largest asset.

Bitcoin has continued its strong momentum since 2024, with a staggering 59.65% increase since the beginning of the year, outperforming all other global asset types.

On March 12th, the price of Bitcoin surpassed the $72,000 mark for the first time in history, and even after adjusting for inflation, the price remains at an unprecedented high level. Furthermore, the total market value of Bitcoin has surpassed that of silver, making it the eighth most valuable asset in the world. Additionally, the price of Ethereum has also surpassed $4,000 for the first time since December 2021.

The five advantages of investing in virtual assets

Investing in virtual asset spot ETFs removes many traditional barriers that hinder investors from using Bitcoin and other virtual assets as investment and trading tools, allowing investors to access the virtual asset market through familiar investment forms and methods on the Hong Kong Stock Exchange.

- Security: Regulated by the Hong Kong Securities and Futures Commission; assets are segregated from custodians and commercial insurance is purchased to protect the assets.

- Transparency: Prices, holdings, net asset value, and overall ETF secondary market data are open to the public.

- High liquidity: Supported by top market makers in Hong Kong, providing liquidity services on the Hong Kong Stock Exchange.

- Cost-effectiveness: Compared to directly purchasing virtual assets, the transaction costs of purchasing Bitcoin through Bitcoin spot ETFs may be relatively cheaper.

- Convenient investment: No need to open a virtual asset wallet, investors can trade through standard securities brokerage accounts.

uSMART is one of the first supporting trading brokers.

Virtual asset spot ETFs reduce many traditional barriers that hinder investors from using virtual assets as investment and trading tools.

uSMART offers a diverse range of investment products, opening the door for you to enter the virtual asset market. After the six Bitcoin spot ETFs go live on April 30th, you can directly search for their codes on the uSMART app for trading. Stay tuned for the latest information!