野村Q1持倉

根據美國證券交易委員會(SEC)披露,野村控股(NMR.US)公佈了截至2023年3月31日第一季度(Q1)的持倉報告(13F)。

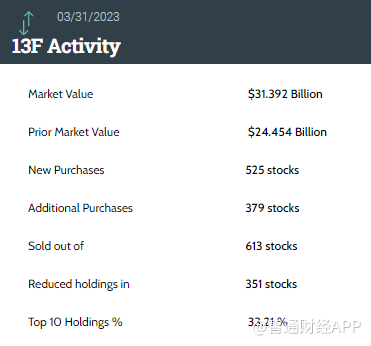

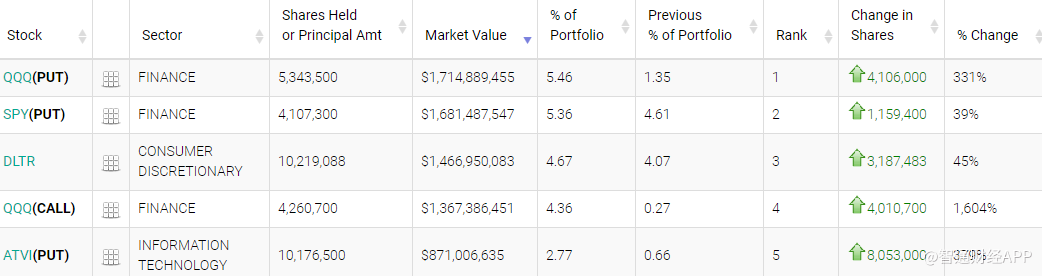

野村控股Q1持倉總市值爲313.92億美元,上一季度爲244.54億美元,環比增長28%。野村控股在Q1的投資組合中新增了525只標的,增持379只標的,減持351只標的,清倉613只標的;其中前十大持倉標的佔總市值的33.21%。

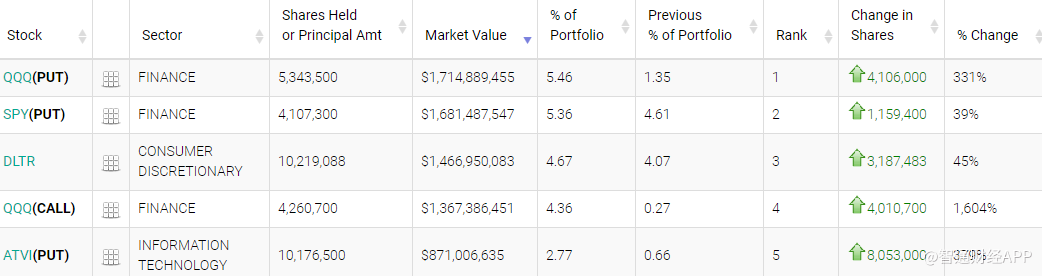

在前五大重倉股中,納指100ETF看跌期權(QQQ.US,PUT)位列第一,持倉534.35萬股,持倉市值約17.15億美元,佔投資組合比例爲5.46%,持倉數量較上季度增加331%。

標普500指數ETF看跌期權(SPY.US,PUT)位列第二,持倉410.73萬股,持倉市值約16.81億美元,佔投資組合比例爲5.36%,持倉數量較上季度增加39%。

折扣零售商美元樹公司(DLTR.US)位列第三,持倉約1021.91萬股,持倉市值約14.67億美元,佔投資組合比例爲4.67%,持倉數量較上季度增加45%。

納指100ETF看漲期權(QQQ.US,CALL)、動視暴雪看跌期權(ATVI.US,PUT)分別位列第四、第五,持倉市值分別爲13.67億美元、8.71億美元,佔投資組合比例分別爲4.36%、2.77%。

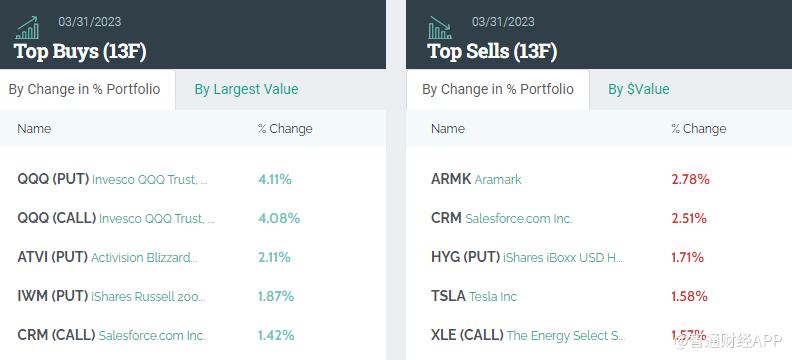

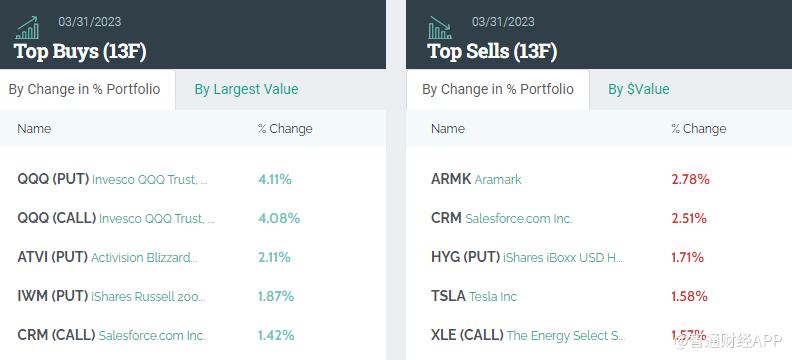

從持倉比例變化來看,前五大買入標的分別是:納指100ETF看跌期權、納指100ETF看漲期權、動視暴雪看跌期權、iShares羅素2000指數ETF看跌期權(IWM.US,PUT)、賽富時看漲期權(CRM.US,CALL)。

前五大賣出標的分別是:Aramark(ARMK.US)、賽富時(CRM.US)、iShares iBoxx高收益公司債券指數ETF看跌期權(HYG.US,PUT)、特斯拉(TSLA.US)、SPDR能源指數ETF看漲期權(XLE.US,CALL)。

野村控股Q1建倉白銀ETF-iShares看漲期權(SLV.US,CALL)、臺積電看漲期權(TSM.US,CALL)等,清倉CF工業控股看跌期權(CF.US,PUT)、安森美半導體(ON.US)、通用電氣(GE.US)、波音(BA.US)等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.