期權大單 | 特斯拉遭“拋棄”,VIX看漲期權需求高漲

市場概覽

上週五,對美國經濟陷入衰退的擔憂打擊了投資者信心,三大指數集體收跌。當日美股期權市場總成交量39,081,778張合約,其中,看漲期權佔比55%,看跌期權佔比45%。

期權成交總量TOP10

特斯拉佔據榜單的第二位。消息面上,近日,“金融巨鱷”索羅斯旗下的基金管理公司(Soros Fund Management)向SEC提交了一季度的13F文件。文件顯示,索羅斯基金一季度大舉減持新能源汽車股,直接清倉拋售了1600萬美元的$特斯拉(TSLA)$股份,同時還清倉了蔚來和$通用汽車(GM)$,賣出了Rivian股票和看漲期權。

另一個關於特斯拉的焦點話題是“史上最大規模召回事件”。近日,國家市場監督管理總局宣佈,日前在其啓動缺陷調查情況下,特斯拉開啓召回計劃,合計約110.46萬輛。這是特斯拉在全球銷售汽車以來最大的一次召回。特斯拉罕見“認錯”表示,將會整改,爲召回範圍內的車輛推送新開發的功能。

特斯拉的股價自4月末開啓了一波小幅反彈,不過目前似乎遇到瓶頸,週五跌超2%。如今遭遇大佬清倉,對市場情緒會帶來多大影響,值得密切關注。

華爾街看到“大風暴苗頭” VIX看漲期權需求高漲

近期,美國兩黨在債務上限問題上的互不相讓令該國面臨債務違約風險。而在華爾街,交易員們已經開始爲這起黑天鵝事件厲兵秣馬。

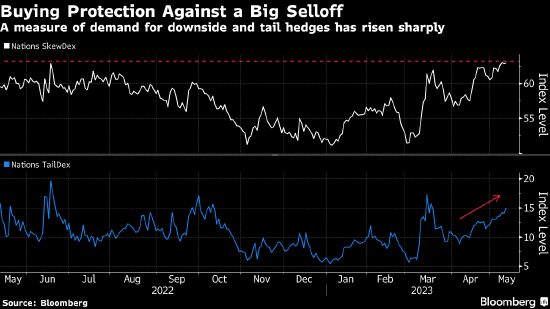

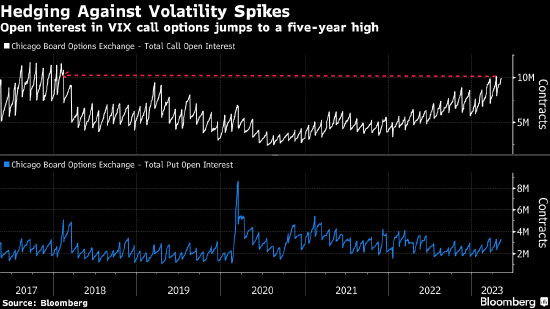

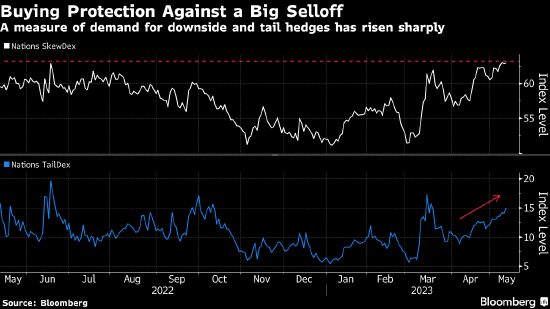

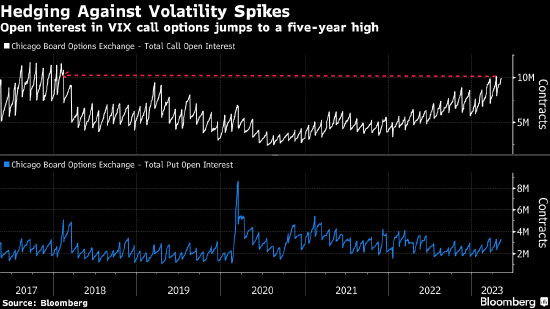

在期權市場,對衝波動率大幅上升風險的需求達到五年來最高水平。對衝市場下跌約10%或一個標準差的成本創一年來最高。尾部風險對衝需求急劇升至3月銀行業動盪高峯期以來之最。

與此同時,市場表面卻相當平靜,Cboe波動率指數VIX低於一年平均水平,但是資深業內人士警告,這可能只是暴風雨來臨前的平靜,就像在2011年那樣,在美國逼近違約邊緣之前,很少有人注意到資金危機。

“防止市場低迷以及尾部風險的需求已經上升,”RBC Capital Markets的衍生品策略主管Amy Wu Silverman說。“想想VIX在2011年美國觸及債務上限前的表現,其實和今天的情況很像。我們會看到做多VIX的需求高漲,因爲以前就發生過這種事。”

美國財政部長耶倫此前敦促白宮與國會領導人儘快化解分歧,因爲到6月1日資金就可能用盡。

對衝波動率上升風險的需求高漲表明6月可能又是一個動盪期。VIX指數的看漲期權未平倉合約最近達到2018年以來的最高水平。從經濟衰退到銀行體系裂痕,再到轉向更寬鬆貨幣政策的期望落空,一系列其他風險正在令市場承壓。

“還有其他因素,例如糟糕的通脹數據,強勁的就業市場等,”Fulcrum Asset Management的合夥人Stephen Crewe表示。 “人們真的不明白爲什麼有這麼多壞消息在,股市卻還能漲,所以他們一直在買入保護性期權。”

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.